Best Practices for Verifying Charitable Organizations

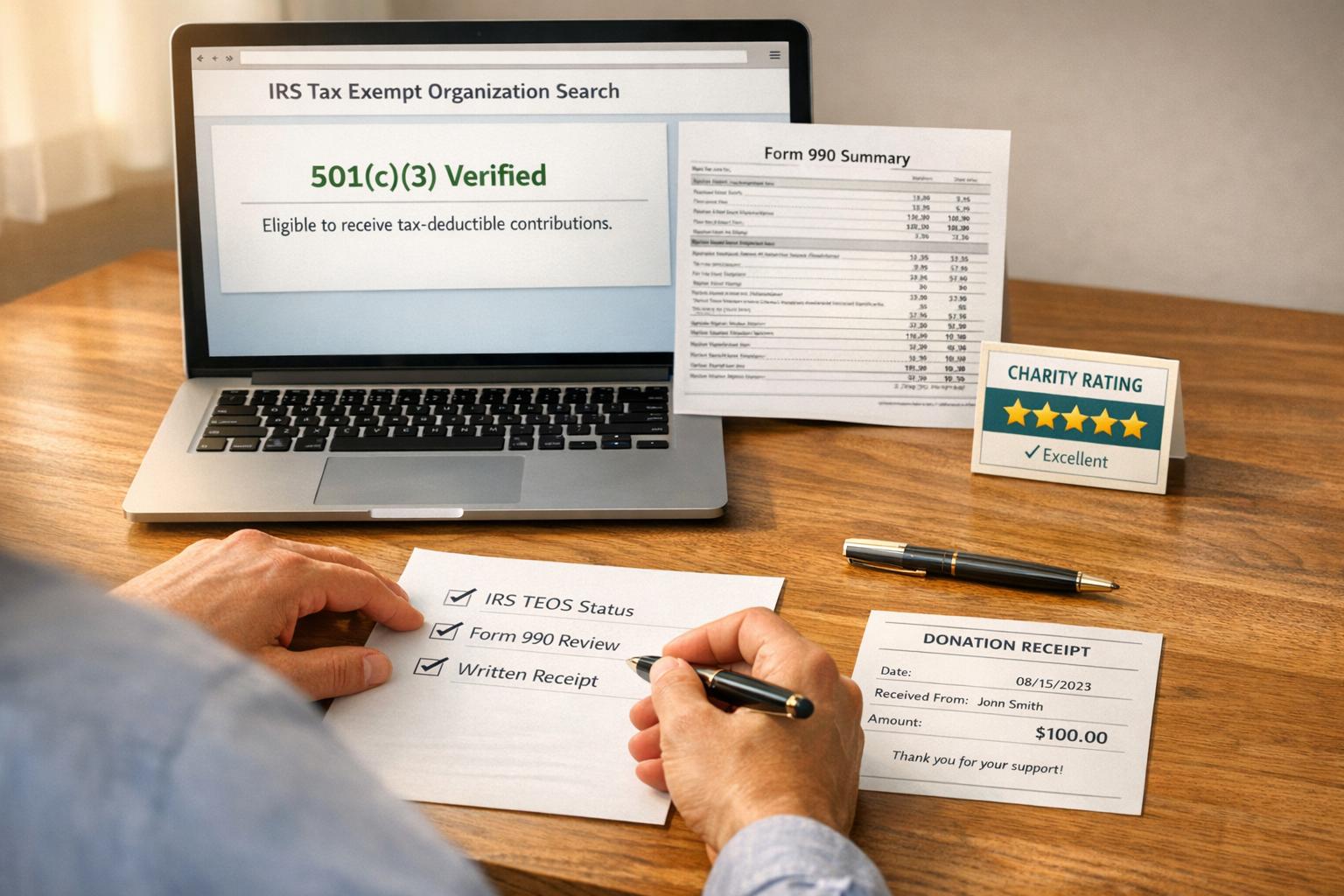

When donating to a charity, it’s essential to confirm its legitimacy to ensure your contribution reaches its intended purpose and qualifies for tax deductions. Fraudulent charities can exploit your goodwill, especially during crises. Here's how you can protect yourself:

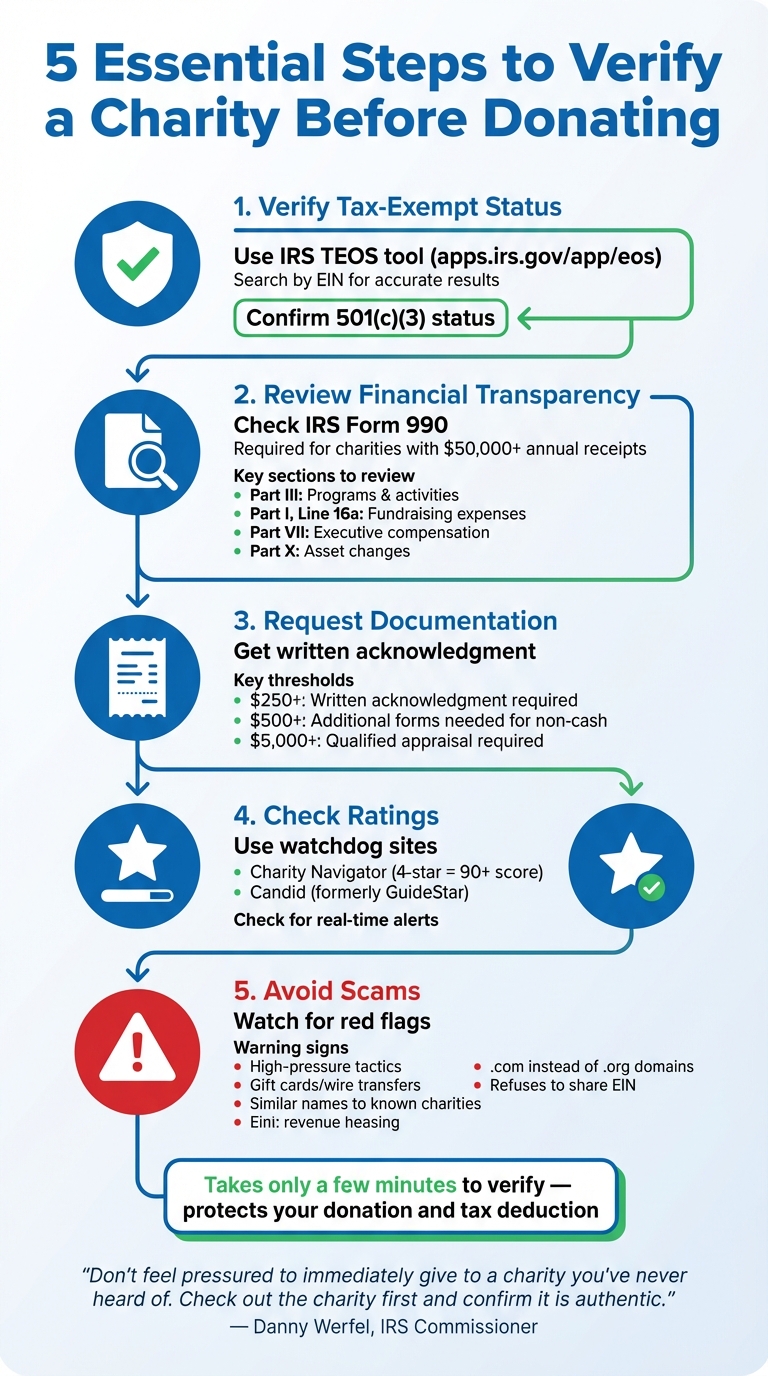

- Verify Tax-Exempt Status: Use the IRS Tax Exempt Organization Search (TEOS) tool to confirm if a charity is eligible for tax-deductible donations. Search by EIN for accurate results.

- Review Financial Transparency: Check IRS Form 990 to understand how funds are allocated and ensure the charity aligns with its mission.

- Request Documentation: Secure written acknowledgments for donations of $250 or more to claim deductions. For non-cash contributions over $500, additional forms may be required.

- Avoid Scams: Be cautious of high-pressure tactics, untraceable payment methods (e.g., gift cards, wire transfers), and suspiciously similar charity names.

- Check Ratings: Use watchdog sites like Charity Navigator or Candid to evaluate a charity’s operations and identify potential red flags.

Taking these steps only takes a few minutes but can save you from financial loss and ensure your donation makes a difference.

5-Step Charity Verification Checklist Before Donating

Charity Scams: How to Verify Legitimate Charities Before Donating After Disasters

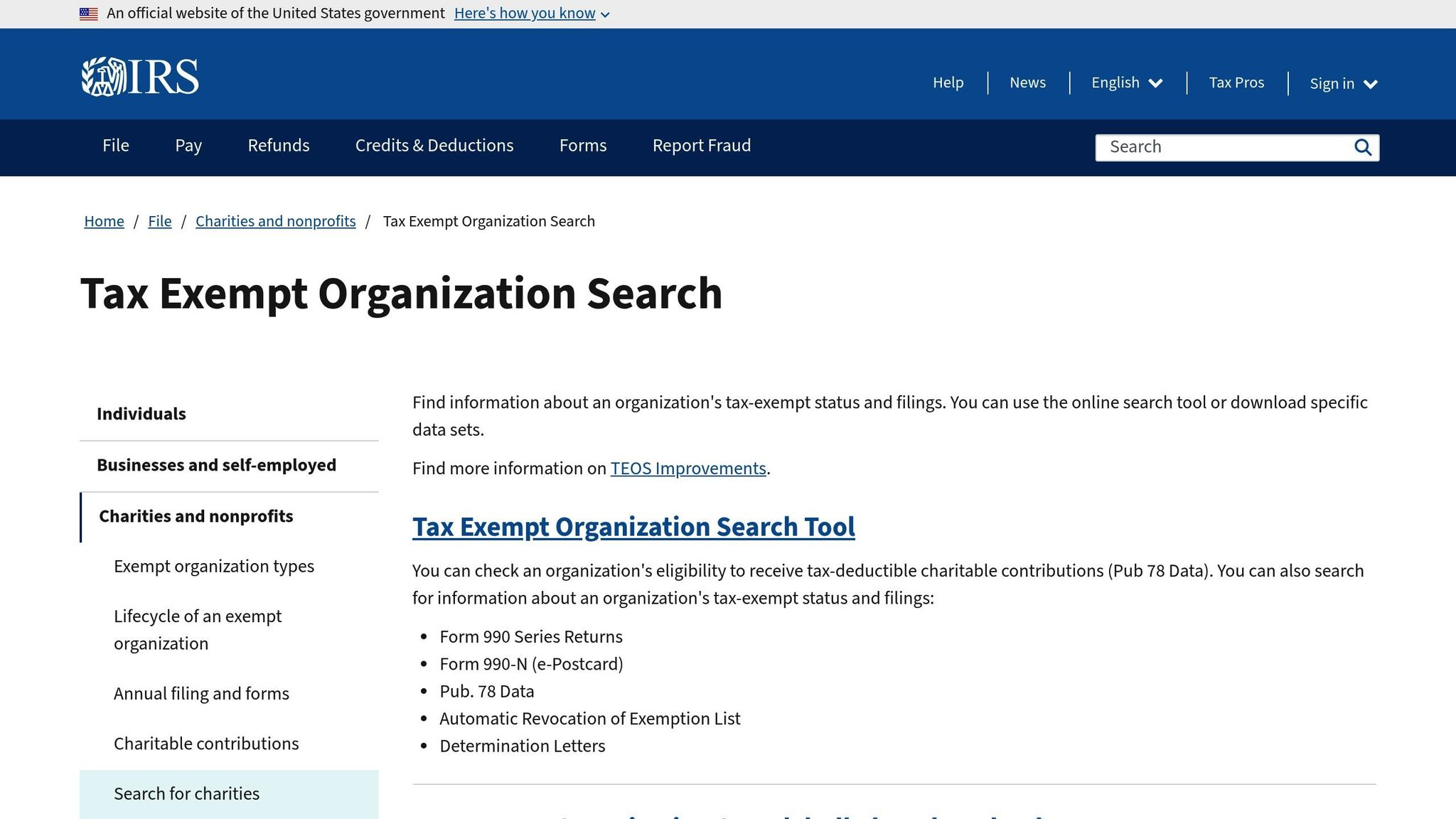

Using the IRS Tax Exempt Organization Search Tool

One of the most reliable ways to verify a charity's legitimacy is by using the IRS's Tax Exempt Organization Search (TEOS) tool. This free online resource helps you confirm if a charity is eligible to receive tax-deductible donations. As the IRS explains, “Taxpayers can use this tool to determine if donations they make to an organization are tax-deductible charitable contributions” [7].

How to Access and Use the Tool

To get started, visit apps.irs.gov/app/eos from any device. You can search for charities using their legal name, "Doing Business As" (DBA) name, or their nine-digit Employer Identification Number (EIN). For the most accurate results, searching by EIN is recommended since it eliminates confusion caused by similar names.

If you're conducting a name-based search, enclose the full or partial name in quotation marks (e.g., "Anytown General") to improve accuracy. Avoid including common words like "the" or "foundation" to refine your results. For EIN searches, it's worth noting that the dash after the first two digits is optional.

The tool pulls information from several key sources, including the Publication 78 database, the Auto-Revocation List, and recent Determination Letters. It also provides access to Form 990 series returns.

Understanding the Search Results

Search results can be sorted by name, EIN, state, or country. The most critical detail to check is whether the charity appears in the Publication 78 database. According to the IRS, “Users may rely on [the Publication 78] list in determining deductibility of their contributions” [9].

If a charity shows up on the Auto-Revocation List, it doesn’t automatically mean its tax-exempt status is still revoked. You’ll need to verify this by checking the Publication 78 database or reviewing a more recent determination letter to see if the organization has been reinstated. Additionally, keep in mind that certain organizations - like churches or government entities - may not appear in Publication 78 but are still eligible to receive tax-deductible donations.

Reviewing Charity Documents and Financial Transparency

Examining a charity's documents goes hand-in-hand with using the IRS search tool. Together, they provide a clearer view of a charity's operations and financial practices, helping you evaluate its legitimacy.

Checking IRS Determination Letters

An IRS determination letter is an official document that confirms a charity's tax-exempt status, typically under 501(c)(3). It also specifies the effective date of the exemption and verifies the organization’s legal name and EIN (Employer Identification Number).

If the determination letter was issued on or after January 1, 2014, you can access it through the TEOS tool. For older organizations, you’ll need to contact the charity directly to request a copy. If that’s not possible, you can obtain one by submitting IRS Form 4506-A or calling 877-829-5500.

For organizations listed on the Auto-Revocation List, it’s crucial to confirm their reinstatement by reviewing a current determination letter [8].

Analyzing Form 990 Reports

Form 990 is a key financial document that tax-exempt organizations with annual receipts over $50,000 are required to file. It provides detailed insights into how the charity allocates funds, who oversees its operations, and the compensation of its executives.

When reviewing Form 990, focus on these sections:

- Part III: Outlines the charity's programs and activities.

- Part I, Line 16a: Shows fundraising expenses.

- Part VII: Lists executive compensation, including anyone earning over $100,000.

- Part X: Highlights changes in assets, offering a snapshot of financial health.

This form is a valuable resource for understanding how a charity manages its finances and whether it aligns with its mission [10].

Requesting Documentation Directly from the Charity

If you’re donating $250 or more, you’ll need a contemporaneous written acknowledgment from the charity to claim a tax deduction. This acknowledgment must be obtained either by the date you file your tax return or the return’s due date, including any extensions [5][6].

For contributions over $75 where you receive goods or services in return (like event tickets or merchandise), the charity must provide a written disclosure statement. This document should estimate the value of what you received. Charities that fail to provide this disclosure can face penalties of $10 per contribution, up to $5,000 per fundraising event [6].

Don’t hesitate to request additional documents like annual reports, budgets, or other financial records. A charity’s unwillingness to share this information can be a warning sign [11].

sbb-itb-e723420

Evaluating Charity Ratings and Reviews

Combining Watchdog Sites with IRS Verification

The IRS ensures a charity's tax-exempt status, but watchdog organizations take it a step further by evaluating how well a charity operates. For instance, Charity Navigator reviews thousands of charities using its Encompass Rating System, which focuses on four main areas: Impact & Measurement, Accountability & Finance, Leadership & Adaptability, and Culture & Community [13].

Charities scoring 90 or above earn a four-star rating, signaling strong operational performance. To confirm details, use the charity's EIN (Employer Identification Number).

Another resource is Candid (formerly GuideStar), which provides governance details like the names of top executives, board members, and financial data for the current year, including revenue and expenses [15]. Before donating, it’s wise to check if Charity Navigator has issued any "Alerts" about misconduct - these real-time warnings won’t show up in IRS filings [12].

By combining IRS verification with these independent reviews, you gain a clearer picture of a charity's operations. However, these reviews can also highlight potential red flags that deserve attention.

Warning Signs to Watch For

Watch out for charities that refuse to share their EIN or provide vague mission statements. High-pressure tactics urging you to donate immediately should also raise concerns.

Fraudsters often exploit certain payment methods, so avoid donating via gift cards, wire transfers, or cash. Instead, choose credit cards or checks for added security [4]. Additionally, be cautious of websites ending in .com rather than .org, as legitimate nonprofits often favor the .org domain [3]. If a charity’s name closely resembles that of a well-known organization, verify its legitimacy using the IRS tool and trusted watchdog sites [3].

"Especially during these challenging times, don't feel pressured to immediately give to a charity you've never heard of. Check out the charity first and confirm it is authentic." - Danny Werfel, Commissioner, IRS [2]

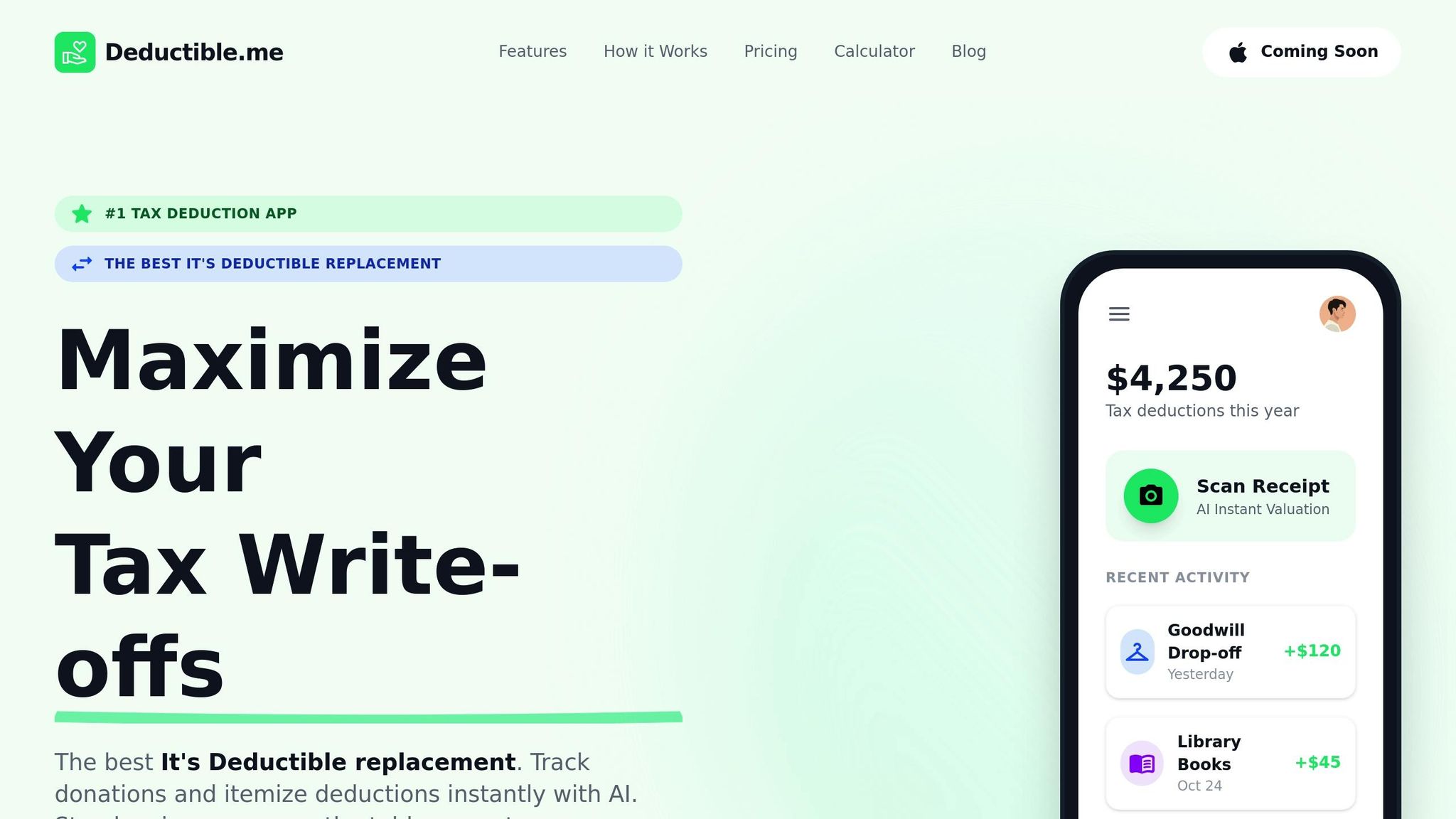

How Deductible.me Simplifies Charitable Giving and Verification

Verifying a charity is just the beginning; keeping track of tax documents is another hurdle. Deductible.me brings everything together by combining charity verification, donation tracking, and IRS-compliant reporting into a single, user-friendly platform.

AI-Powered Verification and Valuation

Deductible.me taps into IRS resources like TEOS and Publication 78 to confirm an organization's 501(c)(3) status [8][1]. It cross-checks details such as EIN, legal name, or DBA with IRS records to ensure the charity’s tax-exempt status is up to date [1][7].

For non-cash donations, the platform uses AI to determine fair market value, following IRS guidelines. This feature helps eliminate guesswork and reduces the risk of valuation errors that could draw IRS attention [6][16][17].

Tracking Annual Giving Goals

With the 2026 tax changes, keeping an eye on charitable contributions is more important than ever. Deductible.me helps users set and track annual giving goals, which will be especially useful when taxpayers can claim up to $1,000 ($2,000 for joint filers) in cash donations to qualified charities without itemizing [16]. It also assists in planning donations within the 60% AGI limit for cash contributions [17].

Generating IRS-Compliant Reports

Deductible.me simplifies tax reporting by creating documents that meet IRS requirements. This includes providing written acknowledgments for donations of $250 or more [5][6][16]. For non-cash donations over $500, the platform helps prepare Form 8283 and flags contributions exceeding $5,000 that require a qualified appraisal [6][16]. These detailed reports connect back to the initial charity verification, ensuring a secure and traceable process.

For just $2/month with the Premium plan, users can enjoy unlimited donation tracking, advanced receipt management, and reports ready for Form 8283.

Conclusion

Make sure to verify charities before donating to secure your tax deductions and ensure your contributions go to legitimate causes. Start by using the IRS Tax Exempt Organization Search tool to confirm the charity's 501(c)(3) status and ensure it hasn’t been revoked [1][14]. You can also review Form 990 filings to see how the charity manages its funds and request supporting documents like IRS determination letters if needed.

IRS Commissioner Danny Werfel emphasizes:

"Don't feel pressured to immediately give to a charity you've never heard of. Check out the charity first and confirm it is authentic." [2]

This advice is especially important during times of disaster relief when fraudulent charities often emerge [4].

Finally, keep thorough records of your donations. For contributions of $250 or more, secure written acknowledgments. If you’re donating noncash items worth over $500 or $5,000, ensure you have the required forms and appraisals [5][6][18].

FAQs

How can I check if a charity is tax-exempt?

To check if a charity is tax-exempt, use the IRS Tax Exempt Organization Search tool. This tool allows you to confirm if an organization is officially recognized as tax-exempt and eligible to receive tax-deductible donations.

Before donating, verify that the charity is listed and its status is current. Taking this step ensures your contribution qualifies for potential tax deductions.

What proof do I need from a charity to claim tax deductions?

To deduct charitable donations on your taxes, make sure you have the right documentation from the organization. This can include acknowledgment letters, receipts, or written statements that verify the donation amount and detail what was donated. If your contributions exceed certain limits, the IRS may require extra proof. Keep these records handy for your tax filings to stay on the right side of the rules.

How can I spot a fake charity?

Spotting a fake charity often comes down to recognizing key warning signs. For instance, be wary of organizations that pressure you to donate immediately. Scammers often use urgent, high-pressure tactics, like emotional appeals through phone calls or social media, to push you into acting without thinking. Another common trick? Mimicking the names of well-known charities to appear legitimate. Always double-check their details using trusted tools, such as the IRS Tax Exempt Organization Search.

A lack of transparency is another red flag. Legitimate charities should willingly provide clear information about how they use donations and proof of their tax-exempt status. If a group refuses to share these details or insists on unsecure payment methods, it’s best to steer clear. A little research can go a long way in ensuring your donations reach a trustworthy cause.