Common Donation Tracking Mistakes and How to Fix Them

When it comes to tracking donations for tax deductions, mistakes can cost you money or even trigger IRS issues. From missing receipts to overestimating donation values, these errors are common - but avoidable. Here's what you need to know:

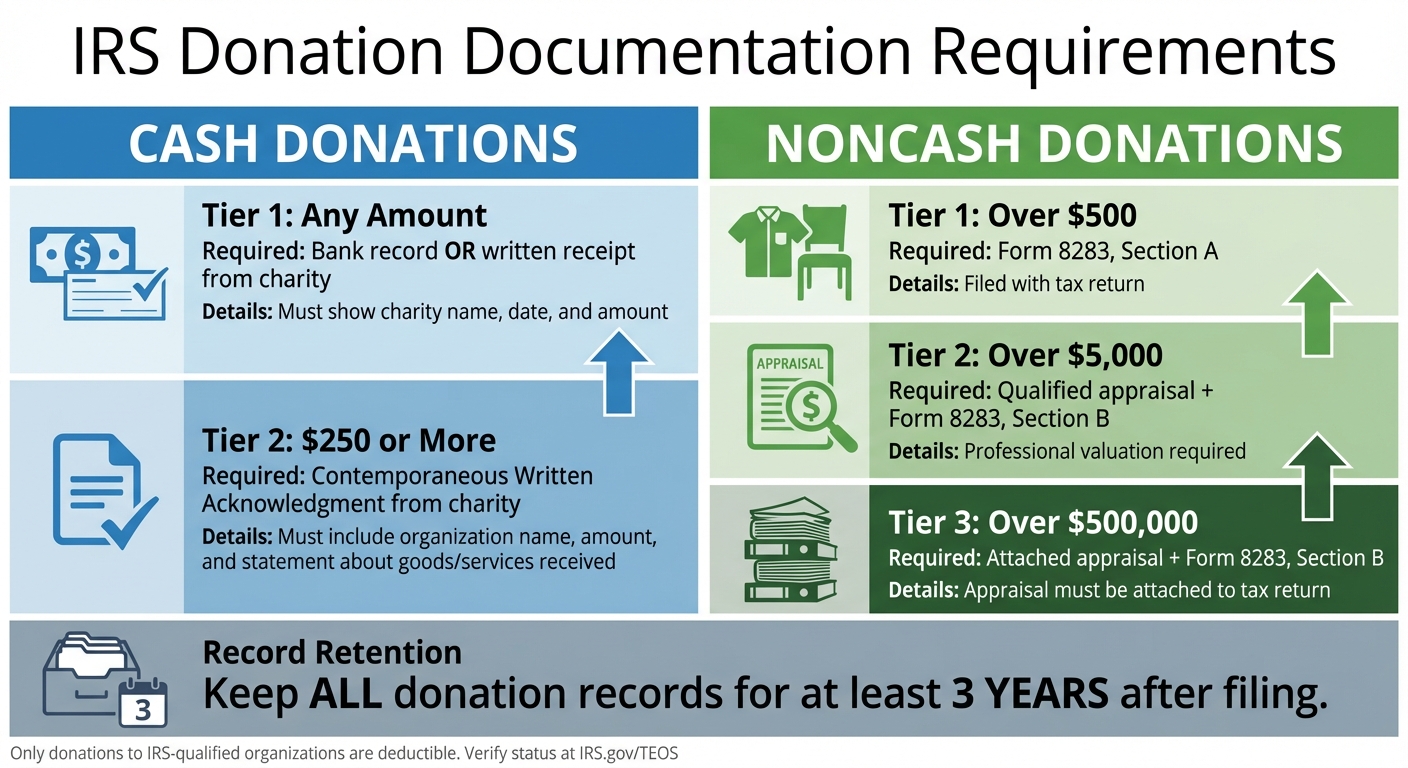

- For cash donations, keep bank records or receipts for every contribution. Donations of $250+ require a written acknowledgment from the charity.

- Noncash items (clothing, furniture, etc.) need accurate fair market valuations. Donations over $500 require additional IRS forms (like Form 8283), and items over $5,000 need a professional appraisal.

- Only donations to IRS-qualified charities are deductible. Use the IRS search tool to verify eligibility.

- Keep all donation records for at least three years in case of an audit.

Starting in 2026, new rules will make tracking even more critical, as the first 0.5% of your adjusted gross income (AGI) donated won't be deductible. Stay organized, follow IRS guidelines, and avoid common pitfalls to maximize your tax savings.

Charity Tax Deduction - How It Works

IRS Requirements for Donation Tracking

IRS Donation Documentation Requirements by Amount and Type

Understanding the IRS rules for tracking donations is essential, as the requirements depend on whether you're giving cash or noncash items. The documentation becomes more detailed as the value of your donation increases.

Cash and Check Donations

For monetary donations, always keep a record. This can include canceled checks, bank or credit card statements, or a receipt that shows the charity's name, the date, and the donation amount.

If you donate $250 or more, the IRS requires a contemporaneous written acknowledgment from the charity. This acknowledgment must include the organization's name, the donation amount, and a statement clarifying whether any goods or services were provided in return. If you received something in exchange - like a dinner ticket or merchandise - the acknowledgment should describe the benefit and estimate its value.

"For any contribution of $250 or more (including contributions of cash or property), you must obtain and keep in your records a contemporaneous written acknowledgment from the qualified organization." - IRS

Noncash Donations

When donating items like clothing or furniture, the documentation rules vary based on the total value of your contributions.

- If your noncash donations exceed $500, you'll need to file Form 8283, Section A with your tax return.

- For donations valued over $5,000, a qualified appraisal is required, and you must complete Form 8283, Section B.

- If a single item or group of similar items is worth more than $500,000, the appraisal itself must be attached to your tax return.

| Donation Type | Amount | Required Documentation |

|---|---|---|

| Cash, Check, or Monetary | Any Amount | Bank record or written receipt from the charity |

| Cash, Check, or Monetary | $250 or more | Contemporaneous written acknowledgment from the charity |

| Noncash Property | Over $500 | Form 8283, Section A |

| Noncash Property | Over $5,000 | Qualified appraisal and Form 8283, Section B |

| Noncash Property | Over $500,000 | Attached appraisal and Form 8283, Section B |

Qualified Organizations

To claim a deduction, your donation must go to an IRS-qualified organization. These are nonprofits established for religious, charitable, scientific, literary, or educational purposes. Examples include churches, nonprofit hospitals, the American Red Cross, United Way, and Goodwill Industries. Donations to individuals, political candidates, social clubs, labor unions, or most foreign organizations do not qualify.

It's worth noting that about 275,000 organizations have lost their tax-exempt status after failing to file required annual reports for three consecutive years. To confirm an organization's current status, use the IRS Tax Exempt Organization Search tool at IRS.gov/TEOS.

Record Retention Period

Keep all donation-related records - such as receipts, acknowledgments, bank statements, appraisals, and forms - for at least three years after filing your tax return. These documents are crucial if the IRS audits your deductions.

These guidelines are the foundation for avoiding common donation tracking mistakes, which will be covered in the next section.

Common Donation Tracking Mistakes and How to Fix Them

When it comes to charitable deductions, the IRS makes one thing crystal clear: the responsibility for proper documentation falls squarely on you - not the charity. Unfortunately, many donors make simple tracking mistakes that can jeopardize their deductions. Let’s break down the most common pitfalls and how to tackle them with straightforward, IRS-compliant practices.

Missing or Incomplete Receipts for Cash Donations

The IRS requires donors to have either a bank record or a written receipt for every monetary donation, no matter the amount. For contributions of $250 or more, you’re also required to obtain a Contemporaneous Written Acknowledgment (CWA) from the charity.

The fix: Stick to traceable payment methods like checks, credit cards, or electronic transfers. These methods automatically create bank records that you can reference during tax season. If you donate cash - whether at an event or through a collection plate - ask for a receipt immediately. Waiting until year-end often results in lost documentation. Keep all receipts and transaction records in an organized file for easy access.

Not Verifying the Charity's Tax-Exempt Status

Donations to individuals, crowdfunding campaigns (unless tied to a registered charity), political candidates, or social clubs are not tax-deductible.

The fix: Before donating, confirm the charity’s tax-exempt status using the IRS Tax Exempt Organization Search tool at IRS.gov/TEOS. Don’t rely on appearances or a charitable-sounding mission - only IRS-qualified charities count.

Incorrect or Inflated Valuation of Noncash Items

Overestimating the value of donated items is a common error. The IRS requires you to deduct the fair market value (FMV) - the price the item would sell for in a regular market transaction. Additionally, clothing and household items must be in "good used condition or better" to qualify. Inflated valuations often raise red flags with the IRS.

The fix: Consult IRS Publication 561 for detailed valuation guidelines. For items worth more than $5,000, secure a qualified appraisal and complete Form 8283, Section B. Take clear photos of your donated items to document their condition. Tools like Deductible.me’s valuation feature can help you determine accurate FMV for common household goods, ensuring your deductions meet IRS standards.

"The IRS requires donors, not charities, to maintain proper documentation for all deductible contributions. Failure to comply can result in disallowed deductions, even for genuine gifts." - Isabella Newman, CPA, Manager at Lumsden McCormick

Losing Track of Recurring or Small Donations

Small, recurring donations can add up over the course of a year, but they’re easy to overlook when tax season arrives. Automatic payments made through bank accounts or credit cards often slip through the cracks.

The fix: Review your bank and credit card statements quarterly to ensure you’re capturing all recurring contributions. A centralized tracking system can help you log donations as they occur, avoiding a last-minute scramble in December. Tools like Deductible.me allow unlimited donation tracking on their Premium plan ($2/month), making it much easier to stay on top of every contribution.

Mixing Personal and Charitable Spending

If you purchase a $100 ticket to a charity gala that includes a $40 dinner, only $60 is deductible. Many donors mistakenly deduct the full ticket price, which can lead to IRS scrutiny. This rule applies to any donation where you receive goods, services, or event access in return.

The fix: Request a statement from the charity that breaks down the deductible portion of your payment. The acknowledgment should clearly describe what you received and estimate its value. Deduct only the amount exceeding the fair market value of the benefits. Keep this documentation with your tax records to avoid issues later.

Disorganized Year-Round Donation Records

Scrambling to locate receipts in December or January often results in missing documentation and lost deductions. Paper receipts fade, emails get buried, and confirmations disappear without a reliable system in place.

The fix: Set up a dedicated folder - either digital or physical - for all donation-related documents, including receipts, acknowledgments, and bank records. Donation tracking tools like Deductible.me can simplify this process by allowing you to scan and store receipts, securely save documentation, and generate IRS-compliant reports on demand. Their Premium plan even offers advanced receipt management and ready-to-use Form 8283 reports, saving you from the year-end chaos.

sbb-itb-e723420

Tools and Strategies for Accurate Donation Tracking

Keeping a clear and consistent record of every donation - whether it’s $10 or $5,000 - is essential for proper reporting and tax compliance.

Categorizing Donations

Organize your donations into straightforward categories: cash (including checks, credit cards, and wire transfers), payroll deductions, and noncash (such as clothing, furniture, vehicles, or securities). This approach not only simplifies your year-end reporting but also ensures you can quickly locate the right documentation for each type of donation. For donations with specific restrictions, track them separately to avoid reporting errors.

Data Fields to Capture for Each Donation

To maintain accurate records, make sure to log these key details for every donation:

- Organization Name and EIN: Record the legal name of the nonprofit and its federal tax ID to confirm tax-exempt status.

- Date of Donation: Note the exact date the donation was made to determine the correct tax year.

- Amount or Value: For cash donations, record the amount. For noncash items, document the fair market value (FMV).

- Donation Type: Specify whether the donation was cash, check, card, payroll deduction, or noncash, as this impacts the required documentation.

- Description: For noncash items, include a detailed description (e.g., "men's wool coat, good condition") to support valuation.

- Valuation Method: Indicate how you calculated FMV - whether through thrift store pricing, comparable sales, or a professional appraisal. For noncash donations exceeding $500, this is a must.

- Goods or Services Received: If the donor received anything in return (like a charity dinner), document the value of the benefit so only the excess amount is deductible.

| Data Field | What to Record | Why It Matters |

|---|---|---|

| Organization Name & EIN | Legal name and federal tax ID | Confirms tax-exempt status [10] |

| Date of Donation | Exact date the donation was received | Determines tax year eligibility [10][4] |

| Amount/Value | Cash amount or FMV for noncash items | Required for all deductions [10][6] |

| Donation Type | Cash, check, card, payroll, or noncash | Dictates documentation needs [10][3] |

| Description | Item details for noncash donations | Supports valuation and IRS review [10][4] |

| Valuation Method | How FMV was determined | Needed for noncash over $500 [2][6] |

Using Donation Tracking Software

Manually tracking donations with spreadsheets can quickly spiral into chaos as the number of contributions grows. That’s where donation tracking software steps in to streamline the process. For example, Deductible.me uses AI to automatically determine the fair market value of noncash items, taking the guesswork out of valuation. It offers features like unlimited tracking, advanced receipt management, and reports that are ready for Form 8283 submissions. You can even scan receipts, upload photos of donated items, and keep everything organized in one centralized platform.

"Tracking donations isn't just an administrative task - it's the foundation of donor trust, organizational credibility, and financial compliance." - Jotform Editorial Team [9]

Year-End Donation Review Checklist

As the year comes to a close, it's time to ensure your donation records are in top shape before filing your taxes. This checklist will help you confirm that every contribution complies with IRS requirements. Taking these steps can help you catch missing paperwork, verify charity eligibility, and maximize your deductions.

Verify Donations to Qualified Organizations

Only donations to IRS-recognized charities are deductible. Use the IRS Tax Exempt Organization Search Tool to confirm each organization's tax-exempt status before claiming your deduction [11].

"Gifts of goods or money must be made to qualified, tax-exempt organizations. To check an organization's ability to receive tax deductible charitable contributions, use the IRS Tax Exempt Organization Search Tool." - Taxpayer Advocate Service [5]

Ensure Documentation for Cash Donations

For every cash donation, keep a bank record or a written acknowledgment that includes the organization’s name, the donation date, and the amount [6]. If you’ve donated $250 or more, you'll need a Contemporaneous Written Acknowledgment as specified by the IRS [6][8]. For credit card donations, document the transaction date, and for mailed checks, the postmark date determines the deduction year [12].

"The IRS requires donors, not charities, to maintain proper documentation for all deductible contributions. Failure to comply can result in disallowed deductions, even for genuine gifts." - Isabella Newman, CPA, Lumsden McCormick [8]

Review Noncash Donations

Noncash contributions, especially those exceeding IRS thresholds, require extra attention. For these donations, ensure you have completed Form 8283 and obtained a qualified appraisal if necessary [6][8]. Clothing and household items must meet the "good used condition or better" standard, and your valuation method should be clearly documented [5][7]. Also, double-check that recurring noncash contributions are accurately reflected in your records.

Reconcile Recurring Donations

Match all recurring donations against your pay stubs or bank statements [6][12]. If you’ve set up payroll deductions, compare your year-end pay stub or Form W-2 with your original pledge card to confirm the total amount withheld aligns with your records [12]. For recurring credit card donations, verify that all charges through December 31 are accounted for [12].

"For payroll deductions, the taxpayer should retain a pay stub, a Form W-2 wage statement or other document furnished by the employer showing the total amount withheld for charity, along with the pledge card showing the name of the charity." - IRS [12]

Generate Annual Donation Reports

After verifying your records, compile a comprehensive annual donation report. This report should consolidate all cash and noncash contributions, ensuring it meets IRS guidelines. Keep this report with your tax documents for seamless recordkeeping.

Conclusion

Keeping track of your donations isn't just about staying organized - it’s about protecting your deductions and ensuring you’re prepared come tax time. Missing receipts, unverified charities, or overestimating the value of donated items can all lead to denied deductions if the IRS comes knocking. By recording details as soon as you donate, you can avoid the stress of scrambling for documentation later.

The common mistakes outlined in this article are entirely avoidable with a little preparation. Keep bank records for every monetary donation, confirm the charity’s status using the IRS Tax Exempt Organization Search tool, and assign fair market values to noncash items. For donations of $250 or more, make sure you get written acknowledgments before filing. If your noncash contributions exceed $500, don’t forget to complete Form 8283. These steps will help you meet IRS requirements and stay ready for an audit.

"Tax software can be a valuable tool for accountants to guide their clients on charitable giving tax strategies." - Thomson Reuters [1]

Tools like Deductible.me make the process even easier by automating documentation and generating IRS-compliant reports - all for just $2 a month. This allows you to focus on making a difference while staying compliant.

Start the new year organized and stress-free. Use your year-end checklist, review your 2025 donations, and set up a system that keeps you on track for 2026 and beyond.

FAQs

What can I do if I’ve lost the receipt for a cash donation?

If you’ve lost the receipt for a cash donation, don’t stress - you can still prove your tax-deductible contribution with other forms of documentation. Start by reviewing your bank or credit card statements. These records typically include the date, amount, and recipient of the donation, which are essential details the IRS looks for.

You can also reach out to the charity and request a replacement acknowledgment. Most organizations can provide written confirmation that includes the donation amount, the date, and a statement clarifying that no goods or services were exchanged for your contribution. For donations of $250 or more, charities are required to provide this documentation, but many will assist with smaller amounts if you ask.

Be sure to store all related documents - such as bank statements, the replacement acknowledgment, and any personal notes about the donation - in a secure spot for at least three years. This way, you'll be ready if the IRS ever asks for proof of your contribution.

How do I figure out the fair market value of items I donate to charity?

When figuring out the fair market value of noncash donations, think about what someone would reasonably pay for the item in its current condition. You can reference comparable sales, consult reliable pricing guides, or, for items worth more than $5,000, get a qualified appraisal. Make sure to keep thorough records and receipts to back up your valuation, as these are required by the IRS.

How can I confirm if a charity is eligible for tax-deductible donations?

To confirm a charity's tax-exempt status, use the IRS Tax-Exempt Organization Search tool to find the organization’s EIN (Employer Identification Number). Make sure it’s recognized as a qualified 501(c)(3) or another eligible tax-exempt entity. Look for any signs of revocation or inactive status. If necessary, review the charity’s Form 990 or its state charity registration to ensure it’s active and eligible for tax-deductible donations. These steps help ensure your contribution may qualify for potential tax benefits.