IRS Donation Rules: A Complete Compliance Checklist

Donating to charity can lower your taxes - but only if you follow IRS rules. Here’s what you need to know to ensure your contributions qualify:

- Verify the charity’s eligibility: Use the IRS Tax Exempt Organization Search Tool to confirm the charity is qualified.

- Understand deduction limits:

- Cash donations: Up to 60% of your Adjusted Gross Income (AGI).

- Non-cash donations: Limits range from 20% to 50% of AGI, depending on the type.

- Excess contributions can be carried forward for up to 5 years.

- Keep proper documentation:

- Cash donations under $250: Bank records or receipts.

- Donations $250+: Written acknowledgment from the charity.

- Non-cash donations over $500: File Form 8283; items over $5,000 need a professional appraisal.

- Value items accurately: Use fair market value (FMV) and avoid overestimations to prevent penalties.

- Time donations correctly: Contributions must be made by December 31 to count for that tax year.

Mistakes like donating to non-qualified organizations or failing to itemize deductions can lead to denied claims. Stick to these guidelines to maximize your tax benefits and avoid penalties.

What Are The IRS Rules For 501(c)(3) Donations? - CountyOffice.org

Check if Your Charity Qualifies

To claim a tax deduction for your donation, the recipient must be an IRS-qualified organization. According to IRS guidelines, "You can deduct your contributions only if you make them to a qualified organization." [1] So, before filing your taxes, it's essential to confirm the charity's eligibility.

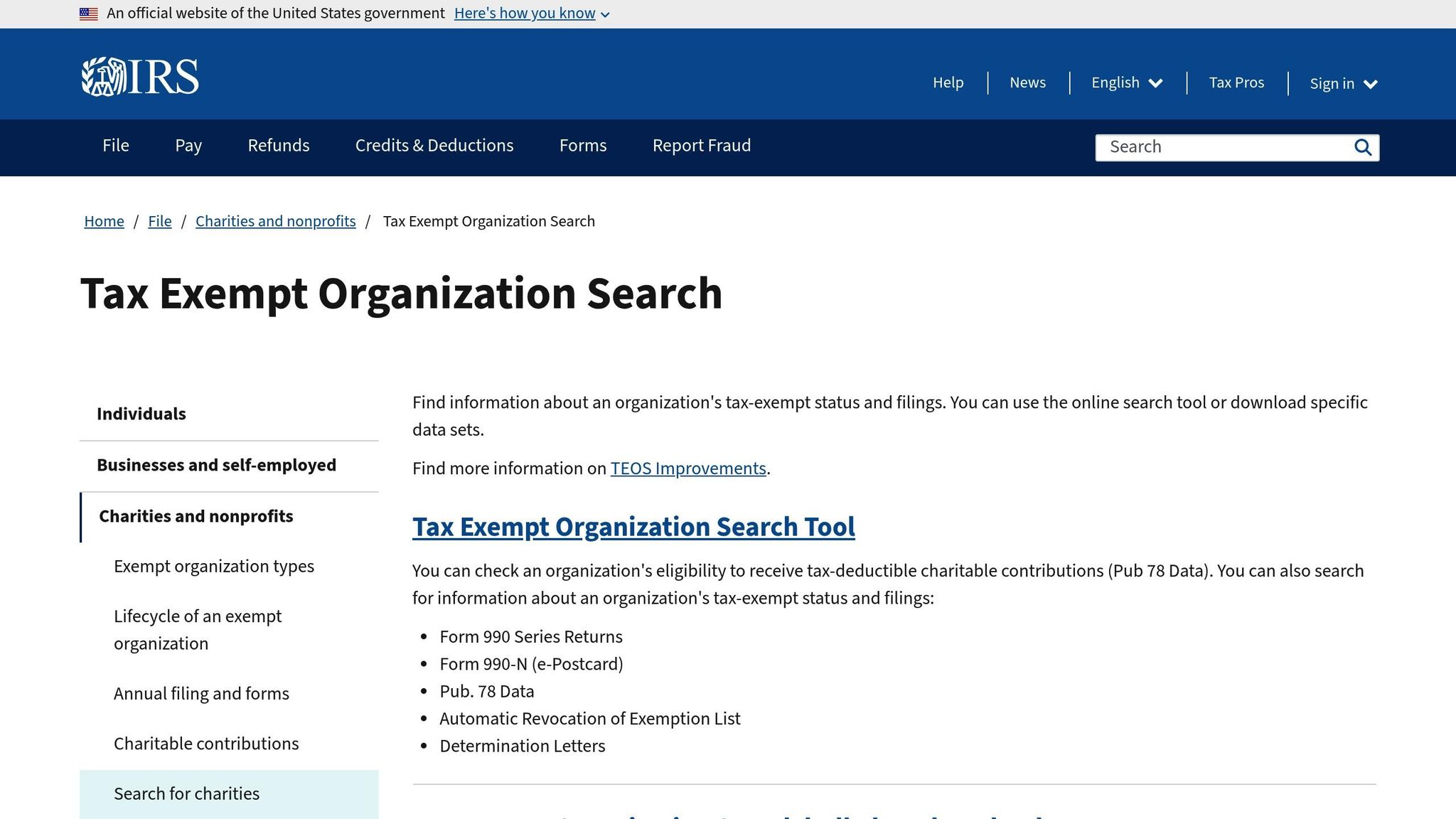

Use the IRS Tax Exempt Organization Search Tool

The IRS Tax Exempt Organization Search (TEOS) tool is the go-to resource for verifying a charity's tax-exempt status. You can search using the organization’s nine-digit Employer Identification Number (EIN) or its official name - though the EIN tends to yield more precise results since many organizations have similar names.

The TEOS tool provides access to IRS Publication 78 data and the Auto-Revocation List, which identifies organizations that lost their tax-exempt status for failing to file Form 990 for three consecutive years. If you’re searching by name, use quotation marks around the exact name (e.g., "Anytown General Hospital") to narrow the results. Some organizations may operate under a "doing business as" (DBA) name, which might not appear in the database. For the most accurate information, use the official IRS-registered legal name.

Know Which Organizations Qualify

The most common type of qualified charity is a 501(c)(3) organization, which includes religious institutions, educational nonprofits, and research groups. Donations to federal, state, and local governments are also deductible if they serve a public purpose - like contributing to a city’s police department reward fund. Other qualifying entities include war veterans' organizations, certain domestic fraternal societies, and nonprofit cemetery companies, though they must meet specific conditions.

It’s important to note that donations to individuals, political organizations, social or sports clubs, labor unions, and chambers of commerce are not deductible. Foreign charities generally don’t qualify either, except for certain organizations in Canada, Mexico, and Israel under specific tax treaties.

Some eligible entities, such as churches, group ruling subordinates, and government units, might not appear in the TEOS database but are still eligible for deductible donations. If you’re unsure, ask the organization directly for its IRS determination letter to confirm its tax-exempt status.

Know Your Annual Contribution Limits

After determining whether a charity qualifies for deductions, it’s important to understand how annual AGI (Adjusted Gross Income) limits influence your ability to claim those deductions. The IRS sets caps on the percentage of your AGI that can be deducted for charitable contributions. According to IRS Publication 526, "Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply." [1] Knowing these thresholds can help you maximize your tax benefits while staying within the rules. Let’s break down these limits for cash and non-cash contributions, and look at how to handle contributions that exceed the limits.

Cash Donation Limits

When it comes to cash donations, the rules are straightforward. You can deduct contributions to public charities up to 60% of your AGI. For instance, if your AGI is $100,000, you can deduct up to $60,000 in cash donations made to eligible 501(c)(3) organizations during that tax year. This includes direct cash gifts, checks, credit card payments, and electronic transfers.

Non-Cash Donation Limits

Non-cash donations have their own set of AGI limits, which vary depending on the type of donation:

- General non-cash items: Items like clothing and furniture are deductible up to 50% of your AGI.

- Appreciated capital gain property: Donations such as stocks, real estate, or artwork are capped at 30% of your AGI.

- Private foundation donations: Contributions to private foundations have stricter limits - 30% for cash donations and 20% for appreciated property.

Carryforward Rules

If your contributions exceed the allowable AGI limits, you’re not out of luck. The IRS allows you to carry forward the excess for up to five years. As stated in IRS guidelines, "You can carry over any contributions you can't deduct for the current year because they exceed the limits based on your AGI." [4] These carryforwards must be applied in chronological order, starting with the oldest, and any unused amounts will expire after five years.

For example, if a donor with an AGI of $250,000 contributes $100,000 in appreciated stock in 2024, they can only deduct $75,000 (30% limit) in that year. The remaining $25,000 can be carried forward and used between 2025 and 2029. [5] This flexibility ensures that excess donations don’t go to waste, provided they are applied within the allowed timeframe.

Keep the Right Documentation

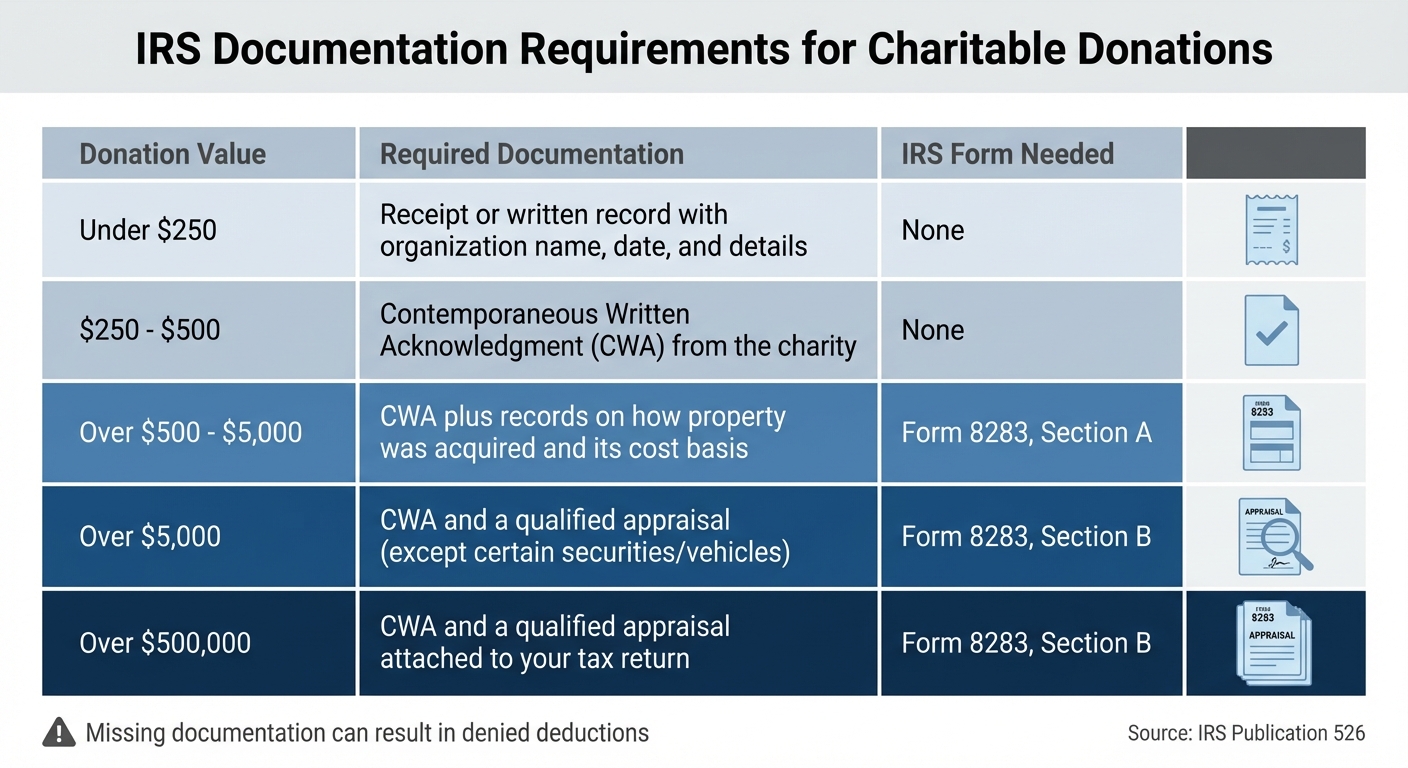

IRS Charitable Donation Documentation Requirements by Value

Keeping accurate records is crucial because the responsibility for proving deductions falls on donors, not charities. Without the right documentation, your deduction could be denied. Here's a breakdown of what you need for both cash and non-cash donations.

Receipts for Cash Donations

If you're donating cash and the amount is under $250, you'll need to keep a bank record (like a canceled check, bank statement, or credit card statement) or a written acknowledgment from the charity. This record must include the charity's name, the date of the donation, and the amount given [6][3][8].

For donations of $250 or more, you must obtain a Contemporaneous Written Acknowledgment (CWA) from the charity. Make sure to get this acknowledgment by the earlier of your tax return filing date or the due date (including extensions) [6][3]. The CWA should confirm the donation amount and state whether any goods or services were provided in return. If so, it must include a description and a good-faith estimate of their value [6][7].

For payroll deductions, keep employer records that show the withheld donation amount [6][3]. If you donate via text message, your phone bill must list the charity's name, the date, and the donation amount [6].

Records for Non-Cash Donations

When donating non-cash items, it's important to document the fair market value (FMV) of the property at the time of the donation, how and when you acquired it, and its original cost. For contributions valued at $250 or more, you'll also need a CWA that includes a description of the donated property and whether anything was received in exchange [2][4][7].

If your total non-cash contributions exceed $500, you'll need to attach Form 8283 (Noncash Charitable Contributions) to your tax return [9][2]. Depending on the value of the donation:

- Items valued at $5,000 or less: Report these in Section A of Form 8283.

- Items valued over $5,000: Fill out Section B of Form 8283, which requires more details and the charity's signature [10][2].

Here's a quick reference table to clarify the documentation requirements:

| Donation Value | Required Documentation | IRS Form Needed |

|---|---|---|

| Under $250 | Receipt or written record with organization name, date, and details | None |

| $250 – $500 | CWA from the charity | None |

| Over $500 – $5,000 | CWA plus records on how the property was acquired and its cost basis | Form 8283, Section A [10][2] |

| Over $5,000 | CWA and a qualified appraisal (except certain securities/vehicles) | Form 8283, Section B [10][2] |

| Over $500,000 | CWA and a qualified appraisal attached to your tax return | Form 8283, Section B [2] |

Extra Requirements for Donations Over $500

For non-cash donations valued above $5,000 (excluding publicly traded securities), you'll need a qualified appraisal from a professional appraiser who meets IRS standards. Note: the charity cannot act as your appraiser [2]. If your deduction exceeds $500,000 or involves artwork worth $20,000 or more, you must attach the appraisal to your tax return [2].

Special rules apply to vehicle donations over $500. You'll need a CWA that includes your taxpayer identification number (TIN), the vehicle identification number (VIN), and details of the sale if the charity sells the vehicle [9][7]. Charities typically use Form 1098-C for this purpose. Additionally, if the charity disposes of donated property worth over $500 within three years, they must file Form 8282 and provide you with a copy [11].

sbb-itb-e723420

Value Your Donated Items Correctly

Getting the valuation right is crucial. According to the IRS, Fair Market Value (FMV) is defined as "the price that property would sell for on the open market. It is the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts" [12]. Simply put, FMV is the price a willing buyer and seller would agree upon under normal circumstances.

When determining FMV, the IRS looks at four key factors: the original cost or selling price, sales of similar items, replacement cost, and expert appraisals [12]. Misstating values can lead to penalties - serious ones. The IRS may apply a 20% or 40% penalty for substantial or gross valuation misstatements [12]. Let’s dive into how to calculate FMV and when professional appraisals are necessary.

Calculate Fair Market Value

For used clothing and household items, FMV is often based on thrift store averages or roughly 30% of the original price if no specific value is listed [12][14][15]. However, these items must be in "good used condition or better" to qualify for a deduction [12]. Tools like the Salvation Army’s online valuation guide or the Valuation Guide for Goodwill Donors can help you estimate typical prices [14].

When it comes to stocks and bonds, use the selling price or bid/ask price on the donation date [12]. For real estate, FMV is typically calculated using comparable sales, income capitalization, or replacement cost minus depreciation [12]. Art and collectibles, on the other hand, require more detailed evaluation, with factors like rarity, condition, and provenance playing a big role [12][13].

To back up your FMV claims, document everything. Take clear photos and provide detailed descriptions of each item, including its condition, age, and style [12][13]. This evidence can be crucial if the IRS questions your deduction.

Get Professional Appraisals for High-Value Items

If your deduction for a single item or a group of similar items exceeds $5,000, you’ll need a qualified appraisal from a professional appraiser [12][2]. A "group of similar items" includes things like a coin collection or a series of books, even if you donate them to different charities [2][10].

Publicly traded securities are an exception - they don’t require an appraisal, no matter their value [12][11][3]. However, if you’re donating art valued at $20,000 or more, you must attach the appraisal to your tax return [12][3]. For art worth $50,000 or more, you can request an IRS Statement of Value. This service costs $7,500 for one to three items, plus $400 for each additional item [12].

Make sure the appraisal is completed within 60 days before the donation and submitted with your tax return [12]. The appraiser must follow USPAP (Uniform Standards of Professional Appraisal Practice) guidelines [12][13][10], and their fee cannot be based on a percentage of the appraised value [12][10].

Time Your Donations Right

To claim deductions for your donations, timing is everything. Donations must be made by December 31 to qualify for that tax year. However, the exact timing rules depend on the method you use to give.

Year-End Deadlines

Credit card donations are simple. The donation counts for the year in which the card issuer processes the charge, even if you don’t pay your credit card bill until the following year. For instance, a donation charged on December 31, 2025, will be deductible on your 2025 tax return.

Mailed checks follow what’s known as the “mailbox rule.” If your check is postmarked by December 31, it qualifies for that tax year - even if the charity receives or cashes it later. Note that the USPS now applies machine postmarks at regional processing centers, which can cause delays. To avoid issues, consider requesting a manual postmark or using Certified Mail.

Electronic transfers like ACH or wire transfers are considered complete when the funds are credited to the charity’s account. Since processing can take a few days, initiate these transfers well before the year-end deadline to ensure they count.

Here’s a quick reference for common donation methods:

| Donation Method | Effective Date for Tax Deduction |

|---|---|

| Credit Card | Date the charge is processed by the issuer |

| Check (via USPS) | Date of the postmark (must be by Dec 31) |

| Check (via FedEx/UPS) | Date the charity receives the donation |

| Wire Transfer / ACH | Date funds are credited to the charity |

| Stock / Securities | Date the broker completes the transfer |

If you’re 70½ or older, you might want to explore an additional option: Qualified Charitable Distributions (QCDs), which offer unique tax advantages.

Qualified Charitable Distributions (QCDs)

For those aged 70½ or older, QCDs allow you to transfer up to $105,000 (as of 2025) directly from your IRA to a qualified charity. The standout benefit? The distribution isn’t included in your taxable income, which can lower your Adjusted Gross Income (AGI) - a potential advantage over claiming a standard charitable deduction.

QCDs also count toward your Required Minimum Distribution (RMD) for the year. However, to qualify as a QCD, the funds must be sent directly from your IRA custodian to the charity. If the check is made payable to you first, it won’t meet the requirements.

To avoid any last-minute issues, contact your IRA custodian early in December. Processing times vary across financial institutions, and waiting until the last minute could risk missing the December 31 deadline. Also, be sure to keep a written acknowledgment from the charity for your records - it’s a crucial part of documenting your QCD.

Avoid Common Mistakes

Once you've grasped the basics of qualification, limits, documentation, and valuation, it's crucial to steer clear of common errors that could lead to your deductions being denied. Missteps can also result in IRS penalties, so staying within the guidelines is essential.

Quid Pro Quo Contributions

If you donate to a charity but receive something in return, only the portion of your contribution that exceeds the fair market value (FMV) of the benefit is deductible[2]. For example, imagine you pay $500 to attend a charity gala where the meal and entertainment are valued at $150. In this case, only $350 of your payment qualifies as a deductible contribution.

"If you receive a benefit in exchange for the contribution... you can only deduct the amount that exceeds the fair market value of the benefit received or expected to be received." - Internal Revenue Service[2]

There’s one notable exception: intangible religious benefits, such as attending a religious ceremony, typically don’t reduce your deduction. However, the acknowledgment from the organization must clearly state that this was the only benefit received[7].

Next, be cautious of donations that might seem eligible but fail to meet IRS requirements.

Donations to Non-Qualified Recipients

To claim a deduction, your contribution must go to an IRS-qualified organization[4]. This means donations to political campaigns, candidates, or social clubs do not qualify. Before giving, confirm the organization's tax-exempt status through the IRS Tax Exempt Organization Search Tool at IRS.gov/TEOS[4].

"A charitable contribution is voluntary, and is made without getting, or expecting to get, anything of equal value in return." - Taxpayer Advocate Service[4]

Standard Deduction vs. Itemizing

Even after verifying your donation type and amount, the way you file your taxes determines whether you can deduct charitable contributions. These deductions are only available if you itemize on Schedule A[4]. For the 2025 tax year, itemizing is worthwhile only if your total deductions - including charitable gifts, mortgage interest, and state and local taxes - exceed the standard deduction for your filing status. Otherwise, charitable contributions won’t provide a tax benefit.

If your total deductions are close to the standard deduction, consider "bunching" donations. This strategy involves combining contributions into a single tax year to push your deductions above the standard threshold[3].

Conclusion

To claim your charitable donation deductions, stick to these IRS guidelines. Start by verifying your charity's eligibility using the Tax Exempt Organization Search tool. Then, keep all necessary documentation - this includes bank records for cash donations and Form 8283 for non-cash donations over $500. When donating items, accurately determine their fair market value, and for any single item valued above $5,000, a qualified appraisal is required[2].

Make sure your donation is made by December 31 and that you itemize deductions on Schedule A to claim it[4]. Remember, if your total itemized deductions don’t exceed the standard deduction for your filing status, your charitable contributions won’t yield a tax benefit. Proper valuations are critical, as errors can lead to severe penalties[1]. Additionally, missing required documentation could result in your deduction being denied[4].

Keep in mind that your deductions are limited to 60% of your adjusted gross income (AGI), though lower limits may apply depending on the type of donation. If your deductions exceed this limit, the excess can be carried forward for up to five years[1][4].

FAQs

How can I check if a charity is eligible for tax-deductible donations?

To check if a charity is eligible for tax-deductible donations, head over to the IRS website and use the IRS Tax Exempt Organization Search tool. Simply type in the charity's name or its Employer Identification Number (EIN) to see if it’s recognized as a qualified 501(c)(3) organization. Remember, only donations to these approved organizations can be claimed as tax deductions.

What records do I need for non-cash donations over $500?

If you're donating non-cash items worth more than $500, you'll need a written acknowledgment from the charity describing the items you gave. Plus, you'll have to include Form 8283 with your tax return:

- Use Section A for items valued between $500 and $5,000.

- For items worth over $5,000, fill out Section B and attach a qualified appraisal of the donation.

Be sure to hold onto all related paperwork, as the IRS might ask for proof to support your claim.

How can I calculate the fair market value of donated items for tax purposes?

To figure out the fair market value (FMV) of donated items, think about what a buyer would reasonably pay a seller in an open market at the time of the donation. The item’s condition plays a big role here. You can check recent sales of similar items - like listings on online marketplaces or prices from local dealers - to get a sense of its worth. If you can’t find a direct comparison, you can make a reasonable estimate based on the original purchase price, adjusted for factors like age and wear.

For donations worth more than $500, you’ll need to fill out IRS Form 8283 and keep written records. These should include details like a description of the item, its condition, and the estimated FMV. If the donation’s value tops $5,000, a professional appraisal is required, and you’ll need to attach that appraisal to your tax return. It’s also a good idea to keep supporting evidence, such as photos or valuation guides, to back up your claim if needed.

By researching comparable sales, considering the item’s condition, and maintaining thorough documentation, you can accurately determine FMV and meet IRS guidelines.