Understanding 60% AGI Limit for Donations

When you donate to charity, the IRS limits how much you can deduct based on your Adjusted Gross Income (AGI). For cash donations to public charities, the cap is 60% of your AGI. For example, if your AGI is $100,000, you can deduct up to $60,000 in cash donations. Non-cash donations, such as stocks or property, have stricter limits (30%-50% of AGI).

Starting in 2026, a new rule applies: only donations exceeding 0.5% of your AGI will qualify for a deduction. For instance, if your AGI is $100,000, the first $500 of donations won't be deductible. Additionally, any unused deductions above the AGI limit can be carried forward for up to five years.

Key points:

- 60% AGI limit for cash donations to public charities.

- Non-cash donations are capped at 30%-50% of AGI, depending on the type.

- New 0.5% AGI floor in 2026: Only donations above this threshold are deductible.

- Excess contributions can be carried forward for up to 5 years.

Careful planning ensures you maximize deductions while staying within IRS rules.

PC 2 - Charitable Giving Strategy: The 2026 Tax Law Changes You Need to Know

How the 60% AGI Limit Works

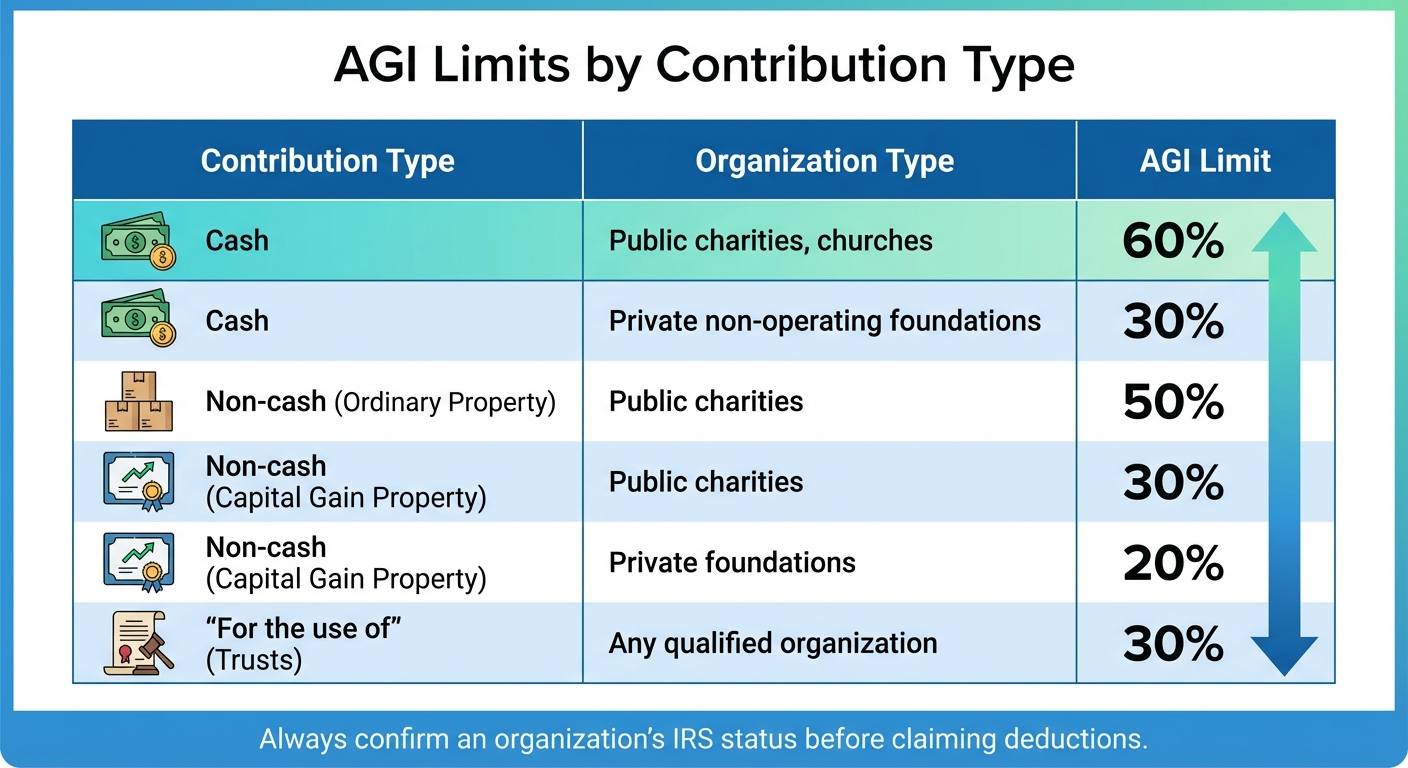

AGI Limits for Charitable Donations by Contribution Type

The 60% AGI limit determines the maximum deductible cash contributions you can claim when donating to public charities.

Cash Contributions vs. Non-Cash Contributions

Cash contributions - such as payments made by check, credit card, electronic transfer, or payroll deductions - generally fall under the 60% AGI limit. However, non-cash donations, like clothing, furniture, vehicles, or appreciated securities, are subject to stricter caps. For example:

- Donations of ordinary income property to public charities are limited to 50% of AGI.

- Donations of capital gain property are capped at 30% of AGI.

Here's a practical example: If you donate appreciated stock worth $40,000 to a local food bank and your AGI is $100,000, your deduction is limited to $30,000 (30% of AGI) instead of the full market value.

Additionally, contributions made "for the use of" a charity - such as assets placed in a trust - are also capped at 30% of AGI, even when the recipient is a public charity.

AGI Limits by Contribution Type

The AGI limit varies based on the type of donation and the organization receiving it. Here's a quick comparison:

| Contribution Type | Organization Type | AGI Limit |

|---|---|---|

| Cash | Public charities, churches | 60% |

| Cash | Private non-operating foundations | 30% |

| Non-cash (Ordinary Property) | Public charities | 50% |

| Non-cash (Capital Gain Property) | Public charities | 30% |

| Non-cash (Capital Gain Property) | Private foundations | 20% |

| "For the use of" (Trusts) | Any qualified organization | 30% |

To avoid errors, always confirm an organization's IRS status before claiming deductions.

Calculating Your Deductible Amount

To calculate your deductible cash contributions, locate your AGI on Form 1040, line 11, and multiply it by 0.60. This gives you the maximum allowable deduction for cash donations. However, if you receive a benefit in return for your donation - like dinner, entertainment, or merchandise - you must subtract the fair market value (FMV) of those benefits from your contribution.

For example:

- If you paid $65 for a ticket to a church dinner dance, and the FMV of the dinner and entertainment was $25, your deductible amount would be $40.

- Similarly, if you spent $40 on a charity movie screening where the regular ticket price is $8, your deduction would be $32.

This straightforward method helps you determine your deduction and sets the groundwork for handling any contributions that exceed the limits.

The 0.5% AGI Floor Starting in 2026

What is the 0.5% AGI Floor?

Starting in 2026, a new rule changes how charitable deductions work. Only donations exceeding 0.5% of your Adjusted Gross Income (AGI) will qualify for a tax deduction [5][6]. In simpler terms, any contributions below this threshold won’t provide a tax benefit. For example, if your AGI is $100,000, the first $500 in donations won’t count toward your deductions. Only the amount exceeding that $500 threshold becomes deductible [5][7].

This rule applies to all types of donations - whether it’s cash, clothing, stock, or other property. It also impacts both itemizers and those claiming the new above-the-line deduction for non-itemizers [5][7]. To calculate your threshold, multiply your AGI by 0.005.

Example Calculations by Income Level

Here’s how the 0.5% floor works at different income levels:

| AGI | 0.5% Floor Amount | Total Donations | Deductible Amount |

|---|---|---|---|

| $100,000 | $500 | $3,000 | $2,500 |

| $300,000 | $1,500 | $10,000 | $8,500 |

| $1,000,000 | $5,000 | $25,000 | $20,000 |

As shown above, the floor increases with your AGI, meaning higher earners need to donate more before deductions kick in [5].

Impact on Different Income Brackets

The 0.5% floor impacts taxpayers based on their income and giving habits. For lower-income donors, smaller contributions may no longer provide any tax advantage [8][5]. Meanwhile, higher-income individuals face additional constraints due to the combined effect of the floor and a new 35% cap on deductions, which reduces tax savings from 37 cents to 35 cents per dollar donated [8][6][4].

This policy shift is expected to generate an estimated $63 billion in federal revenue between 2025 and 2034 [4]. As a result, many taxpayers are turning to "bunching" strategies - grouping several years’ worth of donations into a single year to surpass the 0.5% threshold and maximize their deductions [8][5][6].

Next, let’s explore how carryover rules can help optimize contributions that exceed these limits.

sbb-itb-e723420

Carryover Rules for Excess Contributions

How Carryovers Work

If your charitable contributions exceed the allowable AGI limit, the IRS doesn't just let those deductions vanish. Instead, you can carry forward the excess for up to five years after the year of the original donation[9]. This gives you a chance to claim unused deductions on future tax returns.

Here's how it works: you must apply carryovers in chronological order - starting with the oldest first - to avoid losing them[9]. Skipping a year to try and save a deduction for a better tax situation isn't allowed. When filing, you'll deduct your current-year contributions first, followed by any carryovers from previous years[9].

"The IRS permits you to carry forward excess charitable deductions for up to five years following the year in which you made the contribution." - Kevin Pickett, Greater Houston Community Foundation[9]

However, any unused carryover that remains after the five-year period expires permanently[9]. To claim a carryover, you need to itemize deductions on Schedule A (Form 1040)[1]. IRS Publication 526 provides Worksheet 2, which helps calculate the eligible carryover amount for each year[1].

Take Sarah from Houston as an example. In 2024, with an AGI of $250,000, she donated $100,000 in appreciated stock to public charities. Since donations of appreciated assets to public charities are capped at 30% of AGI, she could only deduct $75,000 in 2024. The remaining $25,000 carried forward to tax years 2025 through 2029. If Sarah’s AGI drops to $180,000 in 2025, she can deduct part of the $25,000 carryover along with her current contributions, as long as it doesn’t exceed the 30% limit[9].

Keep detailed records of each donation, including the date, amount, organization, and type of asset. Track your carryover balances year by year to ensure you apply the oldest amounts first before they expire[9]. For donations of $250 or more, make sure you have a written acknowledgment from the charity - it’s required to substantiate deductions in future years[2]. These carryover rules offer a framework for thoughtful donation planning.

Planning Large Contributions for Maximum Benefit

Knowing how carryover rules work can help you plan large donations strategically. One effective approach is bunching donations, where you consolidate multiple years' worth of contributions into a single tax year. This can help you clear the 0.5% AGI floor and maximize your deductions for that year[9].

Timing is also key. Align major donations with years when your income is higher, such as during a business sale, a large bonus, or retirement distributions. This allows you to claim larger immediate deductions and carry forward any excess to offset income in future years[9]. The higher your AGI in the donation year, the more you can deduct upfront.

Another smart strategy is using Donor Advised Funds (DAFs). By contributing to a DAF, you can claim a large tax deduction in the current year while spreading out the actual donations to charities over several years[9]. This approach lets you maximize deductions during high-income years while maintaining a consistent pattern of charitable giving over time.

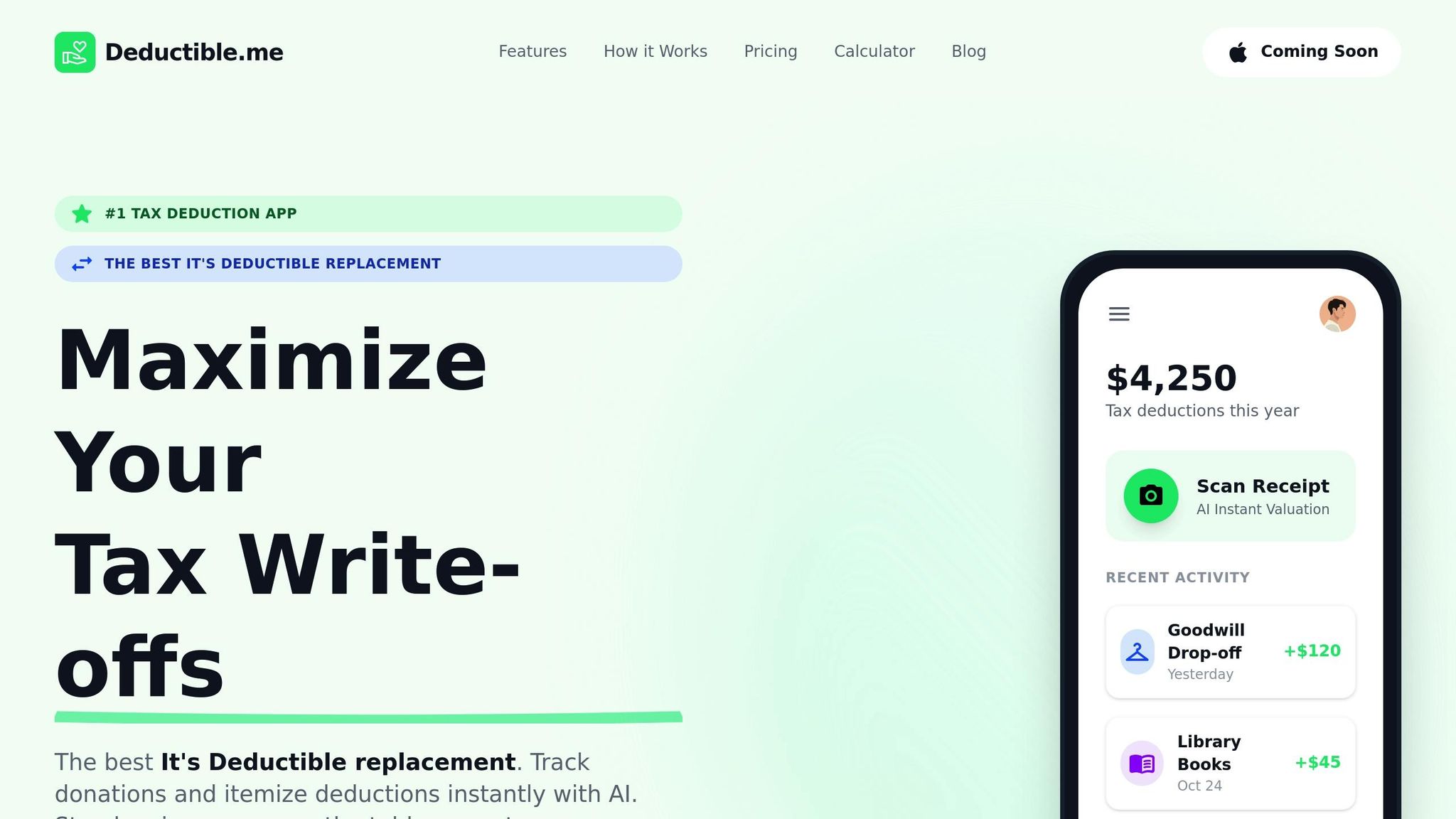

Managing Donations with Deductible.me

Keeping donation records organized is crucial, especially when navigating IRS AGI limits, as outlined earlier.

Tracking Your Donations

Accurate and consistent record-keeping is a must. Deductible.me makes this process easier by consolidating all your donation details in one place. The app tracks critical information like the name of the qualified organization, the donation date, and the donation amount or description. It also stores bank confirmations and acknowledgments, so you don’t have to worry about misplaced receipts[2]. Plus, it helps you monitor your total donations against your AGI, making tax planning more straightforward.

AI-Powered Valuation for Non-Cash Donations

Valuing non-cash donations can be tricky since they must reflect their Fair Market Value (FMV) at the time of the gift[1]. Deductible.me simplifies this with AI technology. By scanning photos of items like clothing, furniture, or household goods, the app estimates FMV based on the item's condition and market trends. This feature makes valuations less stressful and keeps you in line with IRS requirements.

Generating IRS-Compliant Reports

If your non-cash donations exceed certain thresholds, you’ll need to file Form 8283 with your tax return. Deductible.me takes care of this by generating detailed, IRS-compliant reports. These reports include essential information such as the organization’s name, donation dates, and FMV of the items donated[2]. For just $2/month, the Premium plan offers unlimited tracking, advanced analytics, and goal-setting tools. For larger contributions, the app also ensures you obtain the required written acknowledgments. With these features, Deductible.me helps you stay organized and compliant, aligning with the tax strategies discussed earlier.

Conclusion

Grasping the 60% AGI limit is key to making the most of your charitable deductions. When you itemize using Schedule A (Form 1040), cash donations to qualified public charities can generally be deducted up to 60% of your adjusted gross income (AGI) [1]. If your contributions exceed this limit, you can carry the excess forward for up to five years [3]. These basics lay the groundwork for understanding upcoming changes to tax deduction rules.

Beginning in 2026, new factors will influence how deductions work. Alongside the 60% limit, a new 0.5% AGI floor will apply. Additionally, taxpayers claiming the above-the-line deduction (non-itemizers) may be able to deduct up to $1,000 in cash contributions - or $2,000 if filing jointly [2]. These adjustments highlight the importance of planning your charitable giving carefully. Keep in mind that some contributions require specific documentation, as previously mentioned.

To stay on top of these evolving rules, a tool like Deductible.me can be a game-changer. This app helps you organize donation records, monitor contributions against AGI limits, and generate IRS-compliant reports. Its AI-powered valuation tool simplifies determining the fair market value of non-cash items. For just $2/month, the Premium plan offers unlimited tracking and advanced analytics, making it easier to plan your giving strategy year-round.

FAQs

What is the 0.5% AGI floor for charitable deductions starting in 2026?

Starting in 2026, a 0.5% AGI floor will come into effect for charitable deductions. What does this mean? Only the portion of your charitable donations that goes beyond 0.5% of your adjusted gross income (AGI) will be eligible for a tax deduction. Any contributions below this threshold won’t qualify.

Here’s an example: If your AGI is $100,000, you’ll need to donate more than $500 (which is 0.5% of $100,000) for any part of your contribution to be deductible. Donations up to $500 wouldn’t count toward your tax deduction.

This change could influence how you approach charitable giving. It might be a good idea to reassess your strategy to ensure you’re making the most of your potential tax benefits.

What is the difference between AGI limits for cash and non-cash charitable donations?

The IRS has specific adjusted gross income (AGI) limits for charitable contributions, which vary depending on the type of donation. For cash donations, you can generally deduct up to 60% of your AGI. For non-cash donations - like property, stocks, or other assets - the limit is typically 30% of your AGI.

These limits are in place to prevent taxpayers from deducting more than a certain percentage of their income in a single year. That said, there are exceptions and additional rules that might apply, depending on the organization you're donating to or the nature of your contribution. To stay within the rules and make the most of your deductions, it’s always a good idea to check the latest IRS guidelines or consult a tax professional.

What should I do if my charitable donations are higher than the 60% AGI limit?

If your charitable donations surpass 60% of your adjusted gross income (AGI), you don't lose out on those deductions. The IRS lets you carry the excess forward for up to five years, giving you more opportunities to benefit from your generosity over time.

It's worth noting that not all donations follow the same rules. For instance, contributions to public charities generally fall under the 60% AGI limit. However, donations to private foundations often come with stricter limits, such as 30% of your AGI. To make the most of your deductions and stay in line with IRS regulations, keeping accurate records and proper documentation is a must. Tools like Deductible.me can simplify this process by helping you track and organize your charitable giving, making it easier to stay compliant and maximize your tax benefits.