10 Ways to Maximize Your Charitable Tax Deductions

Charitable giving can reduce your taxable income, but only if you plan carefully. With major tax changes coming in 2026, 2025 is your last chance to maximize deductions under current rules. Here’s how you can make the most of your donations:

- Donate Appreciated Assets: Avoid capital gains taxes and deduct the full market value of assets like stocks.

- Qualified Charitable Distributions (QCDs): If you're 70½ or older, transfer up to $108,000 from your IRA tax-free.

- Bundle Donations: Combine multiple years of giving into 2025 to exceed the standard deduction.

- Use Donor-Advised Funds (DAFs): Get an immediate tax deduction while spreading donations over future years.

- Track Donations: Tools like Deductible.me simplify recordkeeping and ensure IRS compliance.

- Verify 501(c)(3) Status: Confirm the charity is eligible for tax-deductible contributions.

- Itemize Deductions: Only itemize if your total deductions exceed the standard deduction for 2025 ($15,750 for single filers, $31,500 for married couples).

- Carry Forward Excess Deductions: Unused deductions can be rolled forward for up to five years.

- Prepare for 2026 Tax Changes: Donate by December 31, 2025, to avoid stricter rules like the 0.5% AGI floor.

- Work with a Tax Advisor: Professional guidance ensures you maximize tax benefits and stay compliant.

Act before December 31, 2025, to lock in savings and stay ahead of upcoming tax law changes.

2025 vs 2026 Charitable Deduction Rules Comparison

New Charitable Deduction Rules for 2026: What High Earners Need to Know

1. Give Appreciated Assets Instead of Cash

Donating appreciated assets you've held for over a year can unlock two key tax advantages. First, you can deduct the asset's full fair market value as a charitable contribution. Second, you sidestep the capital gains tax you would owe if you sold the asset yourself [5][6]. This method not only maximizes your tax savings but also ensures the charity receives a larger benefit.

For example, imagine donating $40,000 worth of appreciated stock with a cost basis of $25,000. If you sold the stock yourself, you'd incur around $3,570 in combined capital gains taxes and surtax, reducing the total value of your gift. By donating the stock directly, however, the charity receives the full $40,000, and you avoid those taxes [6].

Keep in mind, though, that deductions for appreciated assets are capped at 30% of your adjusted gross income (AGI), compared to a 60% cap for cash donations [5][6]. For non-cash donations exceeding $500, you’ll need to file Form 8283. If the asset's value exceeds $5,000, you must also obtain a qualified appraisal [1][3]. Importantly, the asset must be transferred directly to the charity to avoid triggering capital gains taxes. Following these steps ensures your donation is as tax-efficient as possible.

"Donating securities that have been held for a year or more offers the potential for a double tax benefit - a full fair market value tax deduction and elimination of capital gains taxes." - Fidelity Charitable [6]

On the other hand, if an investment has lost value, consider selling it first. You can claim a capital loss on your taxes and then donate the cash proceeds. This way, you combine the benefits of the loss deduction with the charitable contribution deduction [6].

2. Make Qualified Charitable Distributions from Your IRA

If you're 70½ or older, you have the option to transfer up to $108,000 directly from your IRA to a qualified 501(c)(3) charity in 2025 - and here's the key part: the entire amount is excluded from your taxable income [7]. This strategy is called a Qualified Charitable Distribution (QCD), and it offers a tax-saving opportunity for both itemizers and non-itemizers.

For those aged 73 or older who are required to take Required Minimum Distributions (RMDs), a QCD can be especially beneficial. It not only fulfills your RMD obligation but also keeps the transferred funds out of your Adjusted Gross Income (AGI). A lower AGI can help you in multiple ways: avoiding Medicare IRMAA surcharges, reducing taxes on Social Security benefits, and staying eligible for other AGI-based tax credits. As Ed Slott, CPA and IRA expert, puts it:

"QCDs will almost always save taxes – and they will never raise taxes" [7].

Timing your QCD is crucial to get the most out of its tax advantages.

The IRS applies a "first-dollars-out" rule, meaning the first withdrawal from your IRA counts toward your RMD. Let’s break this down with an example: In 2025, if a 76-year-old taxpayer named Joe has a $10,000 RMD and wants to donate $15,000 to charity, Joe should make the $15,000 QCD before taking any personal withdrawals. This way, the QCD satisfies his RMD tax-free. On the other hand, if Joe takes a personal withdrawal first, the amount used to meet the RMD would be taxable.

To avoid generating taxable income, ensure that funds are transferred directly from your IRA custodian to the charity. Married couples can each contribute up to $108,000 from their respective IRAs, giving them a combined limit of $216,000. However, keep in mind that QCDs cannot go to donor-advised funds, private foundations, or supporting organizations. Additionally, you cannot receive any goods or services in return for your donation.

It’s a good idea to initiate your QCD early in the year to ensure you meet your RMD deadline. Be sure to get a written acknowledgment from the charity confirming that no benefits were provided in exchange for your contribution - this step is essential for staying compliant with IRS rules [9].

3. Bundle Multiple Years of Donations into 2025

If your annual giving falls below the standard deduction, it might not provide any tax benefit. But by bunching multiple years of donations into 2025, you can bypass this issue and potentially save a lot on taxes.

Here’s why this works: In 2025, the standard deduction will be $15,750 for single filers and $31,500 for married couples filing jointly [10][11]. For taxpayers over 65, the amounts rise to $17,000 and $33,200, respectively [8]. To benefit from itemized deductions, your total deductions - including charitable donations, mortgage interest, and the $10,000 cap on state and local taxes (SALT) - must exceed these thresholds. If they don’t, you’ll end up just taking the standard deduction.

Let’s break it down with an example: Jack and Aiysha donate $10,000 each year. Combined with their $10,000 SALT, their total deductions are $20,000 - far below the $31,500 standard deduction for married couples. But if they bunch three years of donations into a single $30,000 contribution in 2025, their total deductions jump to $40,000. That’s well above the threshold, unlocking meaningful tax savings [8].

The benefits grow even more for higher-income households. Imagine a couple in the 35% tax bracket with $15,000 SALT and $10,000 in mortgage interest. If they combine three years of $20,000 donations into a $60,000 gift, their itemized deductions hit $85,000. This strategy saves them $18,725 in taxes compared to the $11,550 they’d save by spreading the donations over three years [10].

Timing is critical. To claim the deduction for 2025, your bunched donation must be made by December 31, 2025 [1]. Using a Donor-Advised Fund (DAF) can make this process even smoother. With a DAF, you can make the full bunched donation in 2025 to secure the immediate tax deduction, but then distribute the funds to your chosen charities over the following years. And in the years you don’t itemize, you can simply take the standard deduction instead.

4. Use a Donor-Advised Fund

A donor-advised fund (DAF) acts as a charitable investment account, allowing you to make a contribution, claim an immediate tax deduction, and then recommend grants to IRS-qualified 501(c)(3) organizations over time. The key benefit here is that you receive the full tax deduction upfront, even if you spread your donations across several years [8]. This aligns well with bundling strategies, offering immediate tax perks while letting you distribute your giving at your own pace.

Here’s how it works: Let’s say you contribute $60,000 to a DAF in 2025. You can claim the entire deduction for that year, but distribute $20,000 annually to your chosen charities over the next three years. Meanwhile, the funds in your DAF can be invested and grow tax-free, which means there’s potential for an even larger pool of money to donate in the future [12].

Setting up a DAF is straightforward. Many providers have low or even no minimum contribution requirements, and the annual fees are typically around 1% of your account balance [12]. You can fund the account with various assets like cash, appreciated stocks, or cryptocurrency. If your contribution exceeds the adjusted gross income (AGI) limits, you can carry forward the excess deduction for up to five years [13][15].

For tax compliance, you’ll need to follow a few rules. Contributions of $250 or more require a written acknowledgment from the DAF sponsor. Non-cash donations exceeding $500 must be reported using IRS Form 8283, and donations over $5,000 generally require a qualified appraisal [14]. The good news? The DAF sponsor provides a single receipt for your initial contribution, simplifying recordkeeping - even if you later make grants to dozens of charities [12][16].

Keep in mind, DAFs come with restrictions. The funds can’t be used for personal benefits like school tuition, political donations, or charity gala tickets. Grants must go exclusively to IRS-qualified public charities [12][16]. Additionally, you cannot use a Qualified Charitable Distribution (QCD) from your IRA to fund a DAF, as these are treated separately under tax rules [17].

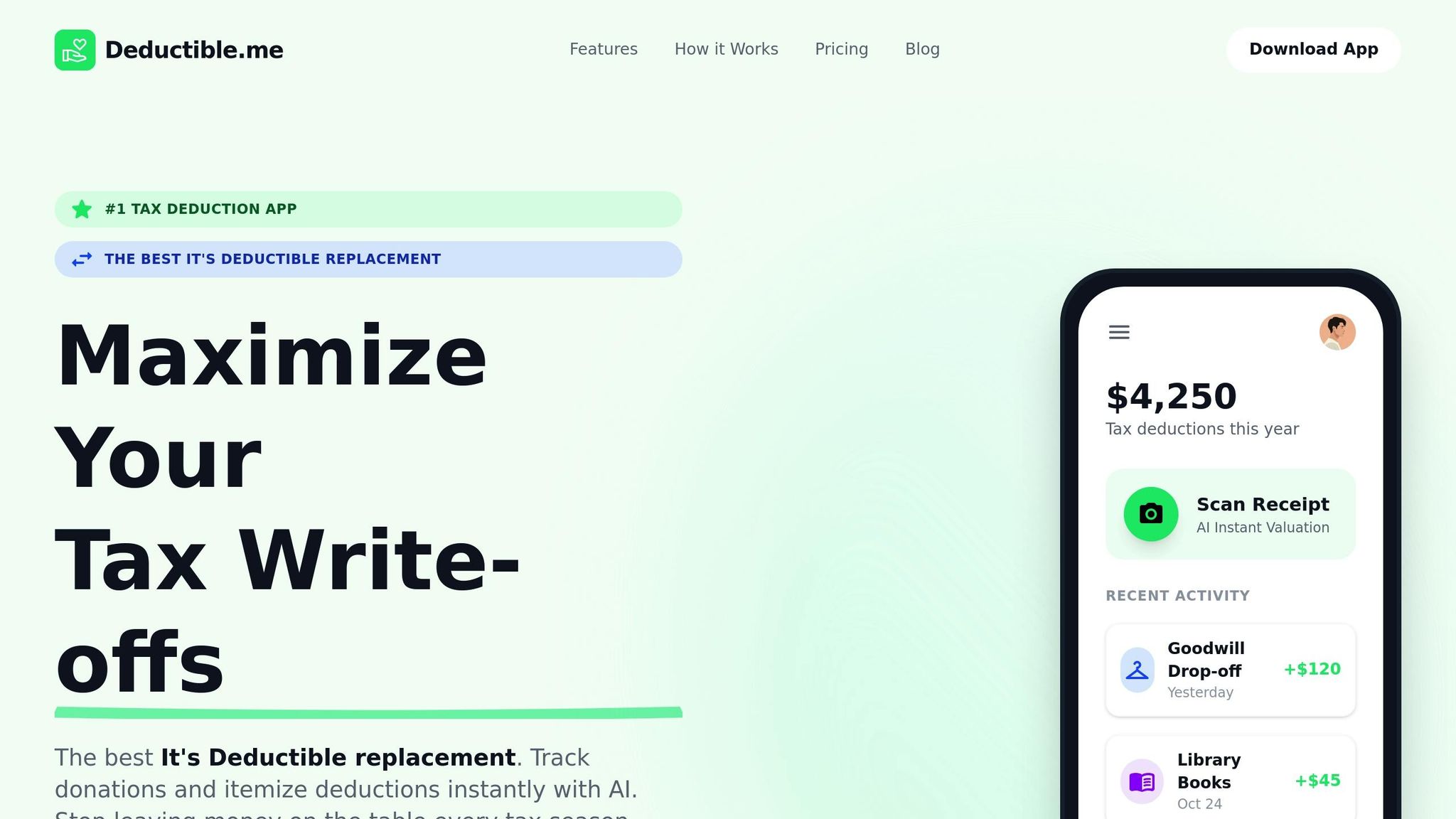

5. Track Donations with Deductible.me for IRS Compliance

Keeping accurate records of your donations isn't just a good habit - it’s a requirement by the IRS. To claim a deduction, every donation needs to be backed by a bank record or a written acknowledgment [2]. Without proper documentation, you could lose your deduction entirely if you're audited. That’s where Deductible.me steps in, making donation tracking simple and centralized. Whether you're donating cash or items like clothing, furniture, or electronics, this platform keeps everything in one place.

One standout feature is its AI-powered valuation for non-cash donations. Just snap a photo, and the AI generates an IRS-compliant valuation based on fair market value. This is especially important because the IRS only allows deductions for items in "good used condition or better." If questioned, you’ll need proof, and Deductible.me ensures you have it [1][20]. The platform also automatically records essential details like organization names, dates, and item descriptions, minimizing errors that could raise red flags during an audit [18][19].

Deductible.me goes further by storing digital receipts, including Contemporaneous Written Acknowledgments (CWAs) for donations of $250 or more. It also assists with Form 8283, which is required for non-cash donations exceeding $500. Without this form, the IRS can reject your deduction entirely [1][2][20].

The platform offers two plans to suit different needs. The free plan tracks donations up to $500, while the Premium plan, at just $2/month, provides unlimited tracking, advanced receipt management, and IRS-ready reports. Premium users also benefit from annual giving goal tracking and priority support - ideal for those bundling donations or managing carryforward deductions over several years.

Since excess contributions can be carried forward for up to five years, having well-organized records is critical. Deductible.me’s dashboard ensures everything is easy to access when tax season rolls around [1][20].

sbb-itb-e723420

6. Confirm 501(c)(3) Status and Keep Proper Receipts

Before making a donation, check the charity's 501(c)(3) status using the IRS Tax Exempt Organization Search (TEOS) tool [21]. This free resource helps you verify if an organization is listed in Publication 78 Data, which includes groups eligible to receive tax-deductible donations [21]. To avoid confusion, search using the charity's Employer Identification Number (EIN) instead of its name, as many organizations have similar names [21].

You should also review the Automatic Revocation of Exemption List to ensure the charity hasn't lost its tax-exempt status. Around 275,000 organizations have had their exemptions revoked for failing to file three consecutive annual reports [22]. If the charity is on this list, confirm whether its status has been reinstated before proceeding with your donation.

Once you've confirmed the charity's eligibility, make sure you keep the proper documentation to protect your tax deduction. Here's a quick guide:

| Donation Type | Donation Amount | Required Documentation |

|---|---|---|

| Cash/Monetary | Under $250 | A bank record (like a statement or canceled check) or a written acknowledgment from the charity showing its name, the date, and the donation amount. |

| Cash/Monetary | $250 or more | A written acknowledgment from the charity that includes the donation amount and specifies whether any goods or services were received. |

| Non-Cash | Over $500 | Form 8283 (Section A). |

| Non-Cash | Over $5,000 | Form 8283 (Section B) along with a qualified appraisal. |

For cash donations of $250 or more, you’ll need a written acknowledgment from the charity. It must include the donation amount, details of any goods or services exchanged, and the estimated value of any benefits received. A bank record alone won’t suffice in this case.

Keep in mind that only donations made by December 31 are deductible for that tax year. Pledges paid in January won’t count. If you’re donating via text message, save your phone bill as proof - it should clearly display the charity’s name, the date, and the donation amount.

7. Itemize When Your Deductions Exceed the Standard Amount

Charitable donations can help lower your tax bill, but only if you itemize deductions on Schedule A instead of opting for the standard deduction. For the 2025 tax year, the standard deduction amounts are as follows: $15,750 for Single or Married Filing Separately, $23,625 for Head of Household, and $31,500 for Married Filing Jointly. If you're 65 or older or blind, you can add an extra $2,000 (Single/Head of Household) or $1,600 (Married) to these amounts [23].

To figure out if itemizing makes sense for you, add up all your deductible expenses - this includes things like mortgage interest, state and local taxes, medical expenses above 7.5% of your adjusted gross income, and charitable donations. If the total exceeds your standard deduction, itemizing could save you more money. While sticking with the standard deduction is simpler, itemizing can pay off when your eligible expenses surpass the standard deduction threshold [23].

"Claiming the standard deduction is easier for taxpayers since they don't have to keep track of expenses. However, if your deductible expenses, like mortgage interest or medical costs, exceed the Standard Deduction, itemizing may save you more." – Viola Robinson Faust, CPA, EA, TurboTax [23]

To get started, check your Form 1098 for mortgage interest and real estate taxes. Then, see if adding your charitable contributions pushes your total deductions above the standard deduction. For 2025, you can deduct up to $40,000 in state and local taxes - a big jump from the previous $10,000 cap. Also, calculate your medical expense floor by multiplying your adjusted gross income by 0.075. Only the out-of-pocket medical costs above this amount can count toward itemizing [23].

8. Use Deductible.me Premium for Unlimited Tracking and Reports

For just $2 a month, Deductible.me Premium provides unlimited tracking, automated Form 8283 preparation, advanced analytics, and priority support. It's an excellent tool for frequent donors and businesses juggling multiple charitable contributions across different organizations.

This service doesn't just make tracking easier - it also helps ensure you're meeting IRS documentation requirements. For instance, the IRS mandates Form 8283 for non-cash contributions exceeding $500. Forgetting this form could result in losing your deduction. While contributions valued over $5,000 still require a professional appraisal, Deductible.me Premium keeps all the necessary documentation in one convenient place [3].

The platform’s advanced analytics are particularly useful for staying within IRS donation limits - 60% of your adjusted gross income (AGI) for cash donations and 30% for appreciated assets. It also tracks the five-year carryforward rule, which is essential when strategizing donations to exceed the 2025 standard deduction thresholds: $15,750 for single filers and $31,500 for married couples filing jointly [15][24]. These features integrate seamlessly with expert guidance.

Speaking of guidance, priority support offers help with tricky valuations and keeps you informed about upcoming tax law changes. For example, beginning in 2026, the One Big Beautiful Bill Act will introduce a 0.5% AGI floor for itemizers. Additionally, centralized digital receipt storage for donations of $250 or more ensures your records are always ready for an audit [9][15].

9. Carry Forward Excess Deductions for Up to 5 Years

If your charitable donations exceed the IRS limits based on your adjusted gross income (AGI), you don’t lose those deductions - they can be carried forward for up to five years [25]. These limits, as previously mentioned, allow you to carry forward any unused portion, making this rule especially handy when large donations bump up against the 60% AGI limit for cash gifts or the 30% limit for appreciated securities.

Let’s break it down with an example: Sarah donates $100,000 in appreciated stock and has an AGI of $250,000. Because of the 30% limit on appreciated securities, she can only deduct $75,000 this year. The remaining $25,000 rolls forward, giving her five years to claim it [25].

"If you have accumulated carryforwards from multiple years, always use the oldest ones first. Since carryforwards expire after five years, using them in the correct order ensures you don't accidentally lose deductions to expiration." - Kevin Pickett, Greater Houston Community Foundation [25]

This highlights how essential it is to keep detailed records of your donations and their carryforward status.

To claim a carryforward, you’ll need to itemize your deductions on Schedule A for the tax year you plan to use it. Accurate recordkeeping is key - track the year of each donation, the amount, recipient organization, and the type of asset donated. Keep all receipts and acknowledgments for at least five years, as required by the IRS. Tools like Deductible.me can simplify this process, ensuring your records stay organized.

A critical point: carryforwards are still subject to the same percentage limits as the original donation. For instance, if your carryforward is from an appreciated stock donation, the 30% AGI limit still applies. If you’re nearing the five-year expiration for an older carryforward, consider reducing your current-year donations to ensure you fully use the older balance before it’s lost.

Carefully managing these details ensures you maximize your deductions while staying compliant with IRS rules. Keeping thorough records and tracking carryforwards not only helps you avoid missed opportunities but also complements broader strategies for effective donation management.

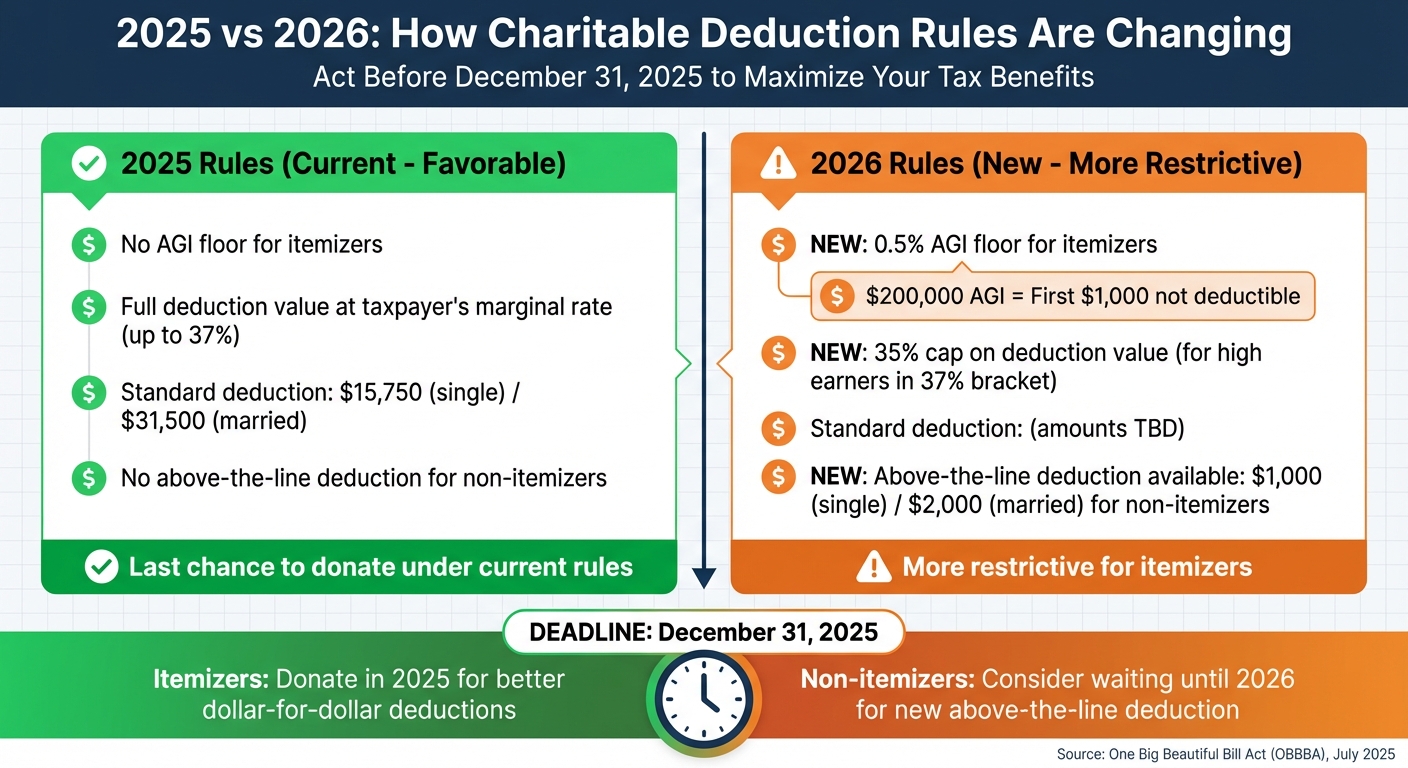

10. Make Gifts Before 2026 Tax Law Changes Take Effect

If you're planning to make charitable contributions, 2025 is a pivotal year to act. The One Big Beautiful Bill Act (OBBBA), passed in July 2025, introduces changes to charitable deduction rules starting January 1, 2026 [15]. This means 2025 is your last opportunity to claim deductions under the current, more favorable rules.

Here’s what’s changing: beginning in 2026, itemizers will face a new 0.5% AGI floor. In simple terms, only donations exceeding 0.5% of your adjusted gross income (AGI) will be deductible. For instance, if your AGI is $200,000, the first $1,000 you donate won’t qualify for a tax benefit [26][27]. Additionally, for high earners in the 37% tax bracket, the value of deductions will be capped at 35% [28].

"Donors who itemize their deductions and are considering making a charitable gift will generally receive a better dollar-for-dollar deduction if they contribute in 2025 rather than waiting until 2026 because of the changes that will go into effect in 2026." - Cara Howe Santoro and Kelly L. Hellmuth, Holland & Knight [30]

To make the most of the current rules, ensure your 2025 donations are completed by December 31, 2025 [15]. One effective strategy is to fund a Donor-Advised Fund. This allows you to secure the 2025 deduction while distributing grants to charities over time.

For those who take the standard deduction - about 90% of taxpayers - waiting until 2026 might actually be advantageous. Starting in 2026, a new above-the-line deduction for cash donations will be available: up to $1,000 for individuals and $2,000 for married couples filing jointly. This benefit wasn’t available under the 2025 rules [29].

Adjust your giving strategy now to align with these upcoming tax changes and maximize your potential benefits.

Conclusion

Getting the most out of your charitable tax deductions takes careful planning and thorough documentation. The ten strategies we've discussed - from donating appreciated assets and making qualified charitable distributions to bunching donations and using donor-advised funds - can help you save on taxes while supporting causes you care about. These approaches are key to building a solid year-end giving plan.

Keeping accurate records is non-negotiable. For every donation, ensure you have IRS-compliant documentation. Tools like Deductible.me can make this easier by tracking receipts, offering AI-powered valuations, and generating reports that meet IRS requirements. Staying organized throughout the year is essential to avoid last-minute headaches.

Timing is just as critical. The year 2025 is a pivotal one for charitable giving. Starting January 1, 2026, new rules - including a 0.5% AGI floor and a 35% cap - will limit deductions. For example, a household with a $300,000 AGI would lose $1,500 in deductions annually due to the new floor [31]. To maximize your benefits, make sure all contributions are completed by December 31, 2025.

Work with a tax advisor or CPA. Miklos Ringbauer, CPA and Founder of MiklosCPA, emphasizes the importance of professional guidance:

"Sit down with [your accountant] before year-end, go through what your scenarios are, and you can come up with a really good solution as to whether [a charitable tax strategy] benefits you or not" [4].

A tax professional can help you evaluate whether itemizing in 2025 or waiting for the 2026 non-itemizer deduction makes the most sense for your financial situation.

FAQs

How does donating appreciated assets help increase my tax deductions?

Donating assets like stocks or real estate that have increased in value can be a smart way to boost your tax deductions. When you give these assets directly to a qualified charity, you can claim a deduction for their full fair market value on your Schedule A - provided you've owned them for over a year.

On top of that, you won't owe capital gains tax on the asset's appreciation. This means the charity receives the full value of your donation, and you enjoy greater tax savings. It's a win-win approach that benefits both you and the cause you support.

What are the advantages of using a donor-advised fund for charitable giving?

A donor-advised fund comes with some appealing perks for those looking to make a difference through charitable giving. One major advantage is the ability to claim an immediate tax deduction for your contributions, even if you choose to distribute the funds to charities gradually. This gives you the freedom to support causes on your own timeline while still taking advantage of tax benefits in the current year.

Another benefit? The assets you contribute - whether it’s cash, stocks, or other appreciated investments - can grow tax-free until they’re granted to the charities you select. This not only boosts the potential impact of your donations but also makes managing your charitable efforts much easier.

Why should I consider maximizing my charitable deductions before 2026?

The current tax laws provide more lenient guidelines for charitable deductions, but starting in 2026, the One Big Beautiful Bill Act will introduce tighter restrictions. By acting now, you can make the most of the benefits currently available, like bunching contributions to increase your deductions and retain more of your tax savings. Thoughtful planning today ensures you can maximize your charitable giving while adhering to IRS regulations.