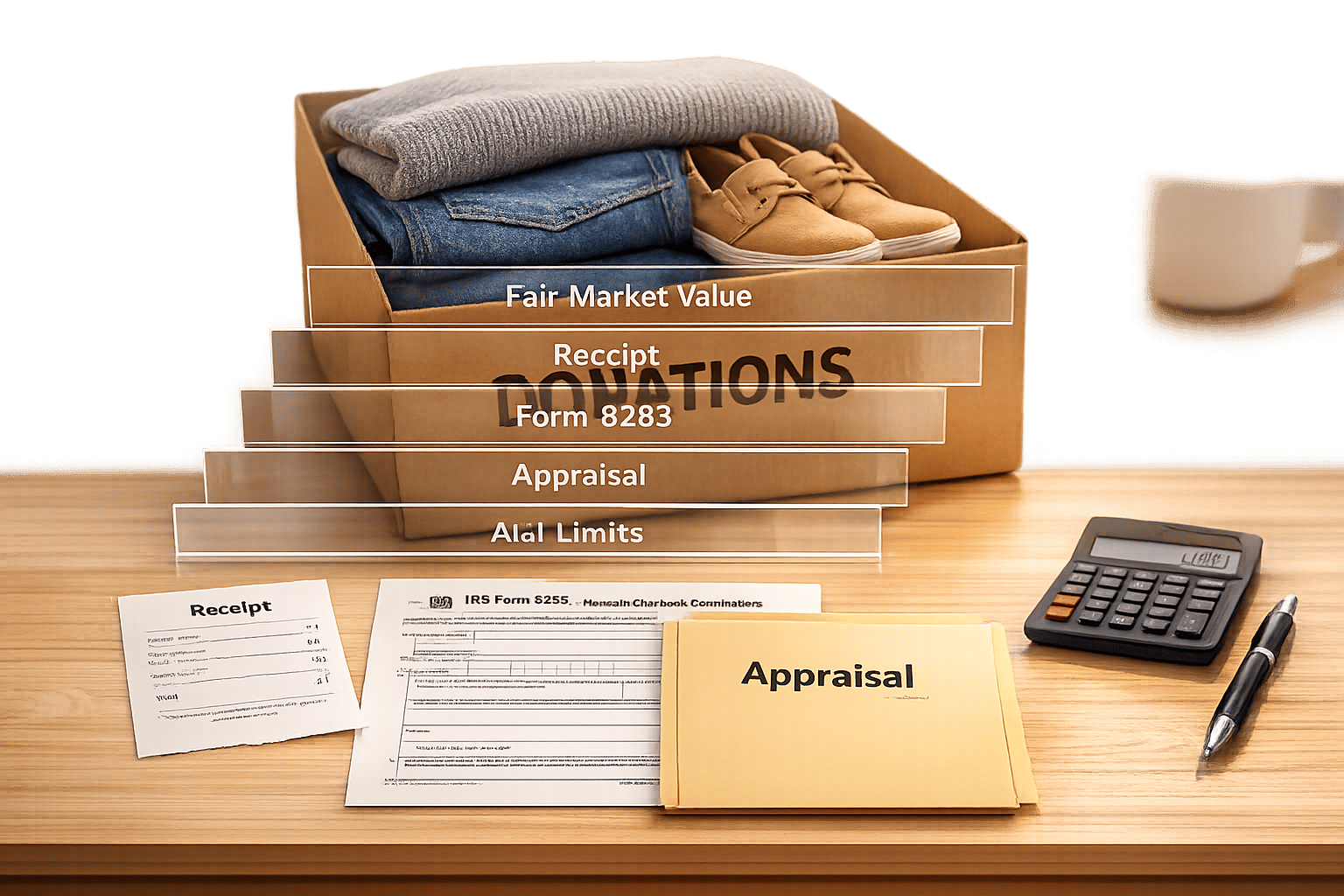

How to Value Non-Cash Donations for Taxes

Determining the value of non-cash donations for tax purposes can be tricky, but it's essential to follow IRS rules for accurate deductions. Here's what you need to know:

- Fair Market Value (FMV): Use the price an item would sell for at a thrift store or similar venue, not its original cost or replacement value.

- Documentation Requirements:

- Under $250: Keep a receipt from the charity.

- $250–$500: Obtain a written acknowledgment with details about the donation.

- Over $500: File Form 8283 and maintain detailed records.

- Over $5,000: Get a qualified appraisal and signatures on Form 8283.

- Penalties for Overvaluation: Overstating value by 150%+ can result in penalties of 20–40% of underpaid taxes.

- Deduction Limits: Deductions are capped at 50%, 30%, or 20% of your Adjusted Gross Income (AGI), depending on the type of donation and recipient organization. Excess deductions can be carried forward for up to five years.

To streamline this process, tools like Deductible.me can help calculate FMV, generate IRS-compliant documentation, and securely store records. Accurate valuation and proper documentation ensure compliance and help you maximize your tax benefits.

IRS Documentation Requirements for Non-Cash Donations by Value

Understanding Fair Market Value (FMV)

What Fair Market Value Means

The IRS defines fair market value as the price an item would sell for on the open market, where both the buyer and seller are willing participants, neither is under pressure to act, and both have a reasonable understanding of the item's details [1]. This definition is essential for determining the value of non-cash donations you claim on your taxes.

Take a used sofa as an example. Its FMV isn’t what you originally paid for it or what it would cost to replace - it’s the amount someone might pay for it at a thrift store. The IRS explicitly states that replacement cost or insured value cannot be used as stand-ins for FMV. Additionally, the FMV must reflect the item's value on the exact date of donation, as market conditions can shift over time.

How to Estimate Fair Market Value

For everyday items, you can estimate FMV by checking local thrift stores or searching online for "sold" listings of similar items. Many nonprofits and tax software platforms provide valuation guides based on real-world data, such as thrift store surveys or auction results.

When it comes to high-value items - those worth over $5,000, like artwork, antiques, or real estate - a qualified appraisal from a certified professional is required to establish FMV [1]. This appraisal serves as formal evidence of the item's value.

It's also wise to document the item's condition with photos, which can help substantiate your valuation if the IRS ever questions it. For clothing and household items, the IRS requires them to be in "good used condition or better" to qualify for a deduction, and photos can provide critical proof.

| Factor | Key Questions to Ask |

|---|---|

| Cost or Selling Price | Was the sale recent, and was it conducted under fair, arm's-length conditions? |

| Comparable Sales | Are the sold items similar to the donated item, and were the sales made under stable conditions? |

| Replacement Cost | What would it cost to replace the item with a new one, and how does depreciation affect its value? |

| Professional Opinions | Does the appraiser’s opinion rely on verifiable facts and recognized expertise? |

Accurately estimating FMV and keeping thorough documentation will help ensure you meet IRS standards and avoid any potential issues.

sbb-itb-e723420

How Do I Value My Donated Items To The IRS? - CountyOffice.org

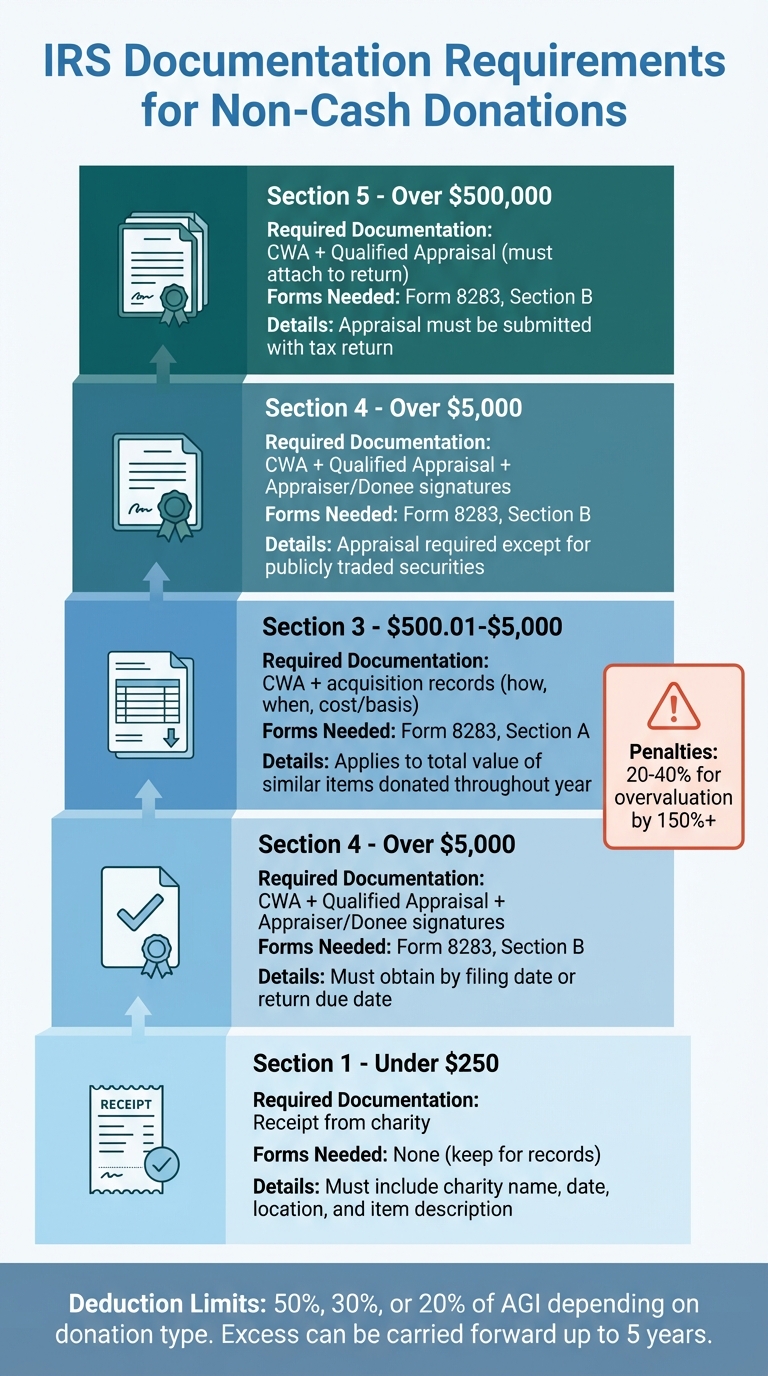

IRS Documentation Requirements by Donation Value

The IRS has specific rules for documenting non-cash donations, and these depend on the value of your contribution. Following these guidelines is crucial to claim your deduction without complications. Here's a breakdown of what's required based on donation value.

Donations Under $250

For donations under $250, you’ll need a receipt from the charity. This receipt should include the charity’s name, the date and location of the donation, and a detailed description of the donated items. If getting a receipt isn’t possible, such as for unattended drop-offs, you should keep a reliable written record instead.

To ensure compliance, maintain proof that your items are in "good used condition or better." This can include photos and a detailed donation log. Your log should document the date, the charity's name, descriptions of the items, and how you determined their fair market value (e.g., using thrift store pricing guides). Record these details immediately, so nothing is overlooked.

Donations Between $250 and $500

Once donations reach $250, the requirements become stricter. You’ll need a contemporaneous written acknowledgment (CWA) from the charity. This acknowledgment must include:

- The charity’s name

- The date and location of the donation

- A detailed description of the donated property

- A statement about whether the charity provided any goods or services in return, along with their estimated value (if applicable). If only intangible religious benefits were provided, this must be noted.

Make sure to obtain the CWA by the earlier of your filing date or the return due date. Although you don’t need to attach it to your tax return, keep it safe for your records. It’s also a good idea to scan your receipts and acknowledgments to avoid losing them. Ensure the description of your donation is specific - listing “three bags of clothes” might not be enough detail compared to itemizing what’s in those bags.

Donations Over $500

For donations exceeding $500 in total value, additional steps are required. You must file Form 8283 with your tax return. This threshold applies to the total value of "similar items" donated throughout the year, even if they went to different charities.

- Use Section A of Form 8283 for items or groups of similar items valued between $500.01 and $5,000.

- Use Section B for items valued over $5,000 or for single clothing or household items not in "good used condition" but valued over $500.

For any donation over $5,000, you’ll also need a qualified appraisal from a certified professional (except for publicly traded securities). Both the appraiser and an authorized charity representative must sign Form 8283. If your donation exceeds $500,000, the appraisal itself must be attached to your tax return.

Keep detailed records, including the acquisition date, cost, and basis of all donated items.

| Donation Value | Required Documentation | Form(s) Needed |

|---|---|---|

| Under $250 | Receipt or written communication from the charity. | None (keep for records) |

| $250 – $500 | Contemporaneous Written Acknowledgment (CWA). | None (keep for records) |

| $500.01 – $5,000 | CWA + records of acquisition (how, when, cost/basis). | Form 8283, Section A |

| Over $5,000 | CWA + Qualified Appraisal + Appraiser/Donee signatures. | Form 8283, Section B |

| Over $500,000 | CWA + Qualified Appraisal (must be attached to return). | Form 8283, Section B |

How to Value Different Types of Donated Assets

Valuing donated assets requires specific approaches tailored to each type, while adhering to the fair market value (FMV) principles previously discussed. Knowing how to assess these assets correctly ensures accurate tax deductions and compliance with IRS regulations.

Clothing, Furniture, and Household Items

For items like clothing, furniture, and household goods, FMV is the price a willing buyer and seller would agree upon in an open market. To estimate this value, check local thrift stores, consignment shops, or online listings of similar items that have been sold [1][6]. Keep in mind that used items are worth less than new ones, and only those in "good used condition or better" qualify for deductions [1][6]. It’s a good idea to document the condition of these items with photos to support their valuation [6].

It's important to note that household items do not include food, paintings, antiques, jewelry, or collections - these follow different valuation rules [1]. If you’re claiming over $500 for a single item not in good condition, a qualified appraisal is required. Additionally, if your total noncash donations exceed $500, you’ll need to file Form 8283 with your tax return [1][3][6].

Stocks, Bonds, and Other Securities

Financial assets like stocks and bonds require a different valuation approach. For publicly traded securities, FMV is determined by averaging the high and low prices on the donation date [1]. For example, if a stock trades between $45.20 and $47.80, its FMV is $46.50 per share.

The date of the contribution varies depending on the transfer method: it’s the delivery date for hand-delivered certificates, the mailing date for mailed certificates, or the date recorded in corporate books for broker transfers [1]. When donating mutual funds, use the published redemption price on the valuation date [2]. If the donation date falls on a non-trading day, calculate the weighted average of prices from surrounding trading days [1].

Notably, publicly traded securities - even those valued over $5,000 - do not require a qualified appraisal and should be reported in Section A of Form 8283 [2][4]. However, non-publicly traded securities worth more than $5,000 do require an appraisal and must be reported in Section B [2][9].

Real Estate and Collectibles

Specialized guidelines apply to real estate and collectibles, particularly for donations exceeding $5,000, which require professional appraisals [1][4][7].

For real estate, the IRS recognizes three key valuation methods:

- Comparable sales of similar properties,

- Capitalization of income for rental or income-producing properties, and

- Replacement cost new, minus depreciation [1].

When it comes to collectibles - such as art, antiques, coins, stamps, and jewelry - valuation depends on factors like authenticity, condition, rarity, and market demand [1]. Detailed records of the item’s provenance and condition are essential since these significantly influence its value [1].

Be cautious when valuing property, as overstating its worth can lead to penalties. The IRS imposes a 20% penalty if the value is overstated by 150% or more, and a 40% penalty if overstated by 200% or more [1][7]. Additionally, any restrictions on how the charity can use the donated property may lower its FMV [1][7].

Deduction Limits and Carryforward Rules

Once you've nailed down the fair market value (FMV) of your donation, the next hurdle is understanding how the IRS limits deductions based on your adjusted gross income (AGI). While accurate valuation ensures you maximize your tax benefits, knowing these AGI-based limits helps you avoid surprises when claiming deductions. The IRS caps the percentage of your AGI that can be deducted annually, and these limits depend on the type of donation and the organization receiving it.

Income-Based Deduction Limits

The IRS imposes specific percentage limits depending on what you donate and where it goes. For donations of ordinary income property - like clothing, furniture, or other household goods - to public charities, the deduction limit is generally 50% of your AGI [10][5]. If you're donating appreciated capital gain property (assets like stocks or real estate held for over a year), the limit drops to 30% of your AGI for donations to public charities [10][5].

Some organizations, like private foundations, veterans' groups, and fraternal societies, have stricter limits. For example, donations of non-cash property to these groups are capped at 30% of your AGI, while contributions of capital gain property are limited to just 20% of your AGI [10][5]. Before making sizable donations, you can check an organization's eligibility using the IRS Tax Exempt Organization Search tool [8][5].

| Donation Type | Receiving Organization Type | AGI Deduction Limit |

|---|---|---|

| Ordinary Income Property (e.g., Clothing, Household Items) | Public Charity (50% Limit Organization) | 50% |

| Capital Gain Property (Appreciated Assets) | Public Charity (50% Limit Organization) | 30% |

| Non-Cash Property | Private Foundation (30% Limit Organization) | 30% |

| Capital Gain Property | Private Foundation (30% Limit Organization) | 20% |

If you're donating capital gain property and want to increase your deduction limit to 50%, you can choose to deduct only the cost basis instead of the full appreciated value [10][2]. This option is worth considering if the property hasn't appreciated significantly.

Knowing these limits also helps explain what happens when your contributions exceed the allowed deduction for the year.

Carrying Forward Excess Deductions

What if your charitable contributions exceed the annual AGI limit? Don't worry - you won’t lose them. The IRS lets you carry forward unused deductions for up to five years [10][8]. However, each year, you must first apply the current year's eligible deductions before using any carryover amounts [10].

To keep things organized, track the date and amount of each donation carefully. Remember, unused deductions must be applied within the five-year window, or they’ll expire. Also, make sure to file Form 8283 with your tax return for the year of the donation and any subsequent year you claim a carryover [2]. Once the five years are up, any leftover deductions are gone for good [10][8].

Using Deductible.me to Simplify Valuation and Compliance

Tracking non-cash donations manually can be a hassle - not to mention prone to errors. Deductible.me steps in to simplify this process, automating the valuation and compliance steps in line with IRS documentation rules. This tool ensures you stay on track with IRS standards while making the entire process much easier.

Key Features of Deductible.me

Deductible.me uses an AI-driven valuation engine to calculate Fair Market Value for donated items. It bases its suggestions on current thrift store resale prices, which the IRS recognizes as the standard for non-cash donations [11]. The platform evaluates each item by condition - Excellent (Like New), Good (Gently Used), or Fair - and assigns a defensible value. For instance, items in Excellent condition are typically valued at 30–40% of their original price, while those in Good condition fall in the 10–20% range [11].

The platform also creates a digital record of your donations. You can snap photos of each item to document its condition and existence instantly [11]. For donations exceeding $250, the system automatically compiles the IRS-required itemized lists, including details like the item's description, condition, fair market value, and donation date. For donations over $500, it even generates IRS Form 8283 for you [11][12].

"Deductible.me lets you snap a photo of each item, assign a condition, and log an IRS-compliant value on the spot. It creates a perfect digital trail as you go, removing uncertainty." - Deductable.ai [11]

How Deductible.me Saves Time and Boosts Deductions

Manual tracking often leads to missed deductions, but Deductible.me ensures every contribution is accounted for. For example, a single box of kitchen gadgets, books, or décor could translate to $50–$100 in tax deductions if properly itemized [11]. The platform stores digital copies of signed charity receipts and itemized lists, eliminating the need for paper records that can fade or get lost. Plus, you can access your donation history anytime from your phone, desktop, or Chromebook through their web app at app.deductable.ai [11].

The platform offers two plans to suit different needs. The Free plan allows you to track up to $500 in donation value, making it perfect for occasional donors trying out the service. For those who donate more frequently, the Premium plan costs just $2/month and includes unlimited donation tracking, advanced analytics, annual giving goal tracking, and priority support - ideal for maximizing deductions year after year.

Conclusion

When claiming deductions for non-cash donations, start by determining their fair market value (FMV) accurately. To meet IRS requirements, ensure the items are in "good used condition or better" and base the valuation on current resale prices at local thrift stores, not the original purchase price.

Beyond valuation, keeping thorough records is just as important. The documentation requirements increase with the value of your contributions: donations over $500 require Form 8283, while those exceeding $5,000 demand a qualified appraisal [2]. If managing multiple donations feels like a hassle, platforms like Deductible.me can simplify the process. This tool automates FMV calculations using resale prices, generates IRS-compliant documentation (including Form 8283), and securely stores digital records with photos and condition details.

Following IRS guidelines isn’t just a recommendation - it’s essential. Errors in valuation or incomplete forms could result in disallowed deductions and penalties ranging from 20% to 40% [1]. By valuing donations accurately and maintaining detailed documentation, you can protect your deductions and make tax filing much smoother.

FAQs

How do I figure out the fair market value of unique or high-value donations?

To figure out the fair market value (FMV) of unique or high-value donations, think about what a buyer would willingly pay a seller for the item under typical market conditions. The IRS bases FMV on factors like the item's condition, age, and how much demand there is for it.

If your donation is worth more than $5,000, the IRS usually requires a qualified appraisal from a certified appraiser. This appraisal needs to be thoroughly documented and submitted with your tax return to back up your deduction. Keep in mind that certain types of property, like collectibles or real estate, may have their own specific valuation rules outlined by the IRS.

Getting the valuation right not only ensures your deductions meet IRS standards but also helps you get the most from your tax benefits.

What documentation do I need for non-cash donations over $5,000?

If you’re donating non-cash items worth more than $5,000, the IRS requires a qualified appraisal to confirm the item's value. Additionally, you’ll need to fill out Section B of Form 8283, which includes details about the appraisal and your signature to verify the information. Keep copies of both the appraisal and the form for your records - they’re crucial for supporting your tax deduction.

What happens if my charitable deductions exceed the AGI limit?

If your charitable contributions exceed the percentage of your adjusted gross income (AGI) allowed by the IRS, don’t worry - those extra deductions aren’t lost. You can carry forward the unused portion for up to five years. This allows you to apply the excess to future tax years, provided it fits within the AGI limits for those years. Make sure to keep thorough records to ensure accurate reporting and stay in line with IRS regulations.