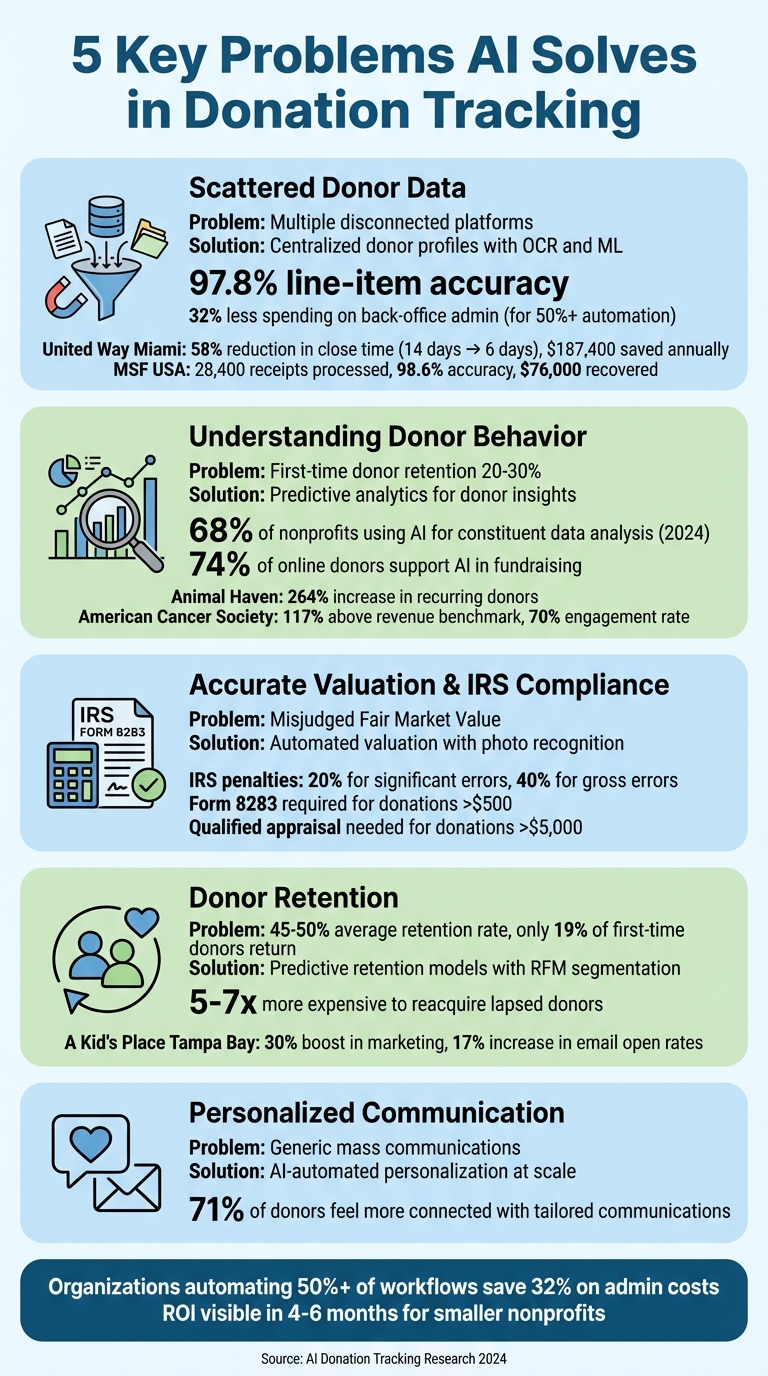

Common Problems AI Solves in Donation Tracking

Managing donations is often time-consuming and prone to errors. AI tools are transforming how nonprofits and donors handle these challenges by automating processes, improving accuracy, and saving time. Here’s a quick look at the main problems AI addresses:

- Scattered Data: AI consolidates donor information from multiple systems into unified profiles, reducing manual data entry and errors.

- Understanding Donor Behavior: Predictive analytics help nonprofits analyze patterns, identify at-risk donors, and tailor outreach for better engagement.

- Valuation and IRS Compliance: AI ensures accurate fair market value (FMV) for non-cash donations, streamlining tax reporting and reducing compliance risks.

- Donor Retention: AI flags disengaged donors early and automates re-engagement efforts to keep relationships strong.

- Personalized Communication: Generative AI creates tailored messages at scale, improving donor connections without overwhelming staff.

AI-powered tools like Deductible.me simplify donation tracking for individuals and nonprofits alike, offering features like automated valuations, compliance-ready reports, and predictive insights. By reducing inefficiencies and ensuring accuracy, AI is reshaping how donations are managed.

5 Key Problems AI Solves in Donation Tracking with Statistics

Problem 1: Scattered Donor Data Across Multiple Systems

Many nonprofits find themselves juggling donor information across several disconnected platforms - from CRMs like Salesforce or Bloomerang to grant-management tools, banking APIs, and outdated legacy systems that don’t talk to each other. This disjointed setup forces finance teams to spend countless hours manually re-entering the same receipts and invoices into multiple databases. That’s valuable time that could be spent on the organization’s mission.

"Every minute your finance team spends re-keying receipts is a minute taken away from program delivery."

- AI Bookkeeping Tools Guide [9]

This lack of integration creates inefficiencies and hampers donor engagement.

For smaller nonprofits, the absence of a formal CRM system can make it nearly impossible to maintain the personalized touch that fosters long-term donor relationships. Larger organizations, on the other hand, often face challenges extracting useful insights from outdated systems or integrating new tools with old infrastructure. The result? Data silos, inconsistent records, limited visibility into fund allocations, and no "single source of truth."

The impact isn’t just operational - it’s financial. Nonprofits that automate over 50% of their finance workflows report spending 32% less on back-office administration compared to those relying on manual processes [9]. Yet, despite this clear benefit, more than three-quarters of nonprofits still lack a formal AI strategy [4], leaving them stuck in inefficient, error-prone workflows.

AI Solution: Centralized Donor Profiles

AI offers a way out of this chaos by consolidating donor data into unified profiles.

Using tools like Optical Character Recognition (OCR), machine learning, and Robotic Process Automation (RPA), AI can pull together data from every source. It scans physical receipts, processes digital forms, and extracts data from scanned invoices with up to 97.8% line-item accuracy [9]. Even legacy systems are no obstacle - AI can integrate with them to automatically populate digital records [2].

The result? Unified donor profiles that update in real-time across platforms. For instance, banking APIs like Plaid can seamlessly connect to CRMs, ensuring every transaction is automatically recorded in a centralized system. Built-in quality checks catch and flag duplicate entries, missing details, or inconsistencies before they cause problems [10].

This isn’t just theory - it’s already making a difference. In July 2024, United Way Miami adopted Sage Intacct Nonprofit with AI GL Outlier Detection to tackle their 14-day monthly close process. The AI system auto-classified 92% of AP invoices, slashing the close time to just 6 days - a 58% reduction - and saved the organization $187,400 annually in overtime and temp staffing costs [9]. Similarly, in November 2024, Doctors Without Borders (MSF USA) deployed Ramp corporate cards integrated with Vic.ai autonomous processing. Over six months, the system processed 28,400 receipts with 98.6% accuracy, flagged suspicious transactions within 24 hours, and recovered $76,000 in duplicate payments that manual reviews had missed [9].

"Philanthropic organizations need reliable data in order to provide 'a single source of truth' - vital for ensuring donors' funds are spent on the right causes."

- Becky Ferguson, Senior Vice-President of Philanthropy, Salesforce [6]

AI doesn’t just save time - it levels the playing field. Smaller nonprofits can now access centralized donor tracking and profiling tools that were once only available to large organizations with big budgets. Solutions like Deductible.me use AI-powered donation tracking to simplify workflows and keep donor data organized, ensuring compliance and accuracy on a scalable level.

Problem 2: Understanding Donor Behavior and Patterns

Nonprofits often face a tough challenge: making sense of the mountains of data hidden in their donor records. Questions like "When did someone last donate?", "How much did they give?", or "Which campaigns caught their attention?" can be difficult to answer when relying on manual spreadsheet analysis. This process not only eats up valuable time but also overlooks critical trends, leaving nonprofits with delayed insights and missed chances to re-engage donors.

The statistics paint a concerning picture. First-time donor retention rates typically fall between 20% and 30%[5], meaning most new supporters don’t return. Without a clear understanding of why donors stop giving or what inspires them to contribute more, nonprofits are left guessing. Traditional analysis methods tend to be reactive, looking backward instead of forward[12]. This approach becomes even more challenging when organizations manage large databases or deal with unstructured data like survey responses.

The outcome? Impersonal and ineffective communication, which leads to donor disengagement. To address these issues, nonprofits need a forward-thinking solution - this is where predictive analytics comes in.

AI Solution: Predictive Analytics for Donor Insights

AI offers a game-changing way to tackle these challenges by predicting donor behaviors. Using machine learning and statistical algorithms, AI analyzes historical data - like donation frequency, amounts, and timing - to forecast future actions[11][12][15]. Instead of waiting to see who stops giving, predictive models identify at-risk donors ahead of time. These models score and rank supporters based on factors like engagement levels, giving capacity, and campaign interests, helping nonprofits focus their outreach efforts where they’ll have the most impact[12][13].

But AI doesn’t stop at just spotting trends. It refines donor engagement by determining the best "ask amount" for each individual, selecting the most effective communication channel (email, direct mail, SMS), and finding the right contact frequency to keep supporters engaged without overwhelming them[13][15]. It also groups donors with similar traits for more targeted messaging[12][15]. By late 2024, 68% of nonprofits were already using AI to analyze constituent data[14], and 74% of online donors expressed support for nonprofits leveraging AI in marketing and fundraising efforts[13].

The results speak for themselves. In 2019, Animal Haven, a New York-based animal rescue nonprofit, teamed up with Fundraise Up to personalize donation suggestions on its website. By using AI insights to tailor the donor experience, they achieved a staggering 264% increase in recurring donors[5]. Similarly, in 2022, the American Cancer Society utilized machine learning to analyze its digital advertising campaigns. Under the leadership of Media Strategy Director Ben Devore, the project pinpointed likely donors and engaged them with interactive banners. The campaign not only surpassed its donation revenue benchmark by 117% but also reached a donor engagement rate of nearly 70%[2].

"AI tools eliminate the guesswork from fundraising, enabling nonprofits to concentrate more energy on their top prospects."

- BWF[13]

Even individual donors are benefiting from AI-powered tools. Platforms like Deductible.me help users analyze their giving patterns, maximize tax deductions, and set personalized donation goals. These tools bring the same level of predictive intelligence to personal philanthropy, making charitable giving more intentional and impactful.

Problem 3: Accurate Valuation and IRS Compliance

Determining the Fair Market Value (FMV) of donated items can be a tricky process. The IRS defines FMV as "the price that property would sell for on the open market between a willing buyer and a willing seller" [16]. However, donors often misjudge this value - either overestimating based on the original purchase price or underestimating out of caution. Both scenarios come with risks: overvaluation could lead to IRS penalties, while undervaluation might mean missing out on potential tax savings. For context, the IRS can impose a 20% penalty for significant valuation misstatements and a 40% penalty for gross errors [16][18].

When it comes to non-cash donations, the paperwork can be just as daunting. Contributions exceeding $500 require IRS Form 8283, and donations valued over $5,000 necessitate a qualified appraisal. Without proper documentation, donors risk audits or losing out on tax benefits altogether. Many either skip deductions entirely, rely on rough guesses without evidence, or spend hours gathering receipts and researching item values manually.

AI Solution: Automated Valuation and Tax Reporting

AI-powered tools are transforming how donors approach valuation and compliance. These solutions take the guesswork out of the process by leveraging photo recognition technology to identify donated items. Once recognized, the system categorizes them - whether it’s clothing, electronics, or furniture [8]. From there, AI valuation engines analyze resale data and pricing trends to suggest accurate FMVs that align with IRS guidelines [17]. For example, items in excellent condition receive higher valuations compared to those in good condition [17].

These platforms also simplify the process of documenting donations. Donors can assign condition tiers like Good, Very Good, or Excellent, and the system automatically generates detailed, itemized lists required for non-cash donations. Additionally, many AI tools store digital copies of charity receipts and link them to the corresponding itemized lists. This creates a reliable, time-stamped audit trail - far more secure and efficient than keeping paper receipts.

One standout example is Deductible.me, which provides AI-driven valuations and audit-ready reports. By ensuring accurate documentation and fair valuations, these tools help donors maximize their tax benefits while staying fully compliant with IRS requirements.

"An accurate valuation ensures you get the full tax benefit you're entitled to, while solid documentation provides the proof the IRS requires." - DeductAble [17]

Problem 4: Donor Retention and Preventing Lapses

Keeping donors engaged is one of the toughest challenges nonprofits face. On average, donor retention rates across the sector sit between 45% and 50%, with only about 19% of first-time donors making a second contribution [21]. Adding to the difficulty, reacquiring a lapsed donor can cost 5 to 7 times more than simply retaining an existing one [21]. Often, donors quietly slip away, and organizations don’t realize it until months later - by then, the connection may have already faded.

Traditional methods of addressing donor lapses tend to be reactive. Nonprofits typically notice disengagement only after a donor has gone 12–18 months without giving. At that point, the relationship may already be strained, leaving fundraising teams scrambling to rebuild trust and re-establish communication. Without early detection, identifying at-risk donors becomes a guessing game. This is where AI steps in with a proactive solution.

AI Solution: Predictive Donor Retention Models

AI is changing the game for donor retention by identifying risks before donors fully disengage. Predictive models analyze historical data - like donation frequency, amounts, and patterns of engagement - to predict the likelihood of donor renewal. Using RFM segmentation (Recency, Frequency, and Monetary value), these models group donors and flag any unusual behavior [36,37]. For example, if a regular donor misses their usual giving period or reduces their contribution amount, the system can send an alert to the fundraising team immediately.

But AI doesn’t stop at financial data. It also monitors engagement across multiple channels, such as email open rates, event participation, website activity, and social media interactions. This creates a holistic picture of a donor’s involvement [19,36,37]. When AI detects signs of disengagement, it can automatically kick off re-engagement efforts. These might include sending a personalized impact story, a quick feedback survey, or notifying a gift officer to reach out directly [20].

"AI can predict which donors are at risk of disengaging and provide insights into how nonprofits can re-engage them before they stop giving." - Stanford Social Innovation Review [5]

The results of these predictive models are already speaking for themselves. For instance, A Kid's Place Tampa Bay used Virtuous's responsive fundraising platform to automate donor journeys. Under Samantha Mellon’s leadership as Director of Development, the nonprofit boosted its marketing efforts by 30% and saw a 17% increase in email open rates through targeted, automated communications [35,33].

With AI, nonprofits can act before it’s too late, keeping more donors engaged and building stronger, longer-lasting relationships.

sbb-itb-e723420

Problem 5: Personalizing Donor Communications at Scale

Reaching donors on a personal level is crucial for keeping them engaged, and this is where AI proves to be a game-changer in the donation process. Nonprofits understand the value of personalized outreach - 71% of donors say they feel more connected when they receive tailored communications [26]. But creating individual thank-you notes, impact reports, or email appeals for every donor can be overwhelming and time-consuming. As a result, many organizations fall back on generic mass emails, which can make donors feel like just another name on a list.

To complicate matters, communication preferences vary widely. Some donors might respond best to text messages in the evening, while others prefer emails sent on weekday mornings. Manually keeping track of these preferences is nearly impossible, leading to missed opportunities to connect in meaningful ways.

AI Solution: Automated Personalization

AI is reshaping how nonprofits can deliver personalized outreach on a large scale. Generative AI tools can create customized email subject lines, thank-you messages, social media updates, and text messages by pulling data like donor names, contribution amounts, volunteer history, and past interactions directly from the organization’s CRM [23][24][3].

This goes beyond simply inserting a name into a template. Predictive models powered by AI analyze donor behavior to determine the best time and method for outreach [22][25]. For instance, if one donor consistently opens emails on Tuesday mornings while another responds better to weekend texts, AI can adjust the communication strategy accordingly. This level of personalization not only makes donors feel valued but also builds stronger, long-term relationships.

"We think about AI a lot for accelerated personalization with donors. Where that's super helpful is if you can predict the next response from a person, that is incredibly powerful."

- Gabe Cooper, CEO of Virtuous [25]

Nonprofits are also using AI to simplify operational tasks, freeing up time for more meaningful donor interactions. For example, the American Red Cross uses an AI-powered chatbot named "Clara" to handle blood donation appointments and answer eligibility questions. This allows staff to focus on nurturing deeper connections with their donors [5].

How to Add AI to Your Donation Tracking Process

Adding AI to your donation tracking process doesn’t have to be overwhelming. Start small, measure the impact, and build from there. Research shows that organizations automating more than half of their finance workflows save 32% on back-office administration costs compared to those relying on manual methods [9]. For smaller nonprofits, the return on investment often becomes clear in just 4 to 6 months [9].

Start by conducting a data audit. Map out every step in your donation tracking process - from receiving donations to preparing tax reports. Pinpoint specific pain points like high error rates, time-consuming manual entries, or inefficiencies in your workflow [9]. This will give you a solid baseline to measure improvements once AI is introduced.

For individual donors, tools like Deductible.me offer an easy way to streamline charitable giving. This platform uses Vision AI to identify donated items from photos, automatically categorizing them and assigning Fair Market Value based on IRS guidelines and resale data. It even lets users import historical data from discontinued services (like ItsDeductible) to maintain seamless records. When tax season arrives, you can generate IRS-ready summaries in PDF or CSV formats with just a few clicks.

Steps to Implement AI-Powered Solutions

If you’re ready to integrate AI into your donation tracking process, here’s how to get started:

Start with a pilot project. Before diving into a full-scale implementation, test the waters. Use 90 days of historical data in a sandbox environment for 3–4 weeks [9]. This lets you measure the potential improvements without disrupting your current operations.

Clean your data before training the AI model. Avoid migrating messy or inaccurate legacy data into your AI system. Archive or remove errors beforehand, as incorrect data can lead to flawed AI behavior [9]. Assign a data steward to oversee classification accuracy and manage feedback loops. This role ensures the system stays accurate and aligned with your goals.

Choose tools that integrate with your existing systems. Look for platforms that connect seamlessly with donor CRMs like Salesforce Nonprofit Cloud or banking APIs such as Plaid [9]. If direct integrations aren’t available, use tools like Make.com or Workato to bridge the gap. Prioritize security by selecting vendors with certifications like SOC 2 Type II or ISO 27001. These measures ensure your sensitive donor and financial data remain protected and aren’t used to train public AI models [9].

Maintain human oversight. AI is there to assist, not replace, your team. Treat AI-generated outputs as drafts that require review for accuracy, tone, and alignment with your organization’s values [1][27]. This "human-in-the-loop" approach is particularly important for handling exceptions and making strategic decisions.

"AI is not here to replace advisors but to enhance their expertise... allowing professionals to focus on what they do best: building relationships, providing measured advice, and understanding donor motivations."

- Paul Caspersen, President and Founder, Planned Giving Interactive [7]

Take inspiration from Oxfam GB, which implemented BlackLine Finance AI integrated with the Wise Business API across 65 country offices in February 2026. This reduced manual reconciliation time from 180 hours to just 24 hours per month and cut foreign exchange variance from 2.1% to 0.5%. A KPMG audit later confirmed a £1.3M reduction in compliance risk exposure [9]. Their success came from combining powerful automation with clear human oversight protocols.

For individual donors, Deductible.me offers features like photo scanning, voice input, and offline syncing. The free tier covers up to $500 in donation value, while the Premium plan costs just $2/month for unlimited tracking.

The time required for full implementation depends on the size of your organization, but a structured plan makes the process manageable. Dedicate 3 weeks to governance, 2 weeks to vendor selection and testing, 3–4 weeks for a pilot program, and 4–5 weeks for a full roll-out. Regularly review KPIs monthly and update your AI models quarterly to keep everything running smoothly [9].

Conclusion

AI has turned donation tracking from a time-consuming, error-prone chore into a streamlined process that saves time while ensuring you get the most out of your tax benefits. By tackling real challenges like scattered records, inaccurate valuations, manual data entry, and compliance headaches, AI simplifies tasks that used to take hours. For example, what once required 30 minutes can now be done in just 30 seconds with AI-powered tools [19].

This isn't just about speed - it’s about getting it right. AI ensures precision and compliance with IRS standards, making the switch from outdated methods to AI-driven platforms a smart move. Tools equipped with features like Vision AI for identifying donated items and automated valuation engines that provide real-time resale data offer documentation that's ready for IRS scrutiny.

For individual donors, platforms like Deductible.me make charitable giving easier and more tax-efficient. Using Vision AI, the platform identifies donated items, assigns Fair Market Value based on IRS rules, and generates reports in PDF or CSV formats. Best of all, it’s accessible: a free tier covers up to $500 in donation value, and the Premium plan, at just $2/month, offers unlimited tracking - perfect whether you donate occasionally or frequently.

Nonprofits benefit, too. They see smoother operations and better outcomes. As Ashutosh Nandeshwar from CCS Fundraising puts it, "AI can help elevate philanthropic outcomes and, ultimately, better mission fulfillment" [2]. Importantly, AI doesn’t replace the personal connection in giving - it simply removes the hassle that often comes with tracking donations.

Whether you’re an individual looking to make the most of your deductions or a nonprofit managing countless donor relationships, AI-powered donation tracking brings noticeable improvements in accuracy, efficiency, and compliance.

FAQs

How does AI simplify donation tracking and data management?

AI takes the hassle out of donation tracking by automating tasks like collecting, organizing, and integrating donation data. This means less manual work and fewer errors. For instance, AI can sort receipts, assign values to donated items, and compile everything into a single, user-friendly system.

Over time, these tools get smarter by learning from new data, which boosts their accuracy and efficiency. This ensures donor information stays current and neatly organized. The result? Users save time, stay on top of IRS reporting requirements, and manage their charitable contributions with greater ease.

How does AI help nonprofits predict donor behavior?

AI is transforming how nonprofits understand and engage with their donors by analyzing past data through machine learning. This technology identifies patterns and trends, helping organizations predict which donors are likely to contribute again, recognize high-value supporters, and tailor their outreach efforts.

By gaining a clearer picture of donor preferences and behaviors, nonprofits can strengthen donor retention, streamline their fundraising strategies, and foster deeper connections. These AI-driven insights enable more targeted campaigns, ensuring charitable efforts have a greater and more meaningful impact.

How does AI help ensure accurate valuations for tax deductions?

AI enhances the accuracy of tax deduction valuations by using tools like photo recognition to evaluate donated items. This technology identifies the items, assesses their condition, and determines their fair market value based on current market trends and comparable sales data. The result? Realistic valuations that align with IRS compliance standards.

By streamlining this process, AI makes tax reporting easier and allows users to claim deductions confidently while adhering to IRS rules.