Itemizing vs Standard Deduction: Which Saves More?

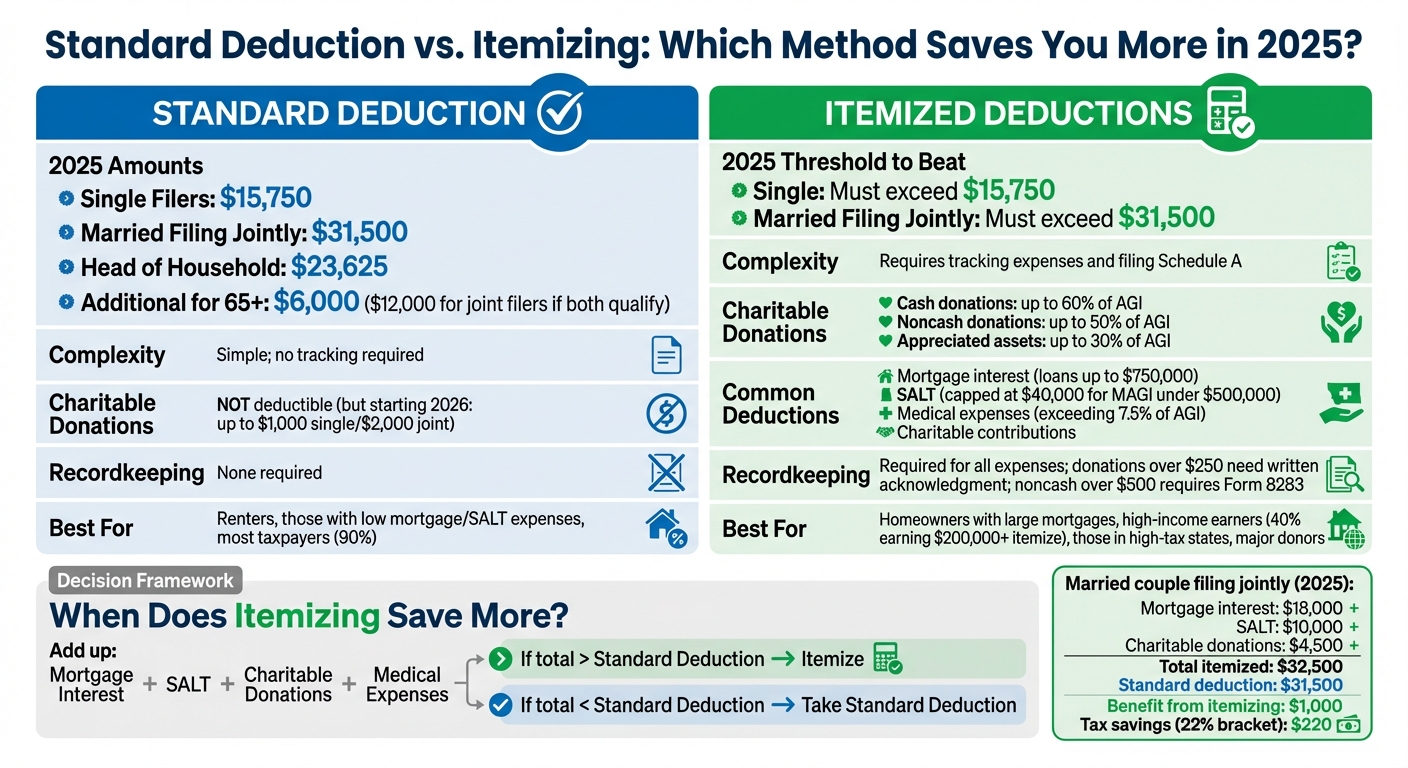

When filing taxes, your choice between the standard deduction and itemizing deductions can significantly impact your savings. The standard deduction offers a fixed, no-hassle reduction in taxable income - set at $15,750 for single filers and $31,500 for married couples filing jointly in 2025. Itemizing, however, requires tracking specific expenses like mortgage interest, state and local taxes (SALT), medical costs over 7.5% of your income, and charitable donations. If these expenses exceed the standard deduction, itemizing could save you more.

Key takeaways:

- Standard deduction: Simpler, fixed amounts; no tracking required.

- Itemizing: Requires detailed records but may lead to greater savings if your deductions exceed the standard deduction.

- Charitable donations: Only benefit you if you itemize, unless you wait until 2026, when a new rule allows non-itemizers to claim up to $1,000 (or $2,000 for joint filers).

For most taxpayers, the standard deduction is the better choice due to its simplicity. But for high-income earners, homeowners, or those with significant medical or charitable expenses, itemizing might be worth the effort. To decide, calculate your potential deductions and compare them to the standard deduction.

How the Standard Deduction Works with Charitable Giving

What is the Standard Deduction?

The IRS offers a fixed standard deduction to lower your taxable income, based on factors like filing status, age, and blindness [6][8]. For the 2025 tax year, the standard deduction amounts are $15,750 for single filers, $31,500 for married couples filing jointly, and $23,625 for heads of household [6][7][10].

If you're 65 or older, you can claim an additional deduction of $6,000 in 2025 - or $12,000 for joint filers if both spouses qualify [6]. However, higher-income taxpayers may see this extra deduction phased out. Unlike itemizing, where deductions are calculated individually, the standard deduction provides a straightforward, fixed reduction.

Charitable Contributions and the Standard Deduction

When you opt for the standard deduction, you cannot separately deduct charitable donations on your federal tax return [10]. It’s an either-or choice: take the fixed standard deduction or itemize your expenses on Schedule A [5][9].

For the 2025 tax year, there’s no provision allowing non-itemizers to deduct charitable contributions [10]. This means your charitable giving won’t directly reduce your taxable income if you stick with the standard deduction. However, starting in 2026, a permanent "above-the-line" deduction will allow non-itemizers to claim some charitable donations.

Recent Tax Law Changes Affecting Nonitemizers

The "Working Families Tax Cut" introduced noteworthy updates regarding charitable donations for non-itemizers [7]. While no deduction for charitable gifts is available in 2025, starting in 2026, non-itemizers can deduct cash contributions up to $1,000 per filer (or $2,000 for married couples filing jointly) [7][11]. This change reflects a significant shift in tax policy and is worth considering when planning your deductions for future tax years.

This new rule resembles a temporary measure from 2021, when a $300 deduction for non-itemizers enabled 29.4% of standard deduction filers to claim it, resulting in approximately $18 billion in donations across 48 million households [7][11]. The upcoming permanent deduction is more generous, but it applies only to cash donations made to public charities. Contributions of property, securities, or gifts to private foundations or donor-advised funds are not eligible [11].

How Itemizing Deductions Works with Charitable Giving

What Are Itemized Deductions?

Itemized deductions let you reduce your taxable income by subtracting specific expenses from your adjusted gross income (AGI) [6][15]. Unlike the standard deduction, which offers a fixed amount, itemizing requires you to track and report each eligible expense on Schedule A (Form 1040) [5].

Common examples of itemized deductions include charitable contributions to qualified organizations, mortgage interest on loans up to $750,000, state and local taxes (SALT) capped at $40,000 for taxpayers with a Modified Adjusted Gross Income (MAGI) under $500,000, and medical expenses exceeding 7.5% of your AGI [6][13]. However, after the 2017 tax reforms, most taxpayers - around 90% - opt for the standard deduction since their itemized expenses often don’t surpass the thresholds of $15,750 for single filers or $31,500 for married couples filing jointly in 2025 [1][2].

High-income earners are more likely to itemize. Nearly 40% of taxpayers earning $200,000 or more choose to itemize, compared to just 14% of those making between $50,000 and $80,000 [1].

Now that we’ve covered the basics of itemized deductions, let’s dive into how charitable contributions fit into the picture.

Rules for Deducting Charitable Contributions

If you itemize, you can deduct cash donations to public charities up to 60% of your AGI, noncash donations like clothing or household goods up to 50%, and gifts of appreciated assets up to 30% of your AGI [12][13][17].

The rules for documentation become stricter as donation amounts increase. For any cash donation, you’ll need a bank record or written confirmation from the charity [16]. Contributions of $250 or more require a contemporaneous written acknowledgment from the organization [13][16]. If your total noncash donations exceed $500, you’ll need to file Form 8283 [14][16]. For single noncash items valued over $5,000, a qualified appraisal completed within 60 days of the donation is typically required [14][16].

If you receive something in return for your donation - like event tickets or merchandise - you can only deduct the amount that exceeds the fair market value of what you received [13][16]. Additionally, you can deduct 14 cents per mile for driving related to volunteer work or dropping off donations [13].

Tax Law Updates for Itemizers

Changes in tax laws are set to alter the landscape for itemized deductions. Starting in 2026, you’ll only be able to deduct charitable contributions that exceed 0.5% of your AGI [17]. For example, if your AGI is $100,000, the first $500 of donations won’t be deductible.

"Beginning in 2026, the law imposes a floor: only charitable contributions in excess of 0.5% of your adjusted gross income (AGI) are deductible." – The Planetary Society [17]

Also in 2026, taxpayers in the 37% tax bracket will see their charitable deduction benefit capped, allowing for about 35 cents of tax savings per dollar donated [17].

These updates could have a significant impact on how taxpayers approach charitable giving in the future.

Standard vs. Itemized Deduction: Which is right for you?

When Itemizing Saves More Than the Standard Deduction

Standard Deduction vs Itemizing Deductions Comparison Chart 2025

The Itemizing Threshold

To determine whether itemizing is worth it, your total deductions need to surpass the standard deduction. For 2025, the standard deduction is set at $15,750 for single filers and $31,500 for married couples filing jointly [6][2].

The math is straightforward: add up your primary deductible expenses. If the total doesn’t exceed the standard deduction, even sizable donations or other deductions won’t translate into extra savings. For instance, let’s look at a married couple filing jointly in 2025. They calculated their total deductions, including mortgage interest and charitable donations, to be $32,500. Since this exceeded the $31,500 standard deduction by $1,000, they chose to itemize. In their 22% tax bracket, this decision saved them $220 in taxes [2].

Situations Where Itemizing Makes Sense

Certain taxpayers are more likely to benefit from itemizing. If you’re a high-income earner or live in a high-tax state, itemizing often pays off [1].

For homeowners with large mortgages, the interest paid can bring you close to the itemizing threshold. Adding moderate charitable donations or other qualifying expenses could push you over the line [2][18]. Similarly, individuals with significant state and local taxes (SALT), major medical expenses, or one-time large charitable contributions might find itemizing the better choice [18][5].

Standard Deduction vs. Itemizing Comparison

| Factor | Standard Deduction | Itemized Deductions |

|---|---|---|

| Eligibility | Available to most taxpayers (unless a spouse itemizes separately) [6][2] | Available to anyone with qualifying expenses [6] |

| Complexity | Simple; no tracking required [6][2] | Requires tracking expenses and filing Schedule A [6][13] |

| 2025 Amount (Single) | $15,750 [6] | Must exceed $15,750 to benefit [2] |

| 2025 Amount (Joint) | $31,500 [6] | Must exceed $31,500 to benefit [2] |

| Donation Types | Not deductible | Cash (up to 60% of AGI) or appreciated assets (up to 30% of AGI) [13][19] |

| Recordkeeping | None [6] | Required for donations over $250, medical bills, and other deductions [13][2] |

| Typical Profile | Renters or those with low mortgage/SALT expenses | Homeowners, high-income earners, or major donors [1][5] |

This table highlights the main differences between the two approaches, helping you decide which method aligns with your financial situation. Knowing these distinctions is key before diving into strategies to optimize your deductions further.

sbb-itb-e723420

Ways to Maximize Your Charitable Deductions

Here are some advanced strategies to help you get the most out of your charitable deductions.

Bunching Contributions

If your annual deductions are just shy of the standard deduction threshold, consider "bunching" your donations. This involves combining several years' worth of contributions into a single year. For instance, instead of donating $12,000 annually, you could donate $36,000 in one year. This approach allows you to itemize in that year while taking the standard deduction in other years. It's a smart way to take advantage of current tax rules before changes set to occur in 2026 take effect [17].

This strategy works well when paired with careful timing of your donations.

Timing Donations Around Tax Law Changes

Plan your donations strategically to align with upcoming tax law changes. For example, making contributions before 2026 can help you avoid the new 0.5% Adjusted Gross Income (AGI) floor that will take effect. High-income earners, in particular, may see reduced benefits in 2026, as the 37% tax bracket will provide a deduction of only about 35 cents per dollar donated. On the other hand, if you typically take the standard deduction, you might benefit from waiting until 2026 to make larger cash donations. By then, a new deduction will allow single filers to claim up to $1,000 and married couples filing jointly to claim up to $2,000 [17].

Beyond timing, lowering your AGI can further optimize your deductions.

Lowering AGI and Using QCDs

Reducing your AGI can open the door to more deductions. For instance, medical expenses are only deductible when they exceed 7.5% of your AGI. Strategies like maximizing pre-tax retirement contributions can help bring down your AGI, making it easier to qualify for these deductions [13].

For those aged 70½ or older, Qualified Charitable Distributions (QCDs) are another powerful tool. With a QCD, you can transfer up to $100,000 annually directly from your IRA to a qualified charity. This transfer counts toward your Required Minimum Distribution but doesn’t increase your taxable income. As a result, you avoid the 0.5% AGI floor and the 35% deduction cap for high-income earners. QCDs are a great option whether you itemize or stick with the standard deduction [17].

These strategies, when combined, can help you make the most of your charitable giving while maximizing your tax benefits.

How to Decide Which Method Saves You More

The key to choosing between the standard deduction and itemizing is simple: crunch the numbers for both and pick the option that gives you the larger deduction.

Steps to Compare Your Options

Start by identifying your 2025 standard deduction, which depends on your filing status:

- $15,750 for single filers

- $31,500 for married filing jointly

- $23,625 for head of household

If you're 65 or older, you can add an extra amount to these figures [2].

Next, calculate your Adjusted Gross Income (AGI) to understand deduction thresholds. Gather records for all qualifying expenses, including mortgage interest, state and local taxes (SALT), charitable contributions, and medical costs. For medical and dental expenses, only the portion exceeding 7.5% of your AGI qualifies as deductible [2].

"Claiming the standard deduction is easier for taxpayers since they don't have to keep track of expenses. However, if your deductible expenses, like mortgage interest or medical costs, exceed the Standard Deduction, itemizing may save you more." - Viola Robinson Faust, CPA, EA [3]

Now, total up your mortgage interest and SALT. If this alone gets close to your standard deduction, adding charitable donations and medical expenses could push your total higher - making itemizing the better choice [18].

One crucial rule: If you're married filing separately and your spouse chooses to itemize, you’re required to itemize too, even if your deductions fall short of the standard deduction [4].

This comparison is especially important if charitable donations make up a significant part of your itemized deductions. With all your numbers in hand, you'll know which option leaves you with more savings.

Using Deductible.me to Track Your Donations

Once you've calculated your deductions, staying organized is key - especially if you plan to itemize. Deductible.me simplifies this process by tracking your charitable contributions throughout the year. Its AI-powered valuation tool helps you determine the fair market value of donated items like clothing and household goods, ensuring you claim every allowable dollar.

The platform organizes all your charitable giving - cash and non-cash donations - in one place. At tax time, you’ll have a complete record ready to go, without the hassle of sifting through receipts. Plus, Deductible.me generates IRS-compliant reports compatible with Schedule A (Form 1040), making it easier to see if your total itemized deductions beat the standard deduction for your filing status.

Conclusion

When deciding between the standard deduction and itemizing, it all comes down to which option gives you the bigger tax break. While many people lean toward the simplicity of the standard deduction, factors like your mortgage balance, state tax payments, charitable giving, and overall Adjusted Gross Income (AGI) can tip the scales. Taking the time to compare both options is a key step in making smart tax decisions each year.

If your itemized deductions are close to the standard deduction, you might want to explore strategies like "bunching" your charitable contributions - essentially grouping donations into a single tax year to push your total over the threshold. As mentioned earlier, timing your donations strategically and keeping detailed records can make a noticeable difference in your tax savings. With tax rules constantly evolving, staying updated is crucial to ensure you don’t leave money on the table.

Keeping your records organized is just as important as the deductions themselves. Missing or incomplete documentation could mean losing out on hundreds of dollars. Tools like Deductible.me make this process easier by offering an AI-powered valuation system to accurately price donated items and a centralized platform to track all your contributions. Whether you’re an occasional donor or give regularly, this tool ensures your records are IRS-compliant and ready when tax season rolls around.

Every taxpayer’s situation is different, but the path to maximizing deductions doesn’t have to be complicated. By comparing your numbers and maintaining accurate donation records, you can make informed decisions and get the most out of your deductions.

FAQs

Should I take the standard deduction or itemize my deductions?

Choosing between the standard deduction and itemizing boils down to one key question: which option reduces your taxable income the most? The standard deduction is a fixed amount set by the IRS, based on your filing status, and it’s updated annually to account for inflation. It’s straightforward to claim - no additional paperwork or receipts needed.

On the other hand, if you’ve racked up significant deductible expenses, itemizing might be the smarter route. Expenses like charitable contributions, mortgage interest, state and local taxes, or medical costs exceeding 7.5% of your adjusted gross income (AGI) can add up quickly. To decide, tally up all your eligible deductions and compare the total to the standard deduction for your filing status. If the itemized deductions exceed the standard deduction, it’s worth the extra effort to itemize and potentially lower your tax bill.

For many taxpayers, the standard deduction is the simpler and more beneficial option, especially if their deductible expenses don’t amount to much. But if you’ve made substantial donations, paid significant mortgage interest, or have other major deductions, itemizing could lead to greater savings. Tax software or a professional can guide you through the calculations to ensure you’re making the right choice.

How does bunching charitable contributions help save on taxes?

Bunching charitable contributions means consolidating several years' worth of donations into a single tax year to make the most of your tax savings. With this method, you can itemize deductions in the year you make the larger contribution and then switch to claiming the standard deduction in other years. This way, you can surpass the standard deduction amount in the year of the bunched donation, significantly lowering your taxable income, while keeping tax filing simpler in the years you take the standard deduction.

This approach has become particularly effective since the Tax Cuts and Jobs Act raised the standard deduction through 2025, making it tougher for many taxpayers to itemize each year. By grouping your donations, you can transform smaller, annual tax benefits into a larger deduction in a single year, potentially reducing your overall tax liability over time.

How will the 2026 tax law changes impact my deductions?

Starting in 2026, the temporary tax break for cash charitable contributions, introduced for 2025, will no longer be available. In 2025, taxpayers could take advantage of an above-the-line deduction for cash donations - up to $300 for single filers and $600 for joint filers - even if they opted for the standard deduction. But starting in 2026, cash donations will only qualify for deductions if you itemize, and they’ll be capped at 60% of your adjusted gross income.

If you’re planning to make substantial charitable donations in 2026, it’s important to weigh your options. Compare the total of your itemized deductions - including charitable contributions, mortgage interest, state and local taxes, and medical expenses - against the standard deduction to see which approach offers better savings. While the standard deduction will still adjust for inflation, no major changes are expected for 2026.

For those considering larger donations, it might be worth front-loading contributions before the end of 2025 to lock in the temporary above-the-line deduction. Otherwise, be prepared to itemize in 2026 if your total deductions exceed the standard deduction.