Bunching vs. Spreading Donations: Tax Impact

Want to maximize your tax savings when donating to charity? The choice between bunching and spreading donations can make a big difference. Here's the quick takeaway:

- Bunching Donations: Combine multiple years of donations into one tax year to exceed the standard deduction. Best for those close to the deduction threshold or during high-income years. Using tools like Donor-Advised Funds (DAFs) can simplify this strategy and provide flexibility.

- Spreading Donations: Make consistent annual contributions. Simpler and ensures steady support to charities but may not provide tax benefits if your total deductions don't surpass the standard deduction.

Key Points:

- 2025 Standard Deduction: $15,750 (single), $31,500 (married filing jointly).

- 2026 Rule Change: Only donations exceeding 0.5% of your adjusted gross income (AGI) will qualify for deductions.

- DAFs: A useful option for bunching, allowing immediate tax deductions while spreading out grants to charities over time.

Bottom Line: If maximizing tax savings is your goal, bunching donations often provides a bigger benefit. However, spreading donations may suit those prioritizing simplicity or consistent charity support. Always consider your income, deductions, and future tax rules.

Charitable Contributions (Part 2) | Bunching | DAF | QCD | Giving

What Is Bunching Donations?

Bunching donations is a tax strategy where you combine several years' worth of charitable contributions into a single tax year to surpass the standard deduction threshold. For example, instead of donating $15,000 annually, you might donate $30,000 in one year and skip donations the following year. By doing this, you can itemize deductions in the year you "bunch" donations and use the standard deduction in the off years. This approach gained popularity after the 2017 Tax Cuts and Jobs Act, which significantly increased the standard deduction amount[3][4][10].

"The strategy allows charitable taxpayers to maximize their overall tax deductions during a two-year period by 'bunching' charitable giving into one tax year, then taking a break from direct charitable giving the following year."

– Jeff Zysik, COO and CFO, DonorsTrust[8]

Many donors make this process easier by using Donor-Advised Funds (DAFs). These accounts let you contribute a large sum in your "on" year to receive an immediate tax deduction. You can then recommend smaller grants to charities over several years, ensuring consistent support even during your "off" years. In the U.S., there are now over 1.9 million DAF accounts, and their usage has grown by an average of 22.6% annually since 2018[9].

Advantages of Bunching Donations

The primary advantage of bunching is the potential for increased tax savings over multiple years. For example, a married couple in the 24% tax bracket who bunches two years' worth of $15,000 donations into one year can increase their total deductions by $4,100 over two years, saving $984 in federal taxes[8].

This strategy also provides flexibility in timing your contributions. You can align a bunching year with periods of higher income, such as receiving a substantial bonus, selling a business, or nearing retirement. By doing so, you maximize the value of your deduction when you're in a higher tax bracket[3][10]. Additionally, donating appreciated assets like stocks or mutual funds to a DAF allows you to avoid capital gains taxes while still claiming a deduction for the full fair market value of the asset[10].

"Giving to a donor-advised fund has the added benefit of allowing individuals to avoid capital gain by gifting appreciated assets. This provides a dual income tax benefit when combined with bunching."

– Molly Petitjean, Charitable Solutions consultant, Thrivent Charitable[10]

Drawbacks of Bunching Donations

While bunching offers clear benefits, it requires careful planning and discipline. You’ll need to commit to a multi-year strategy and avoid making large donations during your "off" years. Straying from the plan could negate the tax advantages[5].

Without a DAF, bunching can also create challenges for charities. Organizations may face inconsistent funding, receiving a large donation one year but none the next, which can complicate their budgeting and operations[5][8].

Additionally, the strategy only works if your itemized deductions (including bunched donations) exceed the standard deduction. Starting in 2026, the rules become even stricter, as only charitable donations exceeding 0.5% of your adjusted gross income (AGI) will qualify as deductible[10][11]. This change may make the calculation more complex and limit the effectiveness of bunching for some taxpayers.

What Is Spreading Donations?

Spreading donations refers to the practice of making consistent, annual contributions to charity rather than concentrating your giving into a single tax year. This traditional approach simplifies planning and provides steady support to charities. For example, if you donate $10,000 each year, you maintain that pattern over time, ensuring a predictable flow of contributions. However, while this method offers stability, it may not deliver the same tax benefits as a carefully planned bunching strategy.

Here’s the challenge: many people find that their annual donations, when combined with other itemized deductions, don’t exceed the standard deduction threshold. In these cases, taxpayers end up claiming the standard deduction, which means their charitable giving doesn’t result in any additional tax savings.

"Many taxpayers who historically itemized deductions may find it advantageous to take the standard deduction in the future."

– Caleb Lund, Director of Charitable Strategies Group, and Hayden Adams, Director of Tax Planning and Wealth Management, DAFgiving360

Take Alison and James, for example. This married couple filed jointly and had $23,000 in itemized deductions annually, including $10,000 in charitable donations. Since their total deductions fell below the 2025 standard deduction of $31,500, they opted for the standard deduction in both years. As a result, their $20,000 in charitable giving over two years provided no specific tax benefit at all[4].

Advantages of Spreading Donations

The main advantage of spreading donations is its simplicity. It requires minimal planning and basic record-keeping, making it an easy approach to maintain year after year. This steady giving also helps charities manage their day-to-day operations and plan budgets effectively. Additionally, spreading donations allows you to adjust your giving annually based on your financial situation - no complex multi-year strategies are required.

However, this simplicity comes with a trade-off: you may miss out on potential tax savings.

Drawbacks of Spreading Donations

The biggest downside to spreading donations is the reduced tax benefit. Since the Tax Cuts and Jobs Act significantly increased the standard deduction in 2017, many taxpayers who previously itemized now find it more beneficial to take the standard deduction instead. This means that whether you donate $10,000 or nothing, the tax outcome remains the same.

The numbers can be eye-opening. Alison and James, for instance, missed out on $3,800 in additional tax deductions over two years by spreading their donations instead of bunching them. For a couple in the 24% tax bracket, that translates to nearly $1,000 in lost tax savings.

Looking ahead, a new rule starting in 2026 will require charitable donations to exceed 0.5% of your adjusted gross income (AGI) before you can claim any deduction[3][13]. This change could make it even harder for those who spread smaller, annual donations to benefit from tax deductions - especially for higher-income taxpayers.

"Many taxpayers won't qualify for the necessary deductions to surpass the standard deduction threshold established by tax reform in 2025."

– Fidelity Charitable

Tax Savings: Bunching vs. Spreading

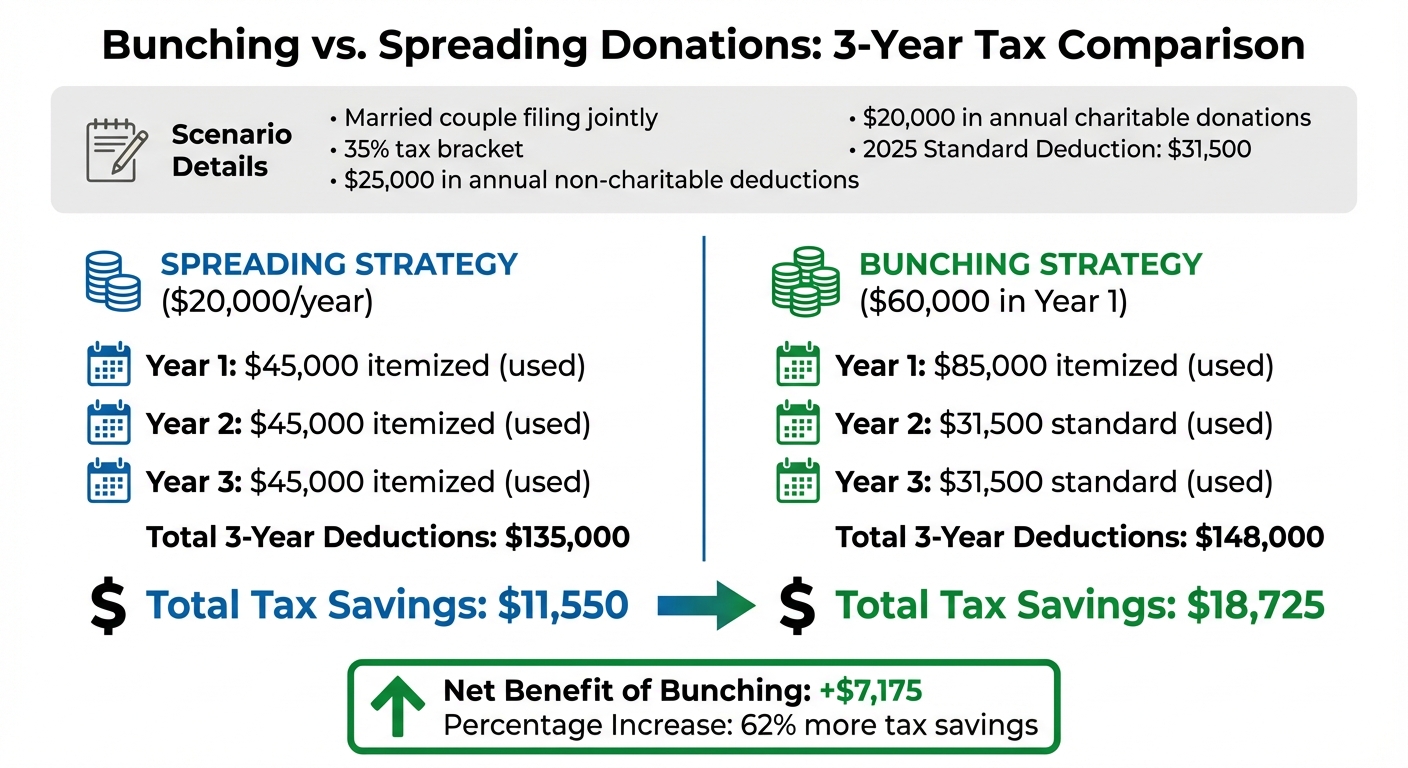

Bunching vs Spreading Donations Tax Savings Comparison

The main difference between bunching and spreading donations lies in the tax savings each strategy can achieve.

Example: Bunching Donations

Let’s look at a married couple in the 35% tax bracket who donate $20,000 annually and have $25,000 in other deductions. By bunching three years of donations - totaling $60,000 - into 2025, their itemized deductions for that year jump to $85,000. This amount exceeds the 2025 standard deduction of $31,500 by $53,500. For Years 2 and 3, they would claim the standard deduction since no charitable contributions are made during those years.

This approach results in $18,725 in total tax savings[3]. The key advantage here is that the Year 1 deduction surpasses the standard deduction by a wide margin, making itemizing worthwhile.

Example: Spreading Donations

Now, let’s consider the same couple opting to spread their donations evenly over three years. With $20,000 donated annually, their itemized deductions total $45,000 each year, which is only $13,500 above the standard deduction. Over three years, this strategy saves $11,550 in taxes - $7,175 less than the bunching strategy[3].

"One tax-efficient strategy is called bunching, where you group multiple years of deductions into a single year to surpass the standard deduction, which can also be especially beneficial in a high-income year or during pre-retirement."

– Fidelity Charitable[3]

Side-by-Side Comparison

Here’s a breakdown for a married couple filing jointly (35% tax bracket) with $25,000 in annual non-charitable deductions:

| Metric | Spreading ($20,000/year) | Bunching ($60,000 in Year 1) |

|---|---|---|

| Year 1 Itemized Total | $45,000 | $85,000 |

| Year 1 Deduction Used | $45,000 (Itemized) | $85,000 (Itemized) |

| Year 2 Deduction Used | $45,000 (Itemized) | $31,500 (Standard) |

| Year 3 Deduction Used | $45,000 (Itemized) | $31,500 (Standard) |

| Total 3-Year Deductions | $135,000 | $148,000 |

| Total Tax Savings | $11,550 | $18,725 |

| Net Benefit | – | +$7,175 |

This table highlights how timing your donations can significantly increase tax savings. In this example, the bunching strategy provides a 62% boost in tax savings compared to spreading donations over three years[3]. Even for couples in the 24% tax bracket, the savings are still worthwhile - bunching two years of $30,000 donations can reduce federal taxes by an additional $2,904[8].

To make this process easier, tools like Deductible.me can help track your donations and determine which strategy offers the best tax benefits.

sbb-itb-e723420

Using Donor-Advised Funds with Bunching

Donor-Advised Funds (DAFs) can simplify your tax strategy while maximizing the benefits of bunching. Think of a Donor-Advised Fund (DAF) as a charitable savings account. You make a large contribution in one year to secure a tax deduction, but you’re not required to distribute those funds to charities right away. Instead, the money stays in your DAF, and you can recommend grants to your chosen nonprofits over several years.

How DAFs Work with Bunching

DAFs make bunching more efficient by allowing you to separate the timing of your tax deduction from when charities actually receive the money. For example, if you typically donate $20,000 annually, you could contribute $60,000 to a DAF in 2025. This approach lets you claim the full deduction that year, exceeding the $31,500 standard deduction threshold for married couples filing jointly [3][5]. Over the next three years, you can recommend $20,000 in grants annually from your DAF, ensuring consistent support for your charities while optimizing your tax benefits.

One tax consultant shared an example of a business owner who contributed $100,000 to a DAF during a high-income year. The owner claimed the full deduction in that year and scheduled grants over the following five years [16].

Tax Advantages of DAFs

Beyond bunching, DAFs offer several other tax perks. Contributions to your DAF can be invested and grow tax-free. Additionally, donating appreciated assets like stocks or mutual funds can help you avoid capital gains taxes while still claiming a deduction for their full fair market value, subject to the 30% limit for non-cash contributions [3][4][14].

"With a donor-advised fund (DAF), you can take advantage of the immediate tax benefits of giving, invest the charitable assets, and then recommend grants when you know exactly where you'd like funds to be directed."

– Rebecca Moffett, President, Vanguard Charitable [15]

This flexibility is particularly useful as the 0.5% AGI floor takes effect in 2026. By contributing in 2025, you can secure the full deduction before the new restriction applies [3][7]. Keep in mind that cash contributions are generally capped at 60% of your AGI, but any excess can be carried forward for up to five years [6][14].

To stay organized, tools like Deductible.me can help you track DAF contributions and ensure IRS documentation compliance [2].

Timing and IRS Requirements

Documentation for Tax-Deductible Donations

The IRS has specific guidelines for documenting charitable contributions, and it's essential to keep accurate records for every donation. Here's a quick breakdown of the documentation needed based on the amount or type of contribution:

| Contribution Amount | Required Documentation |

|---|---|

| Any monetary amount | Bank record or written communication from the charity, including the name, date, and amount of the donation [12][2] |

| $250 or more | A contemporaneous written acknowledgment (CWA) that specifies whether goods or services were provided in exchange for the donation [2][17] |

| Noncash over $500 | Form 8283, Section A [2][17] |

| Noncash over $5,000 | A qualified appraisal and Form 8283, Section B [1][2] |

| Noncash over $500,000 | The qualified appraisal must also be attached to your tax return [2] |

For a CWA to be considered "contemporaneous", you must receive it by the time you file your tax return or by the return's due date (including extensions), whichever is earlier [17].

By maintaining proper documentation, you’ll ensure your contributions meet IRS standards, helping you claim deductions without unnecessary complications.

Year-End Deadlines

Timing is everything when it comes to charitable contributions, especially if you're using strategies like bunching to maximize deductions. To claim a deduction for a specific tax year, your donation must be completed by December 31 of that year [12][1]. Missing this deadline means the deduction will apply to the next tax year instead.

Different payment methods have unique rules for determining the contribution date:

- Checks: Deductible based on the postmark date when mailed [1].

- Credit card payments: Counted in the year the charge is made [1].

- Text message donations: Deductible in the year you send the text, as shown on your phone bill [1].

- Pay-by-phone contributions: The deduction applies on the date your bank processes the payment [1].

Before making a donation, confirm that the organization is tax-exempt using the IRS TEOS tool. This step is especially critical when donating large amounts, as a non-qualifying charity could disrupt your tax planning [12][2]. Proper timing and verification ensure your strategy stays on track.

State Tax Considerations

While federal tax strategies often take center stage, state tax laws can significantly influence the timing and impact of your charitable donations. Many states offer their own deductions or credits for charitable giving, but these come with various caps, phase-outs, and rules that can shift the balance between bunching and spreading your contributions.

State tax credits can impact your federal deduction. If a state or local tax credit exceeds 15% of your donation, the federal deduction is reduced by the full amount of that credit [1]. For instance, donating $1,000 in a state offering a 70% tax credit ($700) would lower your federal deduction to just $300 [1]. This is particularly important in states with high-percentage credits, as it can diminish the federal benefit of bunching contributions.

The specific rules in each state can also sway the decision between bunching and spreading donations. Some states impose caps on the total credit or deduction you can claim each year, which may favor spreading. Take Vermont as an example: the state offers a 5% credit with a $20,000 donation cap, limiting the state credit to $1,000 annually. Donating $40,000 in one year yields the same state credit as spreading $20,000 over two years [18]. Similarly, Colorado limits total itemized deductions to $12,000 for single filers and $16,000 for joint filers if their adjusted gross income (AGI) exceeds $300,000 [18]. In such cases, bunching large donations could result in wasted potential savings.

It’s also worth noting that not all states provide benefits for charitable giving. Nine states with income tax, including Connecticut, New Jersey, and Pennsylvania, offer no state-level charitable deductions or credits [18]. In these states, your decision to bunch or spread donations will hinge entirely on federal tax considerations. Conversely, states like Arizona and Colorado allow even non-itemizers to claim charitable benefits at the state level. This means you could enjoy state tax savings every year by spreading donations, even if you only itemize federally during bunched years [18].

As with federal strategies, state tax rules introduce an additional layer of complexity. Before committing to a bunching approach, evaluate both federal and state tax impacts. Look into your state’s annual caps, AGI-based phase-outs, or high-percentage credits that could reduce your federal deduction. Calculating both levels of tax benefits ensures you maximize your overall savings.

Choosing Between Bunching and Spreading

The choice between bunching and spreading donations depends on your tax situation, income, and charitable objectives. Bunching is particularly useful for taxpayers whose total itemized deductions are close to or just below the standard deduction ($15,750 for single filers and $31,500 for married couples filing jointly in 2025) [3]. If your deductions - like mortgage interest and state and local taxes - already far exceed the standard deduction, you’re likely itemizing every year, which diminishes the value of bunching. On the other hand, if your fixed deductions are relatively low, spreading donations won’t provide much extra tax benefit.

Higher-income taxpayers often gain more from deductions above the standard threshold. Bunching can be especially helpful during high-income years, such as before retirement or following a financial windfall, when offsetting larger tax liabilities becomes a priority. Just be mindful of IRS limits on charitable contributions. If your bunched donations exceed these limits, the excess can be carried over for up to five additional tax years [1][4].

Another factor to weigh is the impact on the charities you support. Many nonprofits depend on steady contributions for their budgeting. Spreading donations ensures consistent funding, while bunching could lead to funding gaps unless you use tools like a Donor-Advised Fund (DAF). A DAF lets you claim an immediate tax deduction in the bunched year while distributing smaller, regular grants to charities, maintaining their financial stability and aligning your tax benefits with your giving goals.

How to Decide Which Strategy Fits Your Situation

Here’s how to evaluate your options. First, calculate the gap between your fixed itemized deductions (such as SALT and mortgage interest) and the standard deduction. If the gap is substantial, bunching several years’ worth of donations into one year can push you past the threshold and result in meaningful tax savings. Be sure your contributions stay within IRS limits to avoid complications with carryovers.

Tax laws can change, so it’s wise to consult a tax advisor to stay updated. Tools like Deductible.me can simplify the process by helping you track donations, create IRS-compliant reports, and monitor your progress toward annual giving goals. Keeping detailed records is essential to make the most of either strategy.

FAQs

How will the 2026 tax changes affect my decision to bunch or spread charitable donations?

The 2026 tax changes bring a new rule: a 0.5% Adjusted Gross Income (AGI) floor for deductible charitable contributions. In simple terms, only the amount of your donations that goes beyond 0.5% of your AGI will count toward a tax deduction.

This shift could make it trickier to qualify for deductions if you spread your donations evenly each year. A strategy to consider is bunching donations - combining contributions from multiple years into one. By doing so, you’re more likely to surpass the AGI threshold and optimize your tax savings. Planning ahead is key to adapting to these changes and ensuring your charitable giving remains as impactful as possible.

What are the tax benefits of using Donor-Advised Funds (DAFs) for bunching donations?

Using Donor-Advised Funds (DAFs) for bunching donations is a smart way to boost your tax savings. By grouping several years' worth of charitable contributions into one tax year, you can more easily exceed the standard deduction threshold. This allows you to itemize deductions and potentially claim a larger tax break for that year.

Here’s how it works: Once you contribute to a DAF, the funds can be distributed to charities over time. This gives you the flexibility to support causes you care about while still optimizing your tax benefits. It’s especially helpful under the higher standard deduction introduced by the Tax Cuts and Jobs Act, which has made itemizing less common for many people. By timing your charitable giving to align with years when itemizing makes the most sense, DAFs let you balance your financial planning with your philanthropic goals.

How do state tax laws affect whether you should bunch or spread out charitable donations?

State tax laws can significantly influence whether it’s better to consolidate charitable donations into a single year or distribute them over several years. While many states align with federal tax rules, they often introduce their own unique twists that can affect how contributions are deducted. For instance, some states impose limits on deductions or set different thresholds, which might sway the decision toward one strategy over the other.

The 2017 tax reform, which raised the federal standard deduction and capped certain itemized deductions like state and local taxes (SALT), made bunching donations into one year a popular tactic. This approach helps taxpayers exceed the standard deduction and maximize their tax savings. However, state-specific regulations can either amplify or restrict the benefits of this method. To navigate these complexities and get the most out of your charitable giving, consulting a tax advisor who understands both federal and state laws is a wise move.