Top Tax-Deductible Donations You Can Claim in 2025

Want to lower your 2025 tax bill while supporting causes you care about? Here’s how charitable donations can help you save on taxes:

- Cash Donations: Deduct up to 60% of your Adjusted Gross Income (AGI) when donating to public charities.

- Appreciated Assets: Donate stocks or investments to avoid capital gains tax and deduct their full market value.

- Non-Cash Items: Give clothing, vehicles, or property, but ensure they meet IRS rules for deductions.

- IRA Distributions: If you're 70½ or older, transfer up to $111,000 from your IRA directly to a charity.

- Donor-Advised Funds: Contribute now, decide later which charities to support, and claim the deduction in 2025.

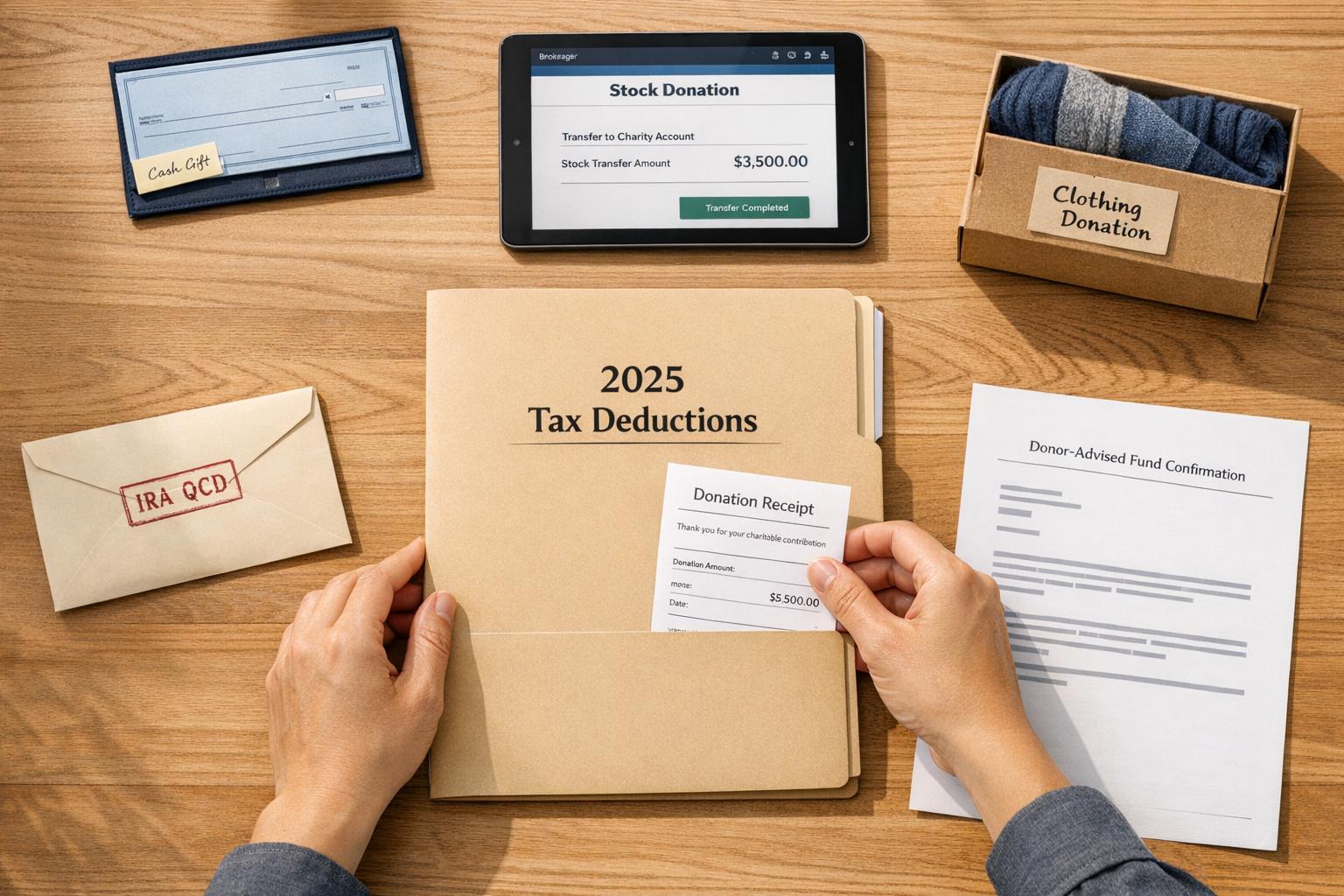

To qualify, donations must be finalized by December 31, 2025, and meet IRS documentation requirements. Keep records like receipts, acknowledgments, or appraisals for larger contributions. Tools like Deductible.me can help simplify tracking and compliance. Always confirm the charity’s eligibility using the IRS Tax Exempt Organization Search tool.

Smart Charitable Giving for 2025–2026: Simple Ways to Give and Save on Taxes

Types of Charitable Donations You Can Deduct

Looking to maximize your tax savings in 2025? Choosing the right type of charitable donation can make a big difference.

Cash Donations to Public Charities

Cash donations are the simplest way to give. For the 2025 tax year, you can deduct these contributions only if you itemize deductions on Schedule A (Form 1040) [2][5]. "Cash" includes payments made via check, electronic transfer, credit card, or even payroll deductions [6]. Eligible recipients range from religious organizations like churches, synagogues, and mosques to nonprofit schools and hospitals. If you're considering other options, donating appreciated assets might provide even greater tax advantages.

Donations of Appreciated Assets

Giving appreciated stock, securities, or other investments offers two major tax perks. First, you avoid paying capital gains tax on the asset's appreciation. Second, you can deduct the full fair market value of the donation. This approach is especially effective if you've held the asset for over a year and its value has significantly increased. Instead of selling the asset, paying taxes, and donating the proceeds, transferring it directly to a qualified charity ensures both you and the organization get the most benefit.

Non-Cash Donations: Clothing, Vehicles, and Property

Non-cash donations, such as clothing, furniture, or vehicles, are deductible at their fair market value (FMV) - essentially, what a buyer would pay in an open market [1][8]. Clothing and household items must be in good condition to qualify [1]. For vehicle donations, the deduction is generally limited to the gross proceeds the charity receives from its sale, rather than the FMV [9]. If your non-cash donations exceed $500, you’ll need to file Form 8283, and for items valued above $5,000, a qualified appraisal is required [8][2]. Keep in mind, if you receive a state or local tax credit greater than 15% of the FMV, your federal deduction must be reduced by the credit amount [1].

Qualified Charitable Distributions (QCDs) from IRAs

If you’re 70½ or older, you can transfer up to $111,000 directly from your IRA to a qualified charity [10]. This Qualified Charitable Distribution (QCD) counts toward your Required Minimum Distribution but doesn’t increase your Adjusted Gross Income (AGI). The funds must be transferred directly to the charity, and married couples have their own individual limits [10]. However, QCDs cannot be directed to private foundations or donor-advised funds [10].

Donor-Advised Fund Contributions

Donor-advised funds offer flexibility by allowing you to claim an immediate tax deduction while deciding which charities to support later. You can contribute cash, securities, or other assets to the fund, take the deduction in the year of the contribution, and then recommend grants to qualified charities over time. This option is particularly useful if you want to consolidate your giving into one year but take your time deciding which organizations to support.

These strategies highlight the variety of ways you can give while optimizing your tax benefits. Next, let’s explore the IRS documentation required to claim these deductions.

IRS Documentation and Reporting Requirements

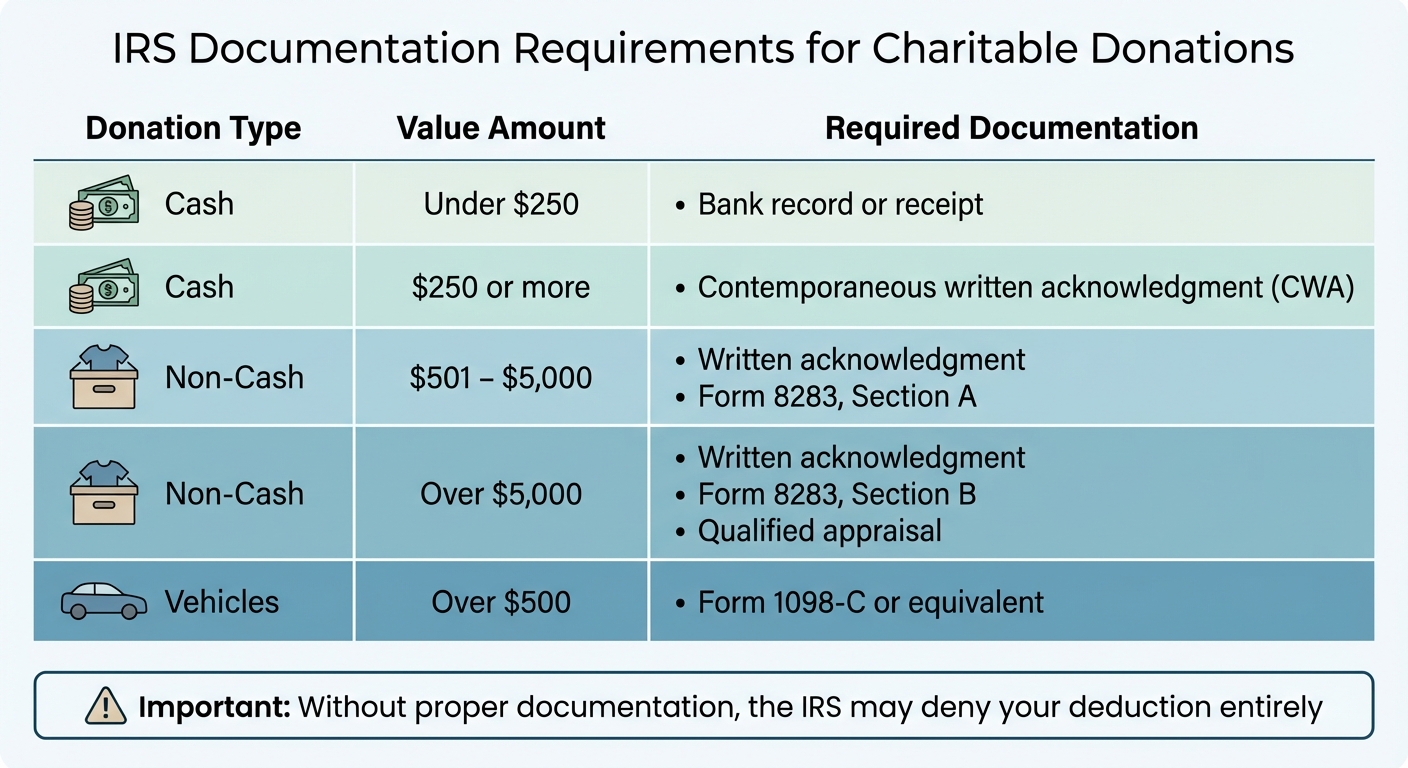

IRS Documentation Requirements for Charitable Donations by Value and Type

Keeping accurate records is key to protecting your deductions. Each type of donation has its own set of documentation rules, depending on the donation's nature and amount.

For cash donations under $250, you'll need a bank record or receipt that includes the charity's name, the date, and the donation amount [2]. If your cash donation is $250 or more, you must obtain a contemporaneous written acknowledgment (CWA) from the charity. This acknowledgment should confirm whether you received any goods or services in exchange for your donation, along with a good-faith estimate of their value. Make sure to get this acknowledgment by the earlier of the filing date or the return's due date, including any extensions [9].

For non-cash donations over $500, you'll need to file Form 8283 [2]. If the items are valued at more than $5,000, a qualified appraisal is required, along with completing Section B of Form 8283 [2]. For donated vehicles worth more than $500, you must include Form 1098-C or an equivalent document with your tax return [4].

| Donation Type | Value Amount | Required Documentation |

|---|---|---|

| Cash | Under $250 | Bank record or receipt [2] |

| Cash | $250 or more | Contemporaneous written acknowledgment (CWA) [2] |

| Non-Cash | $501 – $5,000 | Written acknowledgment and Form 8283, Section A [2] |

| Non-Cash | Over $5,000 | Written acknowledgment, Form 8283 Section B, and appraisal [2] |

| Vehicles | Over $500 | Form 1098-C or equivalent [4] |

Before making a donation, confirm that the organization is eligible by using the IRS Tax Exempt Organization Search tool [7]. For non-cash donations, it's a good idea to document the items with photographs and an inventory list to support your fair market value (FMV) assessment [8]. Detailed records are essential - without them, the IRS could deny your deduction entirely if you're audited [3].

Up next, consider how AGI limits and carryover rules might influence your overall tax plan.

sbb-itb-e723420

2025 AGI Limits and Carryover Rules

The IRS sets limits on how much of your charitable donations you can deduct, based on the type of donation and your Adjusted Gross Income (AGI). Knowing these limits can help you plan your giving more effectively.

For cash donations to public charities, you can generally deduct up to 60% of your AGI [1]. However, if you’re donating appreciated assets like stocks or real estate held for over a year, the deduction limit drops to 30% of your AGI when the recipient is a public charity [1]. Donations to private non-operating foundations come with stricter caps: 30% of AGI for cash and 20% for capital gain property [1].

If your contributions exceed these limits, the IRS allows you to carry the excess forward for up to five years [1]. These carryovers retain their original classification, meaning a donation with a 30% limit remains under that cap in future years. When using carryovers, you must first apply deductions for the current year's contributions before tapping into older carryovers. To simplify this process, refer to IRS Worksheet 2 in Publication 526, which can help you calculate limits and track carryovers. Remember, you’ll need to itemize deductions on Schedule A to claim any charitable contributions, including carryovers [1].

Deduction Limits by Donation Type

Here’s a quick breakdown of AGI limits for different types of donations:

| Donation Type | Recipient Organization | AGI Deduction Limit | Carryover Period |

|---|---|---|---|

| Cash | Public Charity | 60% [1] | 5 years [1] |

| Non-Cash Property | Public Charity (50% Limit Organization) | 50% [1] | 5 years [1] |

| Appreciated Assets | Public Charity | 30% [1] | 5 years [1] |

| Cash | Private Non-Operating Foundation | 30% [1] | 5 years [1] |

| Capital Gain Property | Private Non-Operating Foundation | 20% [1] | 5 years [1] |

For donations of appreciated assets, you might want to consider making a 50% election. This option lets you base your deduction on the asset’s original cost rather than its fair market value, which qualifies it for a 50% AGI limit. While this reduces the immediate deduction amount, it can help avoid carryovers and give you more flexibility in managing your tax strategy [1].

Using Deductible.me to Track Your Donations

Keeping tabs on your donations can feel like a hassle, but Deductible.me makes it a breeze. This platform offers an easy-to-use, tech-driven solution to simplify the process.

One standout feature is the tool’s AI-powered valuation system. All you need to do is snap a photo of your donated items. The AI evaluates their condition and calculates their fair market value (FMV) based on IRS guidelines. This is especially handy since the IRS requires donated items to be in "good used condition" or better for deductions.

Deductible.me also handles the nitty-gritty of documentation. It organizes everything you need, from contemporaneous written acknowledgments (CWAs) for donations of $250 or more to Form 8283 for items exceeding $500. If you're donating items worth over $5,000, the platform even helps with appraisals.

Another helpful feature is its ability to track your contributions against your adjusted gross income (AGI) limits in real time. Since careful record-keeping and staying within AGI limits are essential, Deductible.me provides clarity and helps you stay on top of things. This makes it easier to plan your giving or decide when to carry forward excess contributions.

For those who want more, Deductible.me offers a Premium plan for just $2/month. It includes unlimited donation tracking, advanced analytics, and IRS-compliant reports. Meanwhile, the Free plan is perfect for casual donors, covering up to $500 in donation value without any extra cost. Whether you're a frequent giver or just starting out, there's an option to suit your needs.

Conclusion: Maximize Your Tax Savings While Supporting Good Causes

Charitable donations can help reduce your tax burden if you itemize deductions on Schedule A and contribute to IRS-approved organizations. To confirm an organization’s eligibility, use the IRS Tax Exempt Organization Search tool. Keep in mind, donations are generally capped at 60% of your adjusted gross income (AGI) for cash contributions.

Proper documentation is key. For cash donations of $250 or more, you’ll need a written acknowledgment from the organization. Non-cash contributions exceeding $500 require Form 8283, and items valued over $5,000 must have a qualified appraisal. Without these records, your deductions could be denied. Thankfully, modern tools make staying organized easier.

Deductible.me offers an AI-powered platform to simplify donation tracking and compliance. Whether it’s cash, clothing, or even vehicle donations, this tool automatically values your contributions and organizes receipts, ensuring you’re IRS-ready when tax season arrives.

The platform is budget-friendly, too: the Free plan covers donations up to $500, while the Premium plan - just $2 per month - provides unlimited tracking, advanced analytics, and enhanced receipt management. Start using Deductible.me today to get organized and make the most of your charitable giving.

FAQs

What records do I need to claim tax-deductible donations in 2025?

To claim tax-deductible donations in 2025, you'll need to have the right paperwork to back up your contributions. For cash donations, make sure you keep either a bank record or a written acknowledgment from the charity. This acknowledgment should clearly state the donation amount, the date of the contribution, and the name of the organization.

When it comes to noncash donations valued over $500, you'll need to complete IRS Form 8283. This form requires you to provide details about the donated items and their estimated value. If your noncash donation exceeds $5,000, you'll also need a qualified appraisal and a signed acknowledgment from the charity. Additionally, you'll have to fill out Part III of Form 8283.

Maintaining accurate records not only keeps you in line with IRS requirements but also ensures you can make the most of your tax benefits while continuing to support the causes that matter to you.

How does your adjusted gross income (AGI) impact the charitable donations you can deduct?

Your adjusted gross income (AGI) plays a key role in determining how much of your charitable contributions you can deduct. For instance, cash donations to public charities can usually be deducted up to 60% of your AGI. However, other types of donations, like appreciated assets, often come with lower deduction limits. These thresholds are designed to keep deductions aligned with your income.

It's critical to have proper documentation to back up your claims. Plus, recent tax law updates might impact these limits. To make the most of your deductions, check the latest IRS rules or consult with a tax professional.

Can I apply unused charitable deductions to future tax years?

Yes, you can usually carry forward unused charitable deductions to future tax years, but there are some rules to keep in mind. The IRS imposes limits based on your adjusted gross income (AGI). Generally, you’re allowed to carry forward the unused portion for up to five years, as long as it continues to meet the requirements for deductions in the year you apply it.

To take full advantage of this option, make sure you maintain thorough records of your donations and review the most up-to-date IRS guidelines to ensure compliance.