Year-End Tax Planning with Donation Bunching

Want to save on taxes while supporting your favorite causes? Donation bunching could be your answer.

This strategy involves combining multiple years of charitable donations into a single tax year to exceed the standard deduction threshold. For 2025, the standard deduction is $15,750 for single filers and $31,500 for married couples filing jointly. By itemizing deductions in "bunched" years and using the standard deduction in others, you can maximize tax savings without disrupting consistent charitable giving.

Key points to know:

- How it works: Group several years of donations into one year to surpass the standard deduction threshold and itemize deductions.

- Tools to use: Donor-Advised Funds (DAFs) allow you to claim the full deduction upfront while spreading out donations to charities over time.

- Upcoming 2026 rules: A new 0.5% AGI floor for deductions makes bunching even more effective for tax savings.

- Example: A married couple donating $12,000 annually could save $10,500 over two years by bunching two years of donations into one.

Donation bunching is especially useful during high-income years or when donating appreciated assets like stocks. To optimize this strategy, ensure donations are processed by December 31 and maintain proper documentation.

Charitable Contributions (Part 1) | Bunching | DAF | QCD | Giving

What Is Donation Bunching?

Donation bunching is a tax strategy that involves grouping several years' worth of charitable contributions into a single tax year. The goal? To exceed the standard deduction threshold and take advantage of itemized deductions for greater tax savings. This approach works best when you understand the balance between itemizing and taking the standard deduction.

"Bunching is a tax strategy where you combine multiple years' worth of charitable contributions into one tax year rather than spreading them out over multiple tax years." - Zach Reuter, CFP, Johnson Bixby [5]

The process follows a cycle: in "bunched" years, you make a larger donation, combining it with other deductible expenses like mortgage interest and state and local taxes (SALT) to qualify for itemizing. In "off" years, you revert to the standard deduction.

This strategy gained traction after the Tax Cuts and Jobs Act of 2017 significantly increased the standard deduction. For many taxpayers, this change made it harder to itemize annually. By using bunching, those whose itemized deductions fall just short of the threshold can still reap tax benefits.

Donor-Advised Funds (DAFs) are particularly helpful for this method. They allow you to make a large donation in one year for an immediate deduction while continuing to distribute funds to charities over time.

Standard Deduction vs. Itemized Deduction

Taxpayers must decide between the standard deduction and itemizing. The standard deduction is a fixed amount that reduces taxable income without requiring detailed records. Itemized deductions, however, include specific eligible expenses like charitable contributions, mortgage interest, and up to $10,000 in SALT.

When itemized deductions don’t exceed the standard deduction, charitable gifts won’t lower your taxes. This is where donation bunching can make a difference.

Take the example of a married couple with $10,000 in mortgage interest, $10,000 in SALT, and $6,000 in yearly charitable donations. Their total itemized deductions would be $26,000 - below the $30,000 standard deduction. By default, they’d claim the standard deduction annually, gaining no tax benefit from their donations. But by bunching two years of donations ($12,000) into one, they could raise their itemized deductions to $32,000 - $2,000 above the standard deduction [6].

| Filing Status | 2025 Standard Deduction |

|---|---|

| Single / Married Filing Separately | $15,000 |

| Married Filing Jointly | $30,000 |

| Head of Household | $22,250 |

The key is alternating: itemize during bunched years to maximize deductions, and fall back on the standard deduction in off years. Meanwhile, your DAF ensures your charitable giving remains consistent.

How Bunching Reduces Your Tax Bill

By concentrating larger donations into one year and reducing contributions in others, bunching can significantly lower your tax bill. If you already plan to donate a set amount over several years, grouping those donations into a single year can amplify your tax benefits.

For example, in 2025, the San Diego Foundation highlighted a case involving a married couple filing jointly with $25,500 in annual deductible expenses, including $6,000 in charitable giving. Since their total deductions fell below the $30,000 standard deduction, their donations didn’t provide any tax advantage. By bunching two years’ donations ($12,000) into one year through a DAF, their itemized deductions jumped to $37,500 - securing a $7,500 higher deduction [6].

Fidelity Charitable presented a more dramatic example. A taxpayer in the 35% tax bracket, who typically donated $20,000 annually, also had $15,000 in mortgage interest and $10,000 in SALT. By bunching three years of donations ($60,000) into one, their itemized deductions rose to $85,000. This resulted in potential tax savings of $18,725 - $7,175 more than the $11,550 they would have saved by donating yearly [2].

This strategy becomes especially effective during high-income years. Whether you receive a large bonus, sell a business, or realize significant capital gains, concentrating charitable donations in that year can help offset higher tax liabilities. Donating appreciated assets, like stocks or mutual funds, to a DAF adds another layer of benefit: you avoid capital gains tax and still claim a full fair-market-value deduction.

Starting in 2026, new rules will apply a 0.5% AGI floor to itemized charitable deductions. Only contributions exceeding 0.5% of your adjusted gross income will be deductible [2]. This makes bunching even more advantageous, as grouping donations into one year helps surpass this threshold and ensures you get the full deduction.

Next, we’ll walk through the practical steps to implement donation bunching.

How to Implement Donation Bunching

You can implement donation bunching in three steps: calculate your tax gap, pick the best donation method, and complete your donations before the end of the year.

Step 1: Calculate Your Bunching Amount

Start by identifying the 2025 standard deduction threshold - $15,750 for single filers and $31,500 for married couples filing jointly [2][4]. Then, add up your other itemized deductions, such as State and Local Taxes (SALT) (capped at $10,000), mortgage interest, and qualifying medical expenses [2]. The difference between your standard deduction and these itemized deductions is your "gap." Your charitable contributions need to exceed this gap to give you any tax benefit [4].

Keep in mind, cash donations are deductible up to 60% of your Adjusted Gross Income (AGI), while appreciated non-cash assets are capped at 30% [7]. If your donations exceed these limits, you can usually carry the excess forward for up to five years. However, starting in 2026, only contributions exceeding 0.5% of your AGI will be deductible for itemizers [2].

Many people bunch two to three years of charitable contributions into one tax year to maximize their deductions. For instance, Thrivent Charitable shared a case from July 2025 involving a couple in their early 60s. They typically donated $12,000 annually and had $10,000 in other itemized deductions. Their total of $22,000 fell short of the standard deduction. By bunching three years of donations ($36,000) into a donor-advised fund, their itemized deductions jumped to $46,000, which significantly reduced their tax bill [4].

Once you’ve calculated your gap, the next step is to choose the donation method that works best for you.

Step 2: Choose Your Donation Method

Donor-Advised Funds (DAFs) are a popular choice for donation bunching. They allow you to make a large, tax-deductible contribution in one year while spreading out grants to charities over several years [2]. This approach provides an immediate tax deduction while keeping flexibility for future charitable giving.

You can bunch various types of donations, including cash, checks, electronic transfers, and non-cash property like appreciated securities (stocks, bonds, or mutual funds), real estate, vehicles, and household goods [9]. Donating appreciated assets offers a double benefit: you can deduct the full fair market value and avoid paying capital gains tax [10].

"Giving to a donor-advised fund has the added benefit of allowing individuals to avoid capital gain by gifting appreciated assets. This provides a dual income tax benefit when combined with bunching." - Molly Petitjean, Charitable Solutions consultant, Thrivent Charitable [4]

Before making large donations, confirm that your chosen charities are IRS-qualified. Use the IRS Tax Exempt Organization Search Tool to ensure they’re eligible for tax-deductible contributions [8]. Qualified recipients include 501(c)(3) nonprofits, religious organizations, and government entities serving public purposes.

This step becomes even more critical with the upcoming 2026 rule, where deductions will only apply to contributions above 0.5% of your AGI.

Step 3: Make Donations Before December 31

Once you’ve chosen your donation method, make sure to complete your contributions by December 31 to qualify for the current tax year’s deduction [8].

Timing is key. Donations are counted based on when they’re processed, not when you pay your credit card bill or deposit a check. Here’s how it works:

- Checks: Counted based on the postmark date.

- Credit cards: Counted on the date the charge is processed.

- Electronic payments: Counted on the processing date by your financial institution.

- Text message donations: Counted on the date the text is sent.

- Stock certificates: Counted on the mailing or physical delivery date.

For property donations, start early. These often require appraisals and additional paperwork [7]. Also, for contributions of $250 or more, you’ll need a written acknowledgment from the charity [8]. Non-cash donations exceeding $5,000 generally require a qualified appraisal.

If you usually donate in December, consider waiting until January to shift the deduction into the next tax year and start a new bunching cycle [1]. Alternatively, donating in December can help you claim the deduction for the current year, which could be a smart move ahead of the 2026 AGI floor rule [2].

Donation Bunching Examples

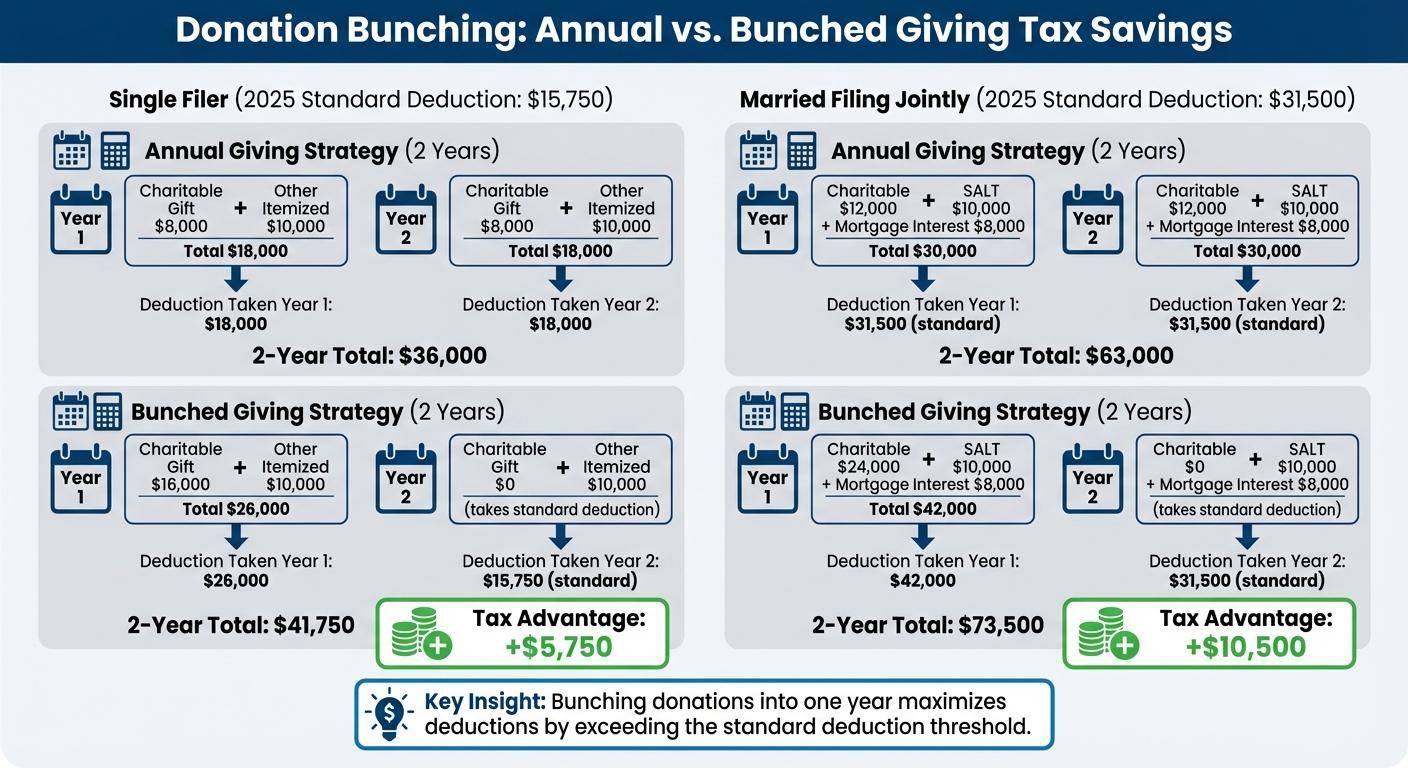

Donation Bunching Tax Savings Comparison: Annual vs Bunched Giving

Donation bunching can help maximize tax savings by grouping multiple years' charitable contributions into a single tax year. Here's how it works in practice, with examples for both single filers and married couples.

Single Filer Example

Imagine a single filer who donates $8,000 annually and has $10,000 in other itemized deductions (like state and local taxes or mortgage interest). Without bunching, their total itemized deductions amount to $18,000 each year - just slightly above the 2025 standard deduction of $15,750. But by combining two years of donations into one (e.g., donating $16,000 in Year 1), the filer increases their deductions significantly in the first year while taking the standard deduction in the second year.

Here’s how the numbers compare over two years:

| Deduction Type | Annual Giving (Year 1) | Annual Giving (Year 2) | Bunched Giving (Year 1) | Bunched Giving (Year 2) |

|---|---|---|---|---|

| Charitable Gift | $8,000 | $8,000 | $16,000 | $0 |

| Other Itemized | $10,000 | $10,000 | $10,000 | $10,000 |

| Total Itemized | $18,000 | $18,000 | $26,000 | $10,000 |

| Standard Deduction | $15,750 | $15,750 | $15,750 | $15,750 |

| Deduction Taken | $18,000 | $18,000 | $26,000 | $15,750 |

| 2-Year Total / Tax Advantage | - | $36,000 | - | $41,750 (+$5,750) |

By using the bunching strategy, this filer increases their total deductions over two years by $5,750 compared to donating annually.

Married Filing Jointly Example

Married couples have a higher standard deduction - $31,500 in 2025 - but certain itemized deductions, like state and local taxes (SALT), remain capped at $10,000 regardless of filing status [11]. Let’s look at a couple who donates $12,000 annually to charity, with $10,000 in SALT and $8,000 in mortgage interest. If they donate annually, their total itemized deductions are $30,000 each year, which falls below the standard deduction. But by combining two years of donations into one (making a $24,000 donation in Year 1), their deductions in that year increase significantly.

Here’s a two-year comparison:

| Deduction Component | Annual Giving (Year 1) | Annual Giving (Year 2) | Bunched Giving (Year 1) | Bunched Giving (Year 2) |

|---|---|---|---|---|

| Charitable Donation | $12,000 | $12,000 | $24,000 | $0 |

| SALT (Capped) | $10,000 | $10,000 | $10,000 | $10,000 |

| Mortgage Interest | $8,000 | $8,000 | $8,000 | $8,000 |

| Total Itemized | $30,000 | $30,000 | $42,000 | $18,000 |

| Standard Deduction | $31,500 | $31,500 | $31,500 | $31,500 |

| Deduction Taken | $31,500 | $31,500 | $42,000 | $31,500 |

| 2-Year Total / Tax Advantage | - | $63,000 | - | $73,500 (+$10,500) |

sbb-itb-e723420

Tools for Tracking Bunched Donations

If you're using a bunching strategy for your donations, keeping detailed records of cash amounts, non-cash valuations, and IRS documentation is a must. This ensures your deductions surpass the standard threshold and remain compliant with tax rules.

Deductible.me is a tool designed to simplify donation tracking, valuation, and IRS-compliant reporting. This is especially important under stricter tax guidelines, including the new 0.5% AGI floor for deductions [12][13]. For those employing a bunching strategy, the platform helps track your contributions to ensure they exceed the required threshold before becoming deductible [12][13]. Here's how Deductible.me can make this process easier.

Key Features of Deductible.me

Accurate recordkeeping is the backbone of maximizing tax benefits from donation bunching, and Deductible.me offers several features to help with this.

- AI-Powered Valuation: The app uses AI to determine fair-market values for non-cash donations like clothing and household items. Instead of guessing or manually researching prices, the tool analyzes your items and generates IRS-compliant valuations.

- IRS-Compliant Reporting: Deductible.me creates documentation that aligns with Schedule A substantiation requirements. This includes support for Form 8283, which is necessary when your non-cash donations exceed $500 [7]. Additionally, it helps you maintain written acknowledgments for single donations of $250 or more - a common area where taxpayers often fall short [7][11].

- Annual Giving Goal Tracking: For those spreading donations over multiple years, this feature allows you to set and track targets during your "on" years. This ensures you're meeting the thresholds needed to make itemizing worthwhile.

Free vs. Premium Plans

Deductible.me offers two pricing options to cater to different donation levels:

| Feature | Free Plan | Premium Plan |

|---|---|---|

| Monthly Price | $0 | $2 |

| Donation Value Limit | Up to $500 | Unlimited tracking |

| Valuation Tools | AI photo scanning & valuation | AI photo scanning & valuation |

| Receipt Management | Basic tracking | Advanced management |

| Reporting | IRS-compliant reports | IRS-compliant reports (Form 8283 ready) |

| Goal Setting | Not included | Annual giving goal tracking |

| Analytics | Not included | Advanced insights |

| Support | Standard | Priority support |

The Free Plan is ideal for casual donors who give smaller amounts, while the Premium Plan at just $2/month is tailored for more frequent donors using a bunching strategy. With unlimited tracking, advanced goal-setting, and enhanced reporting, the Premium Plan integrates seamlessly into your year-end financial planning.

Common Mistakes and Compliance Tips

Small missteps can lead to losing out on valuable tax savings. The IRS has strict guidelines, and even a missed deadline or an overlooked form could cost you hundreds - or even thousands - of dollars in deductions.

One common issue is timing. Donations must be completed by December 31 to count for that tax year. For checks, the date you mail them is what matters - not when the charity deposits them. Similarly, credit card donations are counted in the year the transaction is processed, regardless of when you pay the bill [7][15].

"A few days here or there in late December can make a big tax difference" [3].

This highlights how even small timing errors can significantly impact your deductions. Another critical step is ensuring your donation goes to an eligible organization.

Only contributions to qualified organizations - such as religious, charitable, or educational groups - are deductible. Donations to individuals, no matter how deserving, don’t qualify [14][7]. To confirm eligibility, use the IRS Tax Exempt Organization Search (TEOS) tool before making a contribution [14][15].

Documentation matters too. Missing or incomplete records are a frequent reason for rejected deductions. For any single donation of $250 or more, you’ll need a Contemporaneous Written Acknowledgment (CWA) from the charity before filing your return [14][3]. Non-cash donations over $500 require Form 8283 [14][15]. If the donated items exceed $5,000 in value, a qualified appraisal is also mandatory [14][15]. Additionally, clothing and household items must be in good used condition to qualify [15].

Be mindful of the "quid pro quo" rule. If you receive something in return for your donation - like event tickets, merchandise, or a meal - you can only deduct the amount that exceeds the item’s fair market value [14][7]. Deduction limits also apply: cash donations are capped at 60% of your Adjusted Gross Income (AGI), while donations of appreciated property are limited to 30% of AGI [7][3]. If your donation earns you a state or local tax credit, you’ll need to reduce your federal deduction by the credit amount unless it’s 15% or less of the donation’s value [7].

Conclusion

Donation bunching offers a smart way to rethink charitable giving and tax planning. By grouping several years’ worth of donations into one tax year, you can surpass the standard deduction threshold, leading to meaningful tax savings. This method becomes even more relevant with upcoming tax changes - bunching donations in 2025 can help you sidestep the new 0.5% AGI floor, which will make itemizing more challenging starting in 2026 [2].

This approach isn’t just about saving on taxes; it also gives you flexibility in how you give. For example, using a donor-advised fund allows you to claim the full tax deduction upfront while spreading out grants to charities over time. This ensures nonprofits receive steady support without dealing with fluctuating funding [2]. Additionally, donating appreciated stocks or mutual funds instead of cash provides a double advantage: you avoid paying capital gains taxes and can deduct the full fair market value [4].

Managing bunched donations effectively is key, and Deductible.me simplifies the process. With AI-powered valuation tools and IRS-compliant reporting, it keeps you on top of whether you’re in an "on" year (itemizing) or an "off" year (taking the standard deduction). Their Premium plan, available for just $2/month, offers unlimited donation tracking, helping you maximize every deduction.

Start planning your 2025 bunching strategy now. Make sure to act by December 31 to optimize your tax benefits and continue supporting the causes you care about most.

FAQs

What is donation bunching, and how does it compare to traditional annual giving?

Donation bunching is a tax strategy where donors consolidate multiple years’ worth of charitable contributions into a single tax year. Why? By doing this, they can surpass the standard deduction threshold, making it possible to itemize deductions and reduce their taxable income. In the years that follow, donors often opt for the standard deduction instead of making additional donations.

This approach stands in contrast to traditional annual giving, where individuals make smaller, consistent donations each year. While annual giving provides steady support to charities, it may not offer tax advantages if the total contributions fall below the standard deduction amount.

Donation bunching has gained traction since the 2017 tax law changes, which significantly increased the standard deduction. These higher thresholds have made it more challenging for many taxpayers to itemize deductions on an annual basis. For those looking to maximize their tax benefits, bunching donations can be a smart and efficient option.

How does using a Donor-Advised Fund help with donation bunching?

Using a Donor-Advised Fund (DAF) can be a clever way to make the most of your tax benefits through donation bunching. By grouping several years of charitable contributions into one tax year, you can surpass the standard deduction limit, allowing you to claim a larger tax deduction.

What’s great about a DAF is its flexibility. You get the tax deduction the year you contribute to the fund, but you’re not locked into distributing all the donations at once. Instead, you can support your favorite charities gradually, on your own schedule. This approach not only streamlines your giving process but also makes it easier to plan your contributions thoughtfully.

How could the 2026 AGI floor rule impact my charitable giving strategy?

Starting in 2026, a new rule will limit the deductibility of cash charitable contributions to 60% of your adjusted gross income (AGI). This change could impact your tax planning, so it’s worth rethinking your giving strategy to make the most of your tax benefits.

One strategy to consider is donation bunching. This involves combining several years’ worth of donations into a single tax year. By doing so, you’re more likely to exceed the standard deduction threshold, allowing you to take advantage of itemized deductions. Careful planning will be essential to navigating these updated rules and optimizing your charitable contributions.