Best Methods for Valuing Clothing and Household Donations

When you donate clothing or household items, you can claim a tax deduction by determining the Fair Market Value (FMV) - the price someone would pay for the item at a thrift store. Accurate valuation is key to maximizing deductions while avoiding IRS penalties. Here's what you need to know:

- IRS Rules: FMV is based on thrift store pricing, not the original purchase price. Items must be in "good used condition or better."

- Documentation:

- Over $500: Form 8283 is required.

- Over $5,000: A professional appraisal is needed.

- Over $250: A written acknowledgment from the charity is mandatory.

- Valuation Tips:

- Use thrift store prices or online resale data.

- Refer to guides like those from Goodwill or Salvation Army.

- For high-value or unique items, consider professional appraisals.

- Common FMV Ranges:

- Clothing: $2.00–$96.00 (e.g., shirts: $3.00–$12.00, suits: $5.00–$96.00).

- Household Goods: $0.50–$259.00 (e.g., coffee makers: $4.00–$16.00, refrigerators: $78.00–$259.00).

For easier tracking, tools like Deductible.me can automate valuations, track donations, and generate IRS-compliant reports. By following these steps, you can ensure your deductions are accurate and fully compliant.

How to Estimate the Value of Clothing for IRS Deductions - TurboTax Tax Tip Video

IRS Guidelines for Valuing Donations

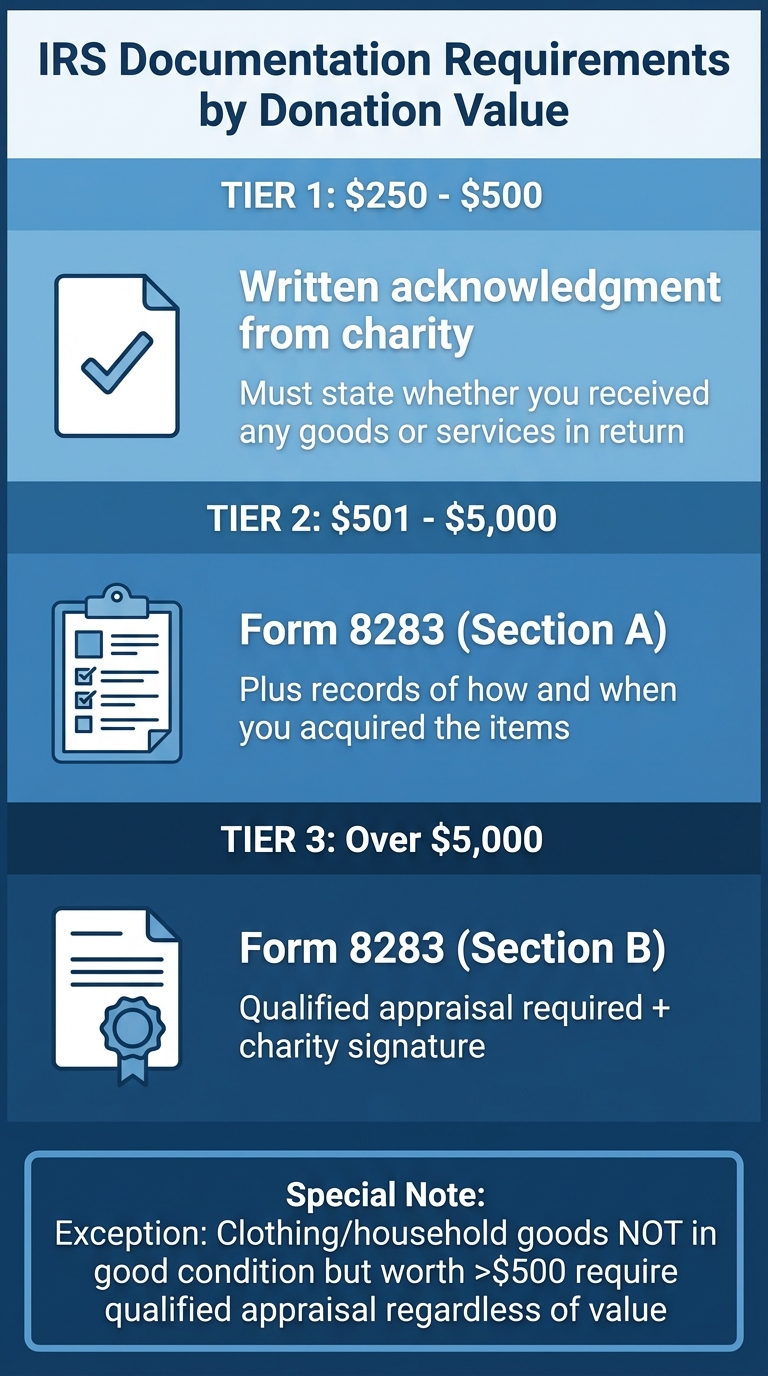

IRS Documentation Requirements by Donation Value

What Fair Market Value Means

The IRS defines Fair Market Value (FMV) as "the price that property would sell for on the open market" between a willing buyer and seller, where neither is pressured to act, and both have reasonable knowledge of the relevant facts [1]. For items like used clothing and household goods, this means looking at the price someone would actually pay in a thrift store or consignment shop - not the original purchase price or what it would cost to replace the item.

This distinction matters because the original cost of an item often has little to do with its FMV. For example, a sweater that originally cost $50 might only sell for $5 at a thrift store, meaning $5 is its FMV for tax purposes. Additionally, the IRS requires donated items to be in "good used condition or better" to qualify for a deduction [1]. As Goodwill Industries puts it, "If you would give it to a relative or friend, then the item is most likely in good condition and is appropriate to donate" [2].

Documentation Requirements for Donations Over $500

Once you determine FMV, the IRS has specific documentation rules for noncash donations exceeding $500. If your total noncash donations for the year surpass this amount, you’ll need to include Form 8283 with your tax return [1]. This form asks for details about each donated item, including how and when you acquired it. The documentation requirements increase as the value of your donations rises:

| Donation Value | Documentation Needed |

|---|---|

| $250 – $500 | Written acknowledgment from the charity stating whether you received any goods or services in return |

| $501 – $5,000 | Form 8283 (Section A) and records of how and when you acquired the items |

| Over $5,000 | Form 8283 (Section B), a qualified appraisal, and a signature from the charity |

There’s an important exception: if you’re donating clothing or household goods that aren’t in good condition but are worth more than $500, you’ll need a qualified appraisal regardless of the value [1]. This rule helps prevent inflated deductions for items that are heavily worn or damaged.

Methods for Valuing Clothing and Household Items

Determining Fair Market Value

One effective way to figure out an item's fair market value (FMV) is by comparing it to similar items sold at local thrift stores [1]. For instance, if you're donating a men's dress shirt, check the prices of shirts in similar condition at nearby stores.

You can also verify FMV online by looking at the average of several recent completed sales on auction sites. This approach accounts for factors like age, condition, style, and functionality. For example, a five-year-old coffee maker that's fully functional might have a higher value than a newer model missing key parts. If you can’t find direct market comparisons, established valuation guides can provide additional insights.

Using Charity Valuation Guides

Charity valuation guides are another helpful tool, offering low and high price ranges for donated items [3]. For example, the Salvation Army's Donation Value Guide provides detailed valuations for household goods, while Goodwill's guide focuses on broader categories [3][4]. These guides are grounded in real thrift store data and can help you make reasonable estimates.

If an item isn’t listed in a guide, some charities suggest using the "30% rule", which values a donation at about 30% of its original purchase price [4]. However, it’s important to remember that the charity doesn’t determine your deduction value - it’s your responsibility to establish a fair and accurate amount [3]. These guides work best when paired with your own research, giving you a solid foundation for determining value.

Typical Value Ranges by Item Category

Different categories of items generally fall within specific value ranges, which can help refine your estimates. For clothing, values typically range from $2.00 to $96.00. High-end items like men's suits are on the upper end, while basics like t-shirts are valued lower [3][4]. Furniture has a broader range, with simple pieces starting around $10.00 and larger items like quality sofas reaching up to $395.00 [3][4].

For appliances, functionality is key. Small items, like toasters, might be valued at around $3.00, while larger, working appliances, such as refrigerators, can go up to approximately $259.00 [3][4]. Keep in mind that many charities won’t accept televisions older than five years, and built-in appliances like ovens or dishwashers are typically excluded from donation valuations [3].

sbb-itb-e723420

Value Estimates for Common Donated Items

Clothing Value Ranges

When donating clothing, understanding typical price ranges can help you estimate their value more effectively. Always ensure your items meet IRS condition standards[1]. Condition plays a big role - a gently used designer blazer in excellent shape will be valued higher than a heavily worn everyday jacket.

Here’s a breakdown of common clothing categories and their fair market value ranges, often based on thrift store pricing. Items like men’s suits typically fall at the higher end, while simpler items, such as children’s shirts, are valued at the lower end[3].

| Item Category | Men's Range | Women's Range | Children's Range |

|---|---|---|---|

| Shirts / Blouses | $3.00 – $12.00 | $3.00 – $12.00 | $2.00 – $10.00 |

| Pants / Jeans | $4.00 – $23.00 | $4.00 – $23.00 | $2.00 – $12.00 |

| Jackets | $8.00 – $45.00 | $4.00 – $12.00 | $3.00 – $26.00 |

| Suits | $5.00 – $96.00 | $6.00 – $96.00 | N/A |

| Shoes / Boots | $3.00 – $30.00 | $2.00 – $30.00 | $3.00 – $21.00 |

| Sweaters | $3.00 – $12.00 | $4.00 – $16.00 | $2.00 – $10.00 |

| Dresses | N/A | $4.00 – $28.00 | $2.00 – $12.00 |

For more specialized items, such as fur coats or evening wear, the values can vary significantly. Fur coats, for example, might range from $26.00 to $415.00, while evening dresses could be valued between $10.00 and $62.00[3]. If you’re donating designer or brand-name clothing not listed in standard guides, a good rule of thumb is to estimate its value at roughly 30% of the original purchase price[4].

Now, let’s take a look at how to estimate values for household goods.

Household Goods Value Ranges

Household items also need clear valuation to ensure accurate deductions. Smaller items, like kitchen utensils or plates, typically fall in the $0.50 to $3.00 range. Larger, functional appliances, such as refrigerators, can range from $78.00 to $259.00[3].

| Item Category | Low Estimate | High Estimate |

|---|---|---|

| Small Appliances (Coffee Maker, Mixer) | $4.00 | $21.00 |

| Microwave | $10.00 | $50.00 |

| Vacuum Cleaner | $5.00 | $67.00 |

| Bakeware / Pots & Pans | $1.00 | $3.00 |

| Kitchen Utensils / Plates | $0.50 | $3.00 |

| Lamps (Floor or Table) | $3.00 | $78.00 |

| Blankets / Bedspreads | $3.00 | $25.00 |

| Curtains / Drapes | $2.00 | $41.00 |

| Pictures / Paintings (Decorative) | $5.00 | $207.00 |

The functionality of appliances is a key factor - items in working condition, like a coffee maker, can range from $4.00 to $16.00[3]. However, if parts are missing or the item is non-functional, its value may drop to nearly nothing. For high-value decorative pieces, such as paintings or antique furniture, consider getting a professional appraisal if the item is worth more than $5,000[2].

Simplifying Valuation with Deductible.me

How Deductible.me Works

Deductible.me takes the hassle out of determining fair market values for your donations. The platform uses trusted charity guides, like those from the Salvation Army, to assign values to your items. This ensures your estimates are both reasonable and audit-ready.

As you donate throughout the year - whether to Goodwill, the Salvation Army, or other qualified charities - Deductible.me keeps everything organized. It tracks your donation totals and ensures you have the right documentation for each IRS threshold. When tax season rolls around, it generates IRS-compliant reports tailored for Schedule A of Form 1040, including Form 8283 when necessary. This makes the entire process faster and more accurate, saving you time and reducing stress.

Benefits of Using Deductible.me

Beyond simplifying valuation, Deductible.me offers a range of benefits. The most obvious perk? Time savings. Instead of manually researching item values, the platform uses AI to handle it instantly. This is a game-changer for frequent donors or anyone contributing high-value items that require detailed records.

For occasional donors, Deductible.me provides a free plan to track up to $500 in donation value. If you need more, the Premium plan costs just $2/month and includes unlimited tracking, advanced receipt management, annual giving goal tracking, detailed analytics, and priority support. Plus, the platform lets you upload item photos to back up condition claims, adding an extra layer of credibility to your records.

Conclusion

Getting donation valuations right is crucial during tax season. It ensures you claim every deduction you're entitled to and helps you steer clear of hefty IRS penalties. The IRS requires you to use Fair Market Value (FMV) for donated items, so accurate valuations are key to staying compliant [1].

To make the process easier, rely on trusted valuation guides and keep detailed records. Proper documentation not only supports your estimates but also simplifies the entire process. Having everything organized can save you a lot of stress down the line.

Using a dedicated tool can take the guesswork out of valuations. Deductible.me is one such platform that applies FMV standards, tracks necessary documentation, and even generates IRS-compliant reports. Their free plan covers up to $500 in donations, while the Premium plan, at just $2/month, offers unlimited tracking and additional features. This way, you can ensure every donation is properly valued and documented.

Don't let uncertainty or paperwork stop you from claiming what you're owed. With the right tools and strategies, you can make the most of your charitable contributions while staying on the right side of tax regulations. Every dollar matters - don’t let it slip through the cracks.

FAQs

How do I accurately determine the value of unique or high-value donations for tax purposes?

When determining the fair market value (FMV) of unique or high-value donations like antiques, artwork, or jewelry, the key is to estimate what a willing buyer would pay a willing seller in an open market. The IRS requires this valuation to be reasonable and well-documented, so supporting your estimate with solid evidence is crucial.

Start by researching comparable sales. Look into recent auction results or marketplace prices for similar items, considering factors like condition, age, and rarity. If the item’s value exceeds $5,000, you’ll need a written appraisal from a qualified appraiser. This report should include a detailed description of the item, the valuation method used, and the appraiser’s signature. For donations valued at $500,000 or more, the IRS requires you to attach the appraisal to your tax return.

Be thorough with your records. Keep photographs, receipts, condition reports, and any valuation resources you used. Also, ensure the charity provides a written acknowledgment that includes a description of the donated item and the date of the donation. Having proper documentation not only keeps you compliant but also allows you to claim the correct deduction with confidence.

What records do I need for donations worth more than $500?

If you’re planning to claim a deduction for non-cash donations like clothing or household items valued at over $500, you’ll need to gather specific paperwork. Start by obtaining a written acknowledgment from the charity. This should include key details such as the donation date, a description of the items, and whether you received anything in return for your contribution. Don’t forget to attach Form 8283 to your tax return to properly report these donations.

To keep your records in order, note the condition of the items and their fair market value at the time you donated them. If your total donation value exceeds $5,000, the IRS may also require you to get a professional appraisal to meet their guidelines.

How does Deductible.me make it easier to value donations for tax purposes?

Deductible.me takes the hassle out of valuing donated clothing and household items by offering a straightforward platform that follows IRS guidelines. Instead of digging through IRS publications or trying to estimate values from thrift store price lists, the tool does the heavy lifting by automatically assigning each item its fair market value (FMV) based on IRS-approved data. For instance, a winter coat might be valued at $14.99, while a set of pots could come in at $3.99. This means you can trust the valuations to be accurate and IRS-compliant, without any guesswork involved.

On top of that, Deductible.me keeps your donation records organized by creating detailed, itemized receipts. These receipts include item descriptions, conditions, and FMVs, meeting IRS requirements for donations over $250 and non-cash contributions exceeding $500. The platform also stores your records digitally and makes it easy to export them for tax forms like Form 8283 or Schedule A. This way, you can claim the deductions you’re entitled to while staying on top of tax compliance.