What Records Do You Need for Donation Tax Deductions?

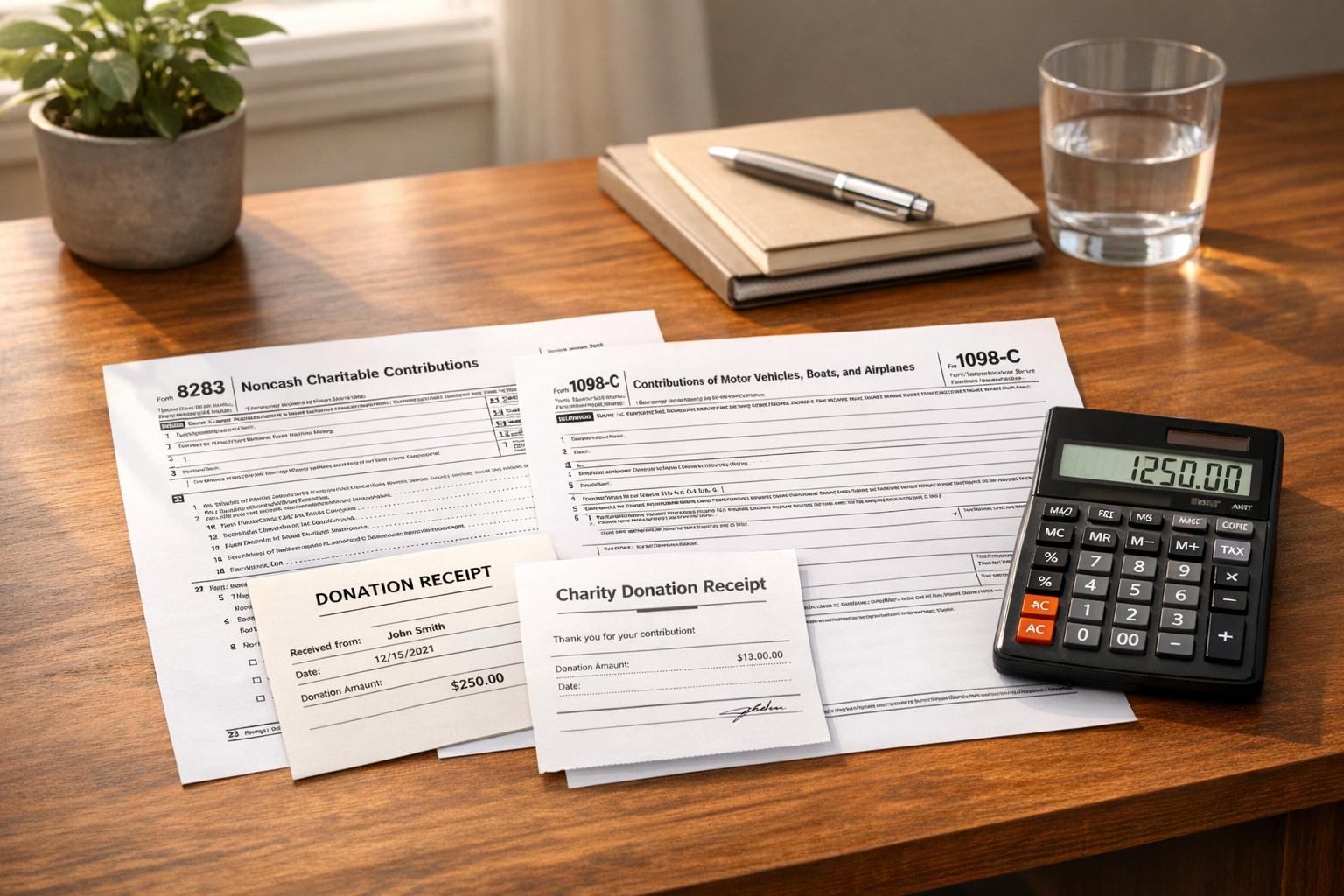

If you want to claim tax deductions for donations, the IRS requires specific documentation. Without proper records, your deduction could be denied, and you might face penalties. Here's what you need to know:

- Cash Donations: Keep bank statements, canceled checks, or written receipts showing the charity's name, date, and amount. For donations over $250, get a written acknowledgment from the charity.

- Non-Cash Donations: For items under $250, keep a receipt with the charity's name, donation date, and item description. Donations over $500 require Form 8283 and additional records, like acquisition details or appraisals for items over $5,000.

- Vehicles: If donating a vehicle worth over $500, file Form 1098-C and base your deduction on the charity’s sale proceeds.

To ensure compliance, organize records by year and type, and keep them for at least three years after filing. Digital tools like Deductible.me can simplify tracking and storing donation records.

Key takeaway: Proper documentation is mandatory to secure your deductions and avoid IRS penalties.

What Records Do I Need For Charitable Tax Deductions?

IRS Recordkeeping Rules for Charitable Donations

Keeping accurate records is essential for maximizing your deductions and staying prepared in case of an audit.

Donations Must Go to Qualified Organizations

To ensure your donation is tax-deductible, it must be made to an IRS-qualified organization. These include 501(c)(3) nonprofits like churches, schools, and hospitals. Contributions to most foreign charities don’t qualify, although there are exceptions for certain organizations in Canada, Mexico, and Israel under specific tax treaties. You can confirm an organization’s status using the IRS Tax Exempt Organization Search tool at IRS.gov/TEOS.

Once you've verified the organization, it’s important to understand the documentation requirements for your donation.

Basic Documentation for Cash Donations

Every cash donation, no matter the amount, requires proper documentation. Acceptable records include a bank statement, canceled check, credit card statement, or a written acknowledgment from the charity. The documentation must clearly show the organization’s name, the date of the donation, and the amount given. If you donate via text message, a copy of your phone bill listing the charity’s name, the date, and the donation amount will suffice. Without these records, you won’t be able to claim the deduction.

Written Acknowledgment for Donations Over $250

For donations of $250 or more, you’ll need a written acknowledgment from the charity. This acknowledgment should specify the amount of cash donated and describe any non-cash items you contributed. Make sure to obtain this statement by the time you file your tax return or the filing deadline (including extensions). If the charity provided any goods or services in return for your donation, the acknowledgment must include an estimate of their fair market value. You can only deduct the amount that exceeds the value of those goods or services.

Records Needed for Cash Donations

When it comes to cash donations, the type of documentation you need depends on how you made the payment and the amount you donated.

Bank Records and Charity Receipts

Every cash donation requires proof, no matter the amount. The IRS accepts several types of documentation, including canceled checks, bank or credit card statements, electronic fund transfer receipts, or written receipts from the charity. These records must clearly show three key details: the charity's name, the date of the donation, and the amount given.

If you donate via text message, your phone bill can serve as proof, as long as it lists the charity's name, the donation date, and the amount.

For payroll deductions, however, the requirements are a bit different.

Payroll Deduction Records

If you're donating through your paycheck, you’ll need two pieces of documentation: a pay stub or Form W-2 showing the amount withheld, and a pledge card from the charity confirming that no goods or services were received in return. Both are essential to meet IRS guidelines.

Common Documentation Mistakes

Even small donations need proper records. For instance, if you drop $20 into a collection plate, you’ll still need a receipt to claim it as a deduction.

Another common mistake is holding onto incomplete receipts. A receipt missing the charity's name, the date, or the exact donation amount won’t meet IRS standards. And if you attend a charity event, make sure to get a written estimate of any meals or benefits you received. This is crucial for calculating the portion of your donation that’s deductible.

sbb-itb-e723420

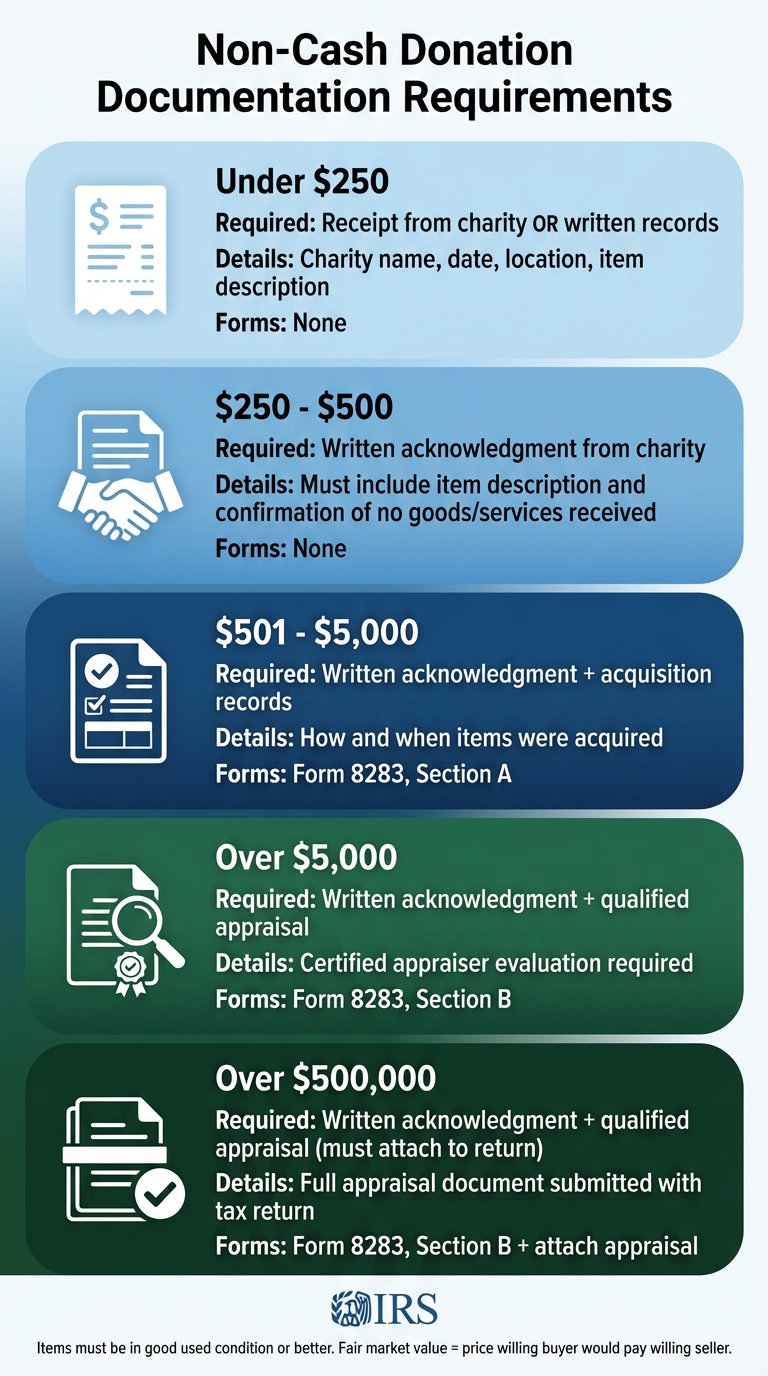

Records Needed for Non-Cash Donations

IRS Documentation Requirements for Charitable Donation Tax Deductions by Value

Donating items like clothing, furniture, or electronics requires different documentation compared to cash donations. The IRS has specific guidelines depending on the total value of the items you're giving away.

Documentation for Items Under $250

If your non-cash donation is valued at less than $250, you'll need a receipt from the charity. This receipt should include the organization's name, the date and location of the donation, and a detailed description of the items donated. If you can't get a receipt - for instance, if you donate through an unattended drop-off bin - keep a personal record of the items.

Your records should also document the fair market value of each item at the time of the donation and how you determined that value. To estimate fair market value, you can research similar items on online marketplaces or refer to valuation guides. Taking photos of the items before donating is a good way to document their condition.

For donations exceeding $500, the IRS imposes additional requirements.

Additional Requirements for Donations Over $500

If your annual non-cash donations total more than $500, you'll need to complete Form 8283 and attach it to your tax return. Here's what to know based on donation value:

- For items valued between $501 and $5,000: Fill out Section A of Form 8283. You’ll also need a written acknowledgment from the charity and records showing how and when you acquired the items.

- For items valued over $5,000: Along with Section A, you’ll need to complete Section B of Form 8283 and obtain a qualified appraisal from a certified appraiser.

- For donations exceeding $500,000: In this case, you must not only complete the required forms but also attach the actual appraisal to your tax return.

Here’s a quick reference table for the documentation requirements:

| Donation Value | Required Documentation | Additional Forms |

|---|---|---|

| Under $250 | Receipt from charity OR your written records | None |

| $250 – $500 | Written acknowledgment from charity | None |

| $501 – $5,000 | Written acknowledgment + acquisition records | Form 8283, Section A |

| Over $5,000 | Written acknowledgment + qualified appraisal | Form 8283, Section B |

| Over $500,000 | Written acknowledgment + qualified appraisal | Form 8283, Section B + attach appraisal |

Item Condition and Valuation Rules

To qualify for a deduction, donated items must typically be in "good used condition or better." This rule applies to clothing and household items. If you’re donating items worth more than $500 that aren’t in good condition, you’ll need a qualified appraisal to claim the deduction.

When determining the fair market value, think of it as the price a willing buyer would pay a willing seller under normal circumstances. This value isn’t what you originally paid for the item, but rather its current worth in its present condition. For vehicle donations over $500, the deduction is generally limited to the charity’s gross proceeds from the sale of the vehicle, and you'll need to file Form 1098-C.

How to Organize and Store Donation Records

Keeping your donation records well-organized is essential to protect your tax deductions. While the IRS doesn’t mandate a specific filing system, you need to be ready to provide documentation if requested. As the IRS states, “Good records are key to qualifying for the full charitable contribution deduction allowed by law.” [1]

Here’s how you can effectively manage and store your donation records, following IRS guidelines.

How Long to Keep Records

Hold onto your donation records for at least three years after filing your taxes [2]. However, if you underreport income by more than 25%, the IRS can review up to six years of records - so it’s safer to keep them for seven years. For property donations, retain records until the statute of limitations expires for the tax year when you disposed of the asset. Once the retention period ends, shred paper documents to protect your personal information [2].

Once you’ve figured out how long to keep your records, the next step is setting up a system to keep everything organized.

Creating a Filing System

Sort your records by calendar year and donation type, using clearly labeled folders. Within each folder, group documents by value categories, such as under $250, $250–$500, $501–$5,000, and over $5,000 [3, 19]. Whether you prefer physical folders or digital storage, make sure to include supporting documents like bank statements, canceled checks, credit card statements, and receipts from charities. For non-cash donations, maintain an inventory list that includes item descriptions, photos, and details on how you calculated the fair market value [3, 19].

Using Deductible.me for Record Management

For a streamlined approach, consider digital tools like Deductible.me. This app allows you to store all your donation records in one place. Its AI-powered features can scan photos, estimate fair market values, and even track your annual giving totals. It also generates IRS-compliant reports, such as Form 8283 for non-cash donations exceeding $500, ensuring your records are tax-ready. With the Premium plan at just $2 per month, you get unlimited donation tracking, advanced receipt management, and the ability to set annual giving goals - making tax season a lot less stressful.

Conclusion

Summary of Documentation Requirements

Let’s quickly recap the IRS requirements for claiming donation deductions. For cash donations, you’ll need bank records or written receipts that confirm essential details. If your donation - whether cash or property - is $250 or more, the IRS mandates obtaining a written acknowledgment from the charity before filing your tax return. Skipping this step can be costly; for instance, the Tax Court denied a $65,000,000 deduction due to missing proper acknowledgment [3].

Non-cash donations come with additional requirements as their value increases. For donations exceeding $500, you’ll need to complete Form 8283. Also, donated clothing and household items must be in "good used condition" or better to qualify for deductions [3].

Once your documentation is in order, the next step is keeping everything well-organized.

Tips for Staying Organized

Consistency is key when it comes to tracking your donations. Set up a system to organize records by year and type of donation, so you’re ready if the IRS ever reviews your deductions. For non-cash donations, consider taking photographs and creating detailed inventory lists to back up your valuations.

Digital tools can make this process easier. For example, Deductible.me’s Premium plan, priced at $2 per month, offers features like unlimited donation tracking, AI-assisted item valuation, and automatic generation of IRS-compliant reports like Form 8283. It even has advanced receipt management to keep all your documentation secure and accessible. Whether you prefer paper or digital methods, the goal is to track donations as they happen. Staying organized ensures your deductions are well-supported and ready for any audit.

FAQs

What records do I need to claim a tax deduction for non-cash donations?

To deduct non-cash donations on your taxes, you’ll need to follow the IRS rules and keep the right documentation. If your donation is $250 or more, make sure you get a written acknowledgment from the charity. This should include your name, the date of the donation, and a description of what you gave. If you’re donating a vehicle worth more than $500, you’ll also need a Form 1098-C or a similar statement from the charity.

It’s also a good idea to hold onto receipts, bank statements, or any other records that prove your donation. These documents can be crucial for staying compliant and prepared if the IRS ever reviews your return.

What records should I keep to claim charitable donation tax deductions?

To claim a tax deduction for your charitable contributions, it's crucial to maintain clear and accurate records. For cash donations, hold onto receipts, bank statements, or written acknowledgment letters from the organization - especially for donations of $250 or more. When it comes to non-cash contributions, such as goods or property, document the item's fair market value and obtain acknowledgment letters from the charity. If you're donating a vehicle, make sure to get Form 1098-C from the charity.

Keep all donation-related paperwork organized in a dedicated file alongside your tax records. Be sure to store these documents for at least three years in case the IRS requests them during an audit. Staying organized not only helps you comply with IRS rules but also ensures you make the most of your eligible tax deductions.

Can I deduct donations made to foreign charities on my U.S. taxes?

In the United States, donations to foreign charities typically don’t qualify for tax deductions. The IRS generally mandates that the organization receiving your donation must be a recognized U.S. nonprofit or charity. That said, there are a few exceptions to this rule. For instance, specific Canadian, Mexican, or Israeli charities may qualify if they meet certain IRS requirements outlined in tax treaties.

To confirm your donation is deductible, make sure the organization is officially recognized as tax-exempt under U.S. law. You can verify this status by checking the IRS database of qualified organizations. Additionally, it’s important to keep proper documentation, like receipts or acknowledgment letters, to support your deduction when filing taxes.